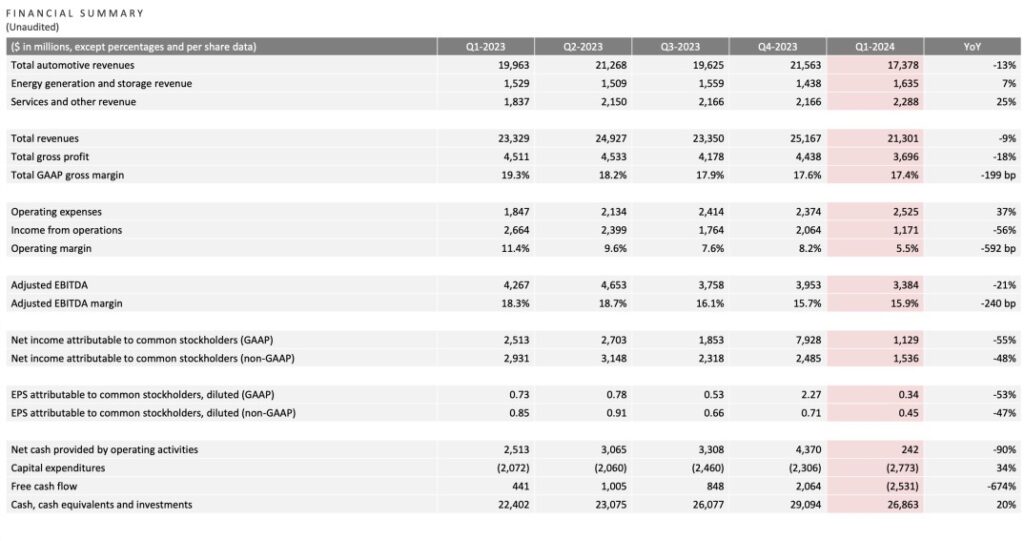

April 23rd, after the US stock market closed, Tesla released its first-quarter financial report for 2024. The data shows that Tesla’s operating revenue in the first quarter of 2024 was 21.301 billion US dollars, a year-on-year decrease of 8.69%, a month-on-month decrease of 15.36%, which was lower than market expectations. At the same time, it was the first time that the year-on-year operating revenue of Tesla has decreased since 2020, and also the largest decline since 2012. In terms of profits, Tesla’s performance is even more pessimistic. The net profit in the first quarter is only 1.13 billion US dollars, a year-on-year decrease of 55.07%, which is lower than the market expected 1.9 billion US dollars.

During the reporting period, Tesla’s free cash flow was -2.53 billion US dollars, while in the previous quarter it was 2.06 billion US dollars. This is the second time that Tesla has had a negative number since 2020. Tesla said that the “unbalanced cash flow” is due to an increase of 2.7 billion US dollars in inventory in the current quarter and a capital expenditure of 1 billion US dollars for the AI infrastructure, and it will continue to increase the core AI infrastructure capacity in the next few months.

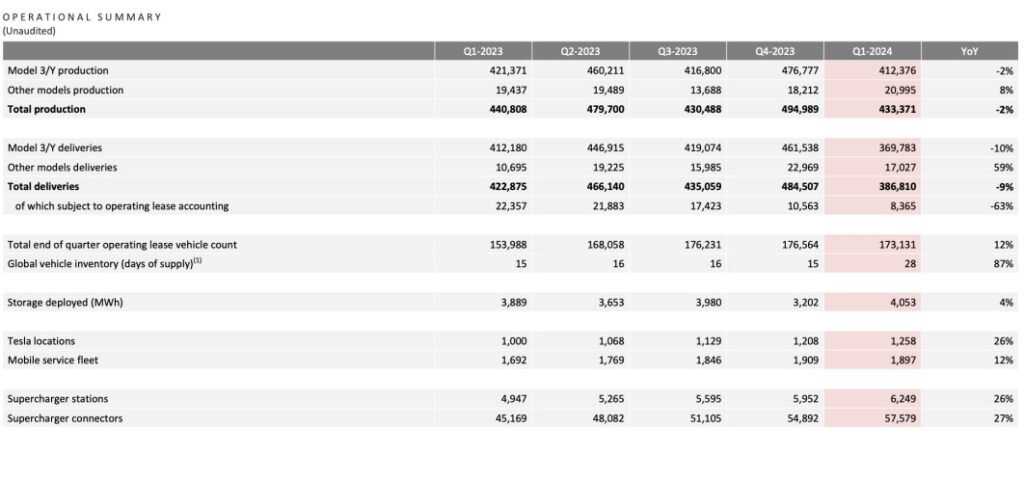

Tesla’s latest financial report is obviously “greatly disappointing”, which mainly boils down to the market concerns arising from vehicle deliveries. In the first quarter of this year, Tesla delivered 386,000 new cars globally, a year-on-year decrease of 8.5%, far below Wall Street’s forecast of 449,000. It is understood that this is the first time Tesla has broken below 400,000 deliveries since the third quarter of 2022 and the first quarter delivery year-on-year decrease since the second quarter of 2020, and the main reason for the decline at that time was the pandemic.

The United States and China are two major markets for Tesla globally. Not long ago, Tesla announced price cuts in both the Chinese and American markets. Among them, the Model Y in the Chinese market has been reduced to 249,900 yuan, setting a new low since it was produced in China. In addition, the Model 3 has been reduced to 231,900 yuan for sale, the Model S is priced at 684,900 yuan for sale, and the Model X is priced at 724,900 yuan for sale. The price reduction aims to strengthen the competition with domestic electric vehicles and thereby increase the delivery volume.

Affected by the performance, Tesla announced a 10% layoff on April 15th, and Musk announced the news in internal emails and social platforms, and said that this is “a decision that I hate but must make.” According to Bloomberg News, Tesla’s entire US marketing team has been laid off. The team focuses on creating advertising for Tesla’s manufactured cars and consists of 40 employees led by senior manager Alex Ingram. It is understood that Alex Ingram is also within the scope of the layoff.

Tesla’s financial report is far below market expectations, coupled with layoffs and the full recall of Cybertruck, which has exacerbated the growing concerns of investors, and Tesla in the secondary market is the best proof. Before the announcement of layoffs, Tesla’s stock price fell by 5.59%, and the market value evaporated by more than 30 billion US dollars. Since 2024, Tesla’s stock price has decreased by 41.77%, of which last week (April 15th – April 19th) fell by 14.03%, and the current total market value is 461.400 billion US dollars, breaking the 500 billion US dollar mark.

Investors urgently need to understand the latest situation of Tesla’s current and future prospects. It can be said that this financial report is likely to be a “crossroads” that determines Tesla’s recent fate, and even one of the most important moments in the company’s history. After the first quarter, Tesla needs to reassure investors that the current encounter is only temporary, rather than the beginning of a market downturn.

Although revenue and profits are far below market expectations, Tesla’s stock price soared after the market closed, and the reason for the stock price surge is that the much-anticipated cheap electric vehicles finally have new progress. Tesla CEO Elon Musk said at the post-earnings conference call that Tesla will accelerate the launch of more affordable economy models. This news further drove up its stock price after the market and rose as a whole by more than 13%. Musk said that it is expected that the cheap models will be put on the market in early 2025, and it may even be brought forward to the later period of 2024. Elon Musk said: “The new model will not rely on any new factories or large-scale new production lines, because our existing production lines can achieve further efficiency improvement in vehicle manufacturing.”

At the same time, the Tesla China website shows that the Model 3 high-performance all-wheel drive version has officially started presale, with a price of 335,900 yuan and is expected to be delivered in the third quarter of 2024. The new car will be equipped with a dual motor, which are the front induction asynchronous motor (3D3) and the rear permanent magnet synchronous motor (4D2), and adopt a four-wheel drive form, which can output a maximum power of 460 horsepower and a maximum torque of 723 N·m. The 0-100km/h acceleration time is 3.1s, and the maximum speed is 261km/h. Elon Musk said that the Model 3 speed exceeds the Porsche 911.

At the beginning of the launch of the Model 3 Performance, there were really few models that could compete with it. But with more Chinese brands launching performance versions one after another, it is no longer the king-like existence in the domestic market. The first one is the newly launched Xiaomi SU7. The power data is similar to the Model 3 Performance, but the body size and market popularity do bring considerable pressure to the launch of the new Model 3 Performance. However, the Tesla Model 3 Performance has more advantages in its various intelligent configurations and control levels, including its strong user base. It will definitely become the focus of attention after the new car is released.