On September 27, Economic Daily (a central Party newspaper established in 1983 with a focus on economic reporting) published an editorial titled “It’s Time to Squeeze the Foam Out of Car Orders.” The article pointed out that the “order inflation” among major car manufacturers has become increasingly excessive, and the “order bubble” has grown larger. Economic Daily emphasized that this practice of inflating orders originally stemmed from the mobile phone industry, but since automobiles are major commodities, it’s not something that can be treated casually with “tens of thousands of orders” appearing overnight. Some companies, in order to quickly gain market share and advantage, have inflated pre-sale orders, leading to exaggeration and false advertising.

The development of a car from research and development to delivery involves a complex system with multiple stages, including market research, development, production, and marketing. It can be divided into four phases: the R&D preparation phase, the production validation phase, the marketing launch phase, and the delivery service phase. Among these, the marketing launch phase is the most critical in determining whether a product will become a hit. During this period, car manufacturers release spy photos of the product to explain the brand’s design philosophy, followed by the product’s first appearance to generate market anticipation and attract the attention of target customers. This usually takes place 3 to 6 months before the product launch. After the first appearance, the product enters the pre-sale phase, where manufacturers announce the pre-sale price, open the ordering channel, and offer pre-sale incentives to attract customers, usually 1 to 2 months before the official launch. Finally, when the product is launched, the company holds an online/offline event to officially announce the final price, which is typically the same as or slightly lower than the pre-sale price to increase customer purchasing intent.

Currently, as competition in the automotive market, especially in the new energy vehicle sector, intensifies, more car manufacturers are beginning to inflate their orders to create a perception of product popularity.

Before diving deeper into this issue, let’s first understand two common concepts in the automotive industry: “small orders” and “big orders.”

Small orders refer to a way for consumers to express interest in purchasing a car, usually during the pre-sale phase. Consumers voluntarily pay a deposit ranging from a few hundred to a thousand yuan, and when the product is launched, they can use this deposit to offset the final purchase price, e.g., a 1000 yuan deposit can offset 5000 yuan of the purchase price, and they also enjoy initial privileges. The key feature of small orders is flexibility—consumers can request a refund at any time without being bound, so they face almost no risk. Therefore, small orders only reflect market interest and not actual purchase intent.

Big orders, on the other hand, mark the actual purchase process. After the official launch price is confirmed, consumers need to confirm the model, version, and configuration, sign a formal purchase contract, and the deposit amount is much higher, usually above 10,000 yuan, which can be about 10% of the car price. Even in this stage, consumers generally have a 1-3 day hesitation period to cancel the order, but the deposit is non-refundable. Big orders can provide a better reflection of real purchase intent, with the order volume indicating the vehicle’s popularity.

In theory, order data can indeed help us understand how well a new car is received in the market. However, the reality is that they are easily inflated. Whether it’s small orders, big orders, or locked orders, there are no third-party institutions to supervise them, and car companies can adjust these figures based on their needs. There are no technical or regulatory restrictions, making it difficult for outsiders to verify the authenticity.

Mainly led by new energy vehicle brands, some car manufacturers, with a focus on marketing, have publicly announced large quantities of small orders during the pre-sale period to create hype. A representative case is a newly launched extended range SUV in September 2025, where the pre-sale orders surpassed 20,000 units in 10 minutes and 100,000 units in 1 hour, with the “app crashing” due to the demand.

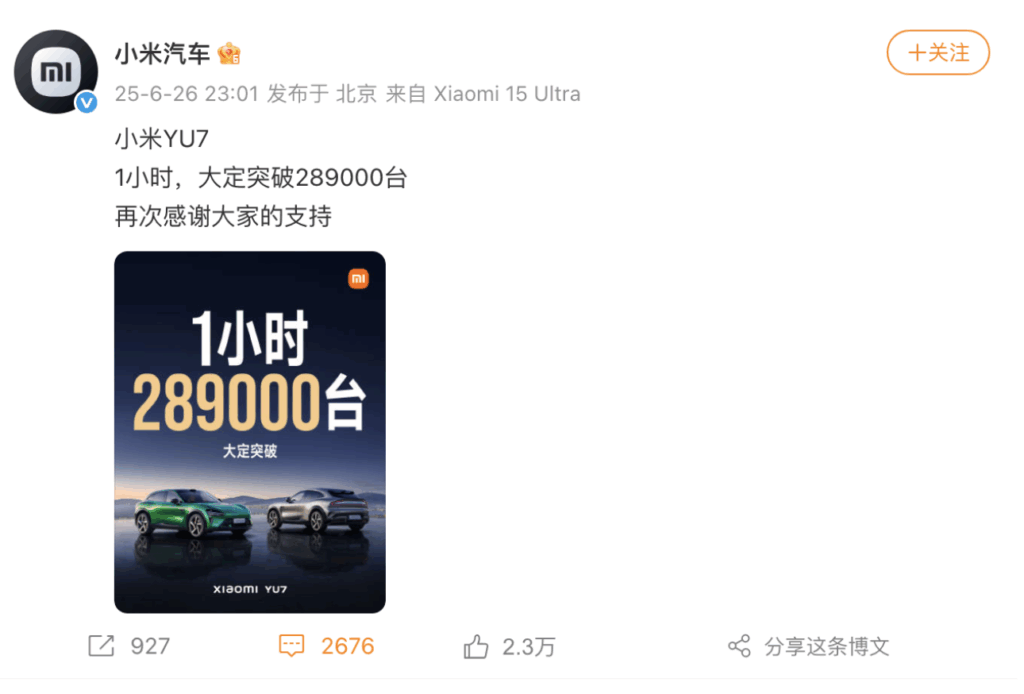

Some brands, such as Xiaomi Cars, choose to only announce “big order data” after the product’s release, to maintain authenticity while still pursuing hype. Xiaomi announced that its model, the YU7, received over 200,000 reservations in 3 minutes and 289,000 in 1 hour. According to Xiaomi’s policy, consumers can cancel their order within 7 days if they haven’t locked the configuration, but the deposit becomes non-refundable once the configuration is locked.

Furthermore, some brands, like NIO, don’t release any order data at all. Instead, they assess market performance through monthly or quarterly delivery figures. Li Bin, the CEO of NIO, stated in an interview that, “If we followed the published order numbers, we’d have 100 million orders. We don’t participate in this ‘inflation’.” According to Li Bin, the focus on order data is becoming more of a marketing tool, which could lead to mismatched production and sales, creating unnecessary risks.

In response, Economic Daily has called for the introduction of third-party oversight, real-time delivery data publication, and the establishment of a true customer review system. It also suggested that government departments should verify pre-sale data and punish fraudulent behavior according to the law.

With the rapid development of new energy vehicles, new models are launched almost every week, making it increasingly difficult to attract consumer attention with competitive configurations and prices. For car companies, it’s better to focus on technology research and development, product optimization, and service improvements, rather than inflating order data. Only by offering high-quality, reliable products and services can companies earn consumer trust and market recognition. For regulatory bodies and industry organizations, establishing transparent supervision mechanisms and strengthening regulatory penalties are crucial to ensuring the healthy development of the industry.