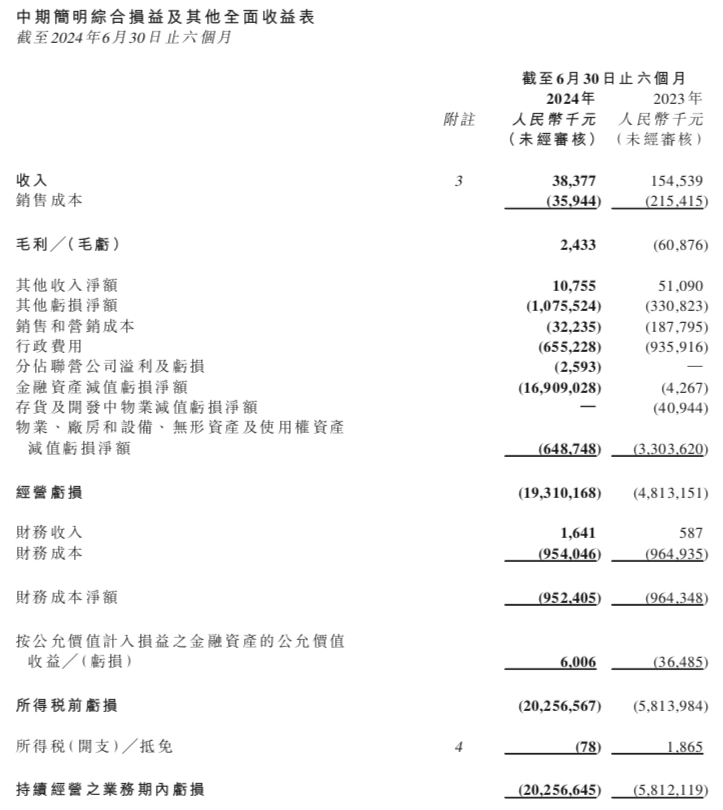

On the evening of the 30th of the month, Evergrande Auto released the interim financial report data for 2024. The financial report shows that as of June 30, 2024, Evergrande Auto’s revenue was 38.377 million yuan, a year-on-year decrease of 75.17%, due to the reduction in sales of Hengchi 5; the gross profit was 2.433 million yuan, a year-on-year decrease of 103.99%; the total net loss was 20.257 billion yuan, a year-on-year increase in loss of 194.73%. Among them, the revenue from the new energy vehicle business was 16.095 million yuan, a year-on-year decrease of 62.7%. In detail, the sales revenue of automobiles and auto parts was 5.54 million yuan, the revenue from providing technical services was 10.435 million yuan, and the other revenue was 0.12 million yuan; in addition, the property sales revenue was 22.282 million yuan. Currently, Evergrande Auto only has one mass-produced model, Hengchi 5. Data shows that as of June 30, 2024, Evergrande Auto’s Tianjin factory has cumulatively produced 1,700 Hengchi 5 vehicles and cumulatively delivered more than 1,429 new energy vehicles. As of June 30, 2024, Evergrande Auto’s cash and cash equivalents were only 39 million yuan; while the total assets were 16.369 billion yuan; the total liabilities were 74.35 billion yuan, including 26.59 billion yuan in borrowings, 46.695 billion yuan in trade and other payables, and 1.065 billion yuan in other liabilities. That is to say, Evergrande Auto is already seriously insolvent and faces huge financial pressure. Based on the first-half financial report, Evergrande Auto’s losses in the first half of the year have far exceeded the losses for the entire year of 2023. For comparison, in 2023, Evergrande Auto suffered a loss of about 12 billion yuan, when the total assets were 34.851 billion yuan and the total liabilities were 72.543 billion yuan. Evergrande Auto stated in the financial report announcement that the company’s financial situation is more tense than in 2023. It must obtain a large amount of financial support in the future. To reduce operating costs, measures have also been taken to arrange for some personnel to have vacations. In addition, the Tianjin manufacturing base, Shanghai manufacturing base, and Guangzhou manufacturing base all carry out equipment maintenance and management in accordance with the shutdown management system and plan. Evergrande Auto has been trapped in the capital chain for a long time and also faces a series of problems such as factory shutdowns, bankruptcy reorganization of subsidiaries, and survival crises. Currently, its situation is very difficult, but Evergrande Auto has not given up on survival. Instead, it is trying to save itself by introducing potential third-party investors. Unfortunately, this measure has not yet made substantive progress. On August 26, Evergrande Auto issued an announcement stating that the discussions among the potential seller, the potential buyer, and the company are still ongoing, but the potential seller and the potential buyer have not yet entered into a purchase and sale agreement, and the potential buyer and the company have not yet entered into a credit agreement. Evergrande Auto particularly emphasized that this potential transaction is uncertain. The partial acquisition of Evergrande Auto’s shares began on May 26. At that time, Evergrande Auto issued an announcement stating that 29% of the shares were about to be acquired by a potential buyer, and the potential buyer would provide a credit line to Evergrande Auto to fund the company’s continued operation and development of the electric vehicle business. But three months have passed since this news, but the specific acquirer has not been confirmed yet, which also makes the prospects of Evergrande Auto more confusing. The “mysterious buyer” mentioned above is regarded by Evergrande Auto, which is deeply mired in the debt crisis, as the last straw, but there is still great uncertainty about who will be the acquirer. At the same time, some industry insiders believe that even if some of Evergrande Auto’s shares are acquired, it will be difficult to return to the mainstream market. Since entering the auto-making industry across borders, Evergrande Auto has accumulated losses of more than 110 billion yuan, but it only has one mass-produced model, Hengchi 5, and the sales volume is poor. So far, the cumulative delivery is only about 1,429 vehicles, and its presence in the auto market is extremely low. Against this background, how far Evergrande Auto can go under huge debt pressure may have an answer soon. As of the close of trading on August 30, Beijing time, Evergrande Auto’s Hong Kong shares closed at HK$0.290, an increase of 7.41%, with a total market value of 3.145 billion yuan.

Owing 74.4 billion yuan! A certain carmaker is insolvent.