March 22, Brilliance Auto announced in the Hong Kong Stock Exchange that Shen Tiandong has submitted his resignation as an executive director, the company’s CEO, and a member of the compensation committee, nomination committee, and subsidiary executive appointment committee due to other official business. In addition to resigning from the above positions, Shen Tiandong also resigned as a director of Brilliance Renault Jinbei Automobile Co., Ltd., a subsidiary of the company, as well as all other positions in the subsidiary, joint venture, and associated company.

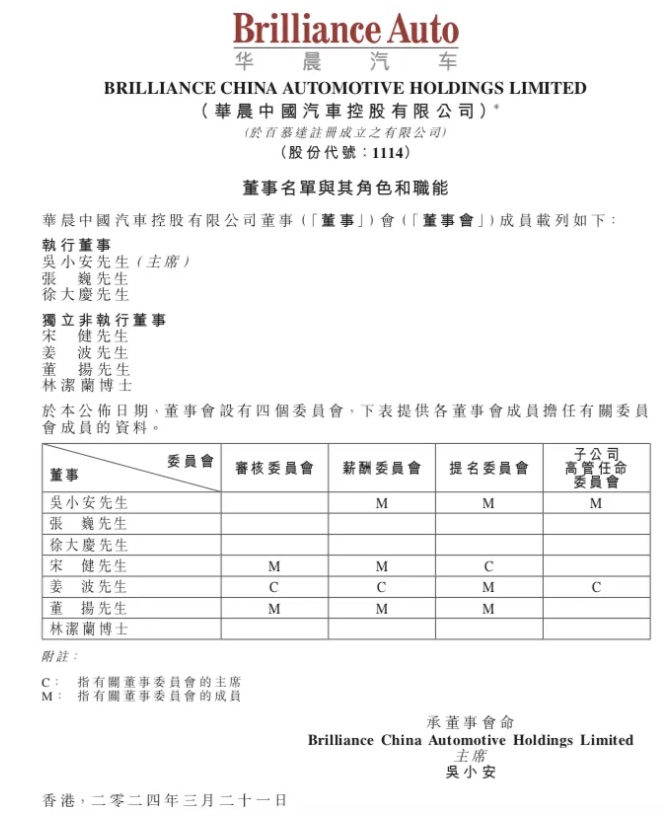

Meanwhile, Brilliance Auto announced that the board of directors of Brilliance China Automotive Holdings Limited includes executive directors Mr. Wu Xiaonan (chairman), Mr. Zhang Wei, and Mr. Xu Daqing; independent non-executive directors Mr. Song Jian, Mr. Jiang Bo, Mr. Dong Yang, and Dr. Lin Jielan.

According to the information, Shen Tiandong was born in November 1969. He graduated from the Department of Political Economy, Liaoning University, with a bachelor’s degree in economics. He has an on-the-job postgraduate degree and a doctoral degree, and is a senior economist. He started working in June 1992. Before assuming the position of Party Secretary and Chairman of Brilliance Auto Group, Shen Tiandong has successively served as the deputy minister of the Trust Department of Liaoning International Trust and Investment Company; the minister of the Capital Operations Department of Liaoning International Cooperation (Group) Co., Ltd.; the deputy general manager of Liaoning Energy Investment (Group) Co., Ltd.; the vice mayor of Panjin Municipal People’s Government, Liaoning Province, the member of the Standing Committee of the Municipal Party Committee, and the secretary-general. Later, he was transferred to Liaoning Energy Investment (Group) Co., Ltd., serving as the vice chairman, deputy Party secretary, and general manager; and the chairman and Party secretary of Liaoning Provincial Environmental Protection Group Co., Ltd. In June 2021, Shen Tiandong became the Party Secretary and Chairman of Brilliance Auto Group.

From Shen Tiandong’s work resume, it can be seen that he is not from the automotive industry. However, he has rich experience in the government and enterprises. During his tenure as the Party Secretary and Chairman of Brilliance Auto Group, it was also the stage when Brilliance Auto Group entered the bankruptcy reorganization process. At that time, “how to help Brilliance Auto Group overcome the difficulties of bankruptcy reorganization” was an important task after taking office. Currently, the reorganization of Brilliance Auto Group has entered a new stage.

On March 15, the National Enterprise Credit Information Disclosure System shows that Brilliance Auto Group Holding Co., Ltd. (hereinafter referred to as “Brilliance Auto”) has undergone a change in investors. The original shareholders, Liaoning Provincial Social Security Fund Council (Provincial Industry (Entrepreneurship) Investment Guidance Fund Management Center) and Liaoning Provincial State-owned Assets Supervision and Administration Commission, have withdrawn. A new addition, Shenyang Automobile Co., Ltd. (hereinafter referred to as “Shenyang Automobile”) has become a shareholder and holds 100% of the shares. Currently, Brilliance Auto is wholly-owned by Shenyang Automobile, and the legal representative of the company is Shen Tiandong.

As for why Shenyang Automobile wants to acquire Brilliance Auto? In fact, this news has been leaked since April 2023, but it was not officially confirmed until March 15 this year. At that time, the industry believed that Shenyang Automobile was formed by the local government to reorganize Brilliance Auto. The actual controller of Shenyang Automobile is Shenyang Municipal State-owned Assets Supervision and Administration Commission (i.e., Shenyang Municipal People’s Government State-owned Assets Supervision and Administration Commission). Information from Tianyancha shows that Shenyang Automobile Co., Ltd. was established in February 2023, which was then a wholly-owned subsidiary of Shenyang Cairui Investment Co., Ltd. (hereinafter referred to as “Shenyang Cairui”). On March 14, Shenyang Automobile added a new shareholder, Shenyang Cairui Automotive Industry Development Partnership (Limited Partnership), and the registered capital was increased from 500 million yuan to 4.88 billion yuan.

The secretary-general of the China Passenger Car Association, Cui Dongshu, once said that the restructuring of Brilliance Auto has lasted for three years. The selection of Shenyang Auto as the restructuring investor reveals a signal that all parties are trying their best to solve the problem and complete the restructuring.

In November 2020, Brilliance Auto encountered a financial crisis. Subsequently, the Shenyang Intermediate People’s Court ruled to accept the creditor’s application for the restructuring of Brilliance Auto. Since then, Brilliance Auto has entered the bankruptcy restructuring process. The Shenyang Intermediate People’s Court ruled that 12 enterprises including Brilliance Auto should be tried by substantive consolidation and restructuring, and appointed the manager of Brilliance Auto to serve as the substantive consolidation and restructuring manager of 12 enterprises including Brilliance Auto. However, after several setbacks, the restructuring plan has not achieved substantial competition, until August 2023, the restructuring plan of Brilliance Auto was finally approved by the court.

Since the bankruptcy restructuring was approved in November 2020, the restructuring of Brilliance Auto has been constantly fluctuating. With the completion of the industrial and commercial change of Shenyang Auto’s acquisition of Brilliance, it means that the restructuring of Brilliance Auto has entered a new stage. However, in the context of the increasingly fierce competition in the auto market, the future of Brilliance Auto is still shrouded in mystery. Financial report data shows that in the first half of 2023, Brilliance China achieved a total operating income of 507 million yuan, a 8.9% decrease from 558 million yuan in the same period in 2022. Brilliance China attributed this to the shift in the demand of the automotive consumer market from traditional fuel vehicles to electric and hybrid vehicles, which led to a decline in the demand for the company’s automotive components.