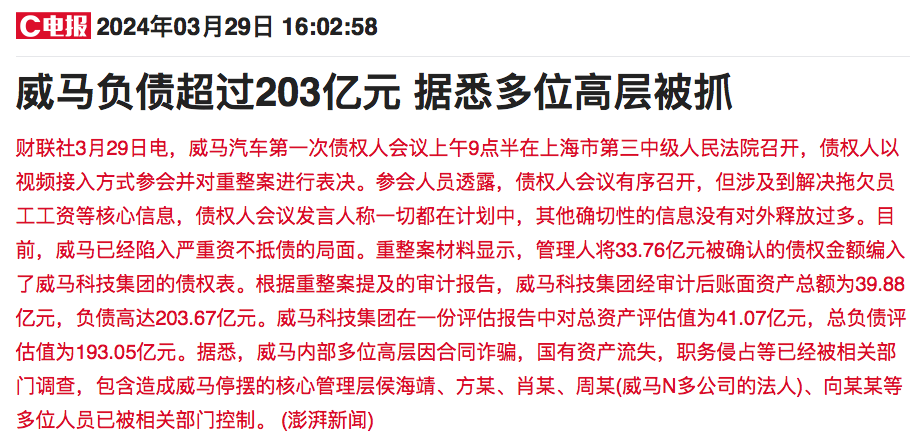

March 29, the first creditors’ meeting of Weltmeister was held in the Third Intermediate People’s Court of Shanghai. According to media reports such as The Paper, according to the materials of the reorganization case, as of March 18, the administrator had received a total of 1,456 bonds declared by 1,412 creditors, with a total declared claim amount of 44.202 billion yuan. After review, the administrator confirmed 564 creditors of WM Technology Group, and the confirmed total amount of claims was 3.376 billion yuan. Among them, the creditors with security rights include Shanghai Pudong Development Bank and Corelink Leasing Co., Ltd., with a total amount of 1.585 billion yuan. The total assets of WM Technology Group after audit are 3.988 billion yuan, and the total liabilities are 20.367 billion yuan. From the data, it is not difficult to know that Weltmeister has fallen into a serious situation of insolvency.

It is worth noting that the report pointed out that this creditors’ meeting is not only to reorganize the debt of Weltmeister, but also to investigate the internal illegal issues of Weltmeister. Several senior executives within Weltmeister have been investigated by relevant departments for involving contract fraud, loss of state-owned assets, and duty encroachment, including many personnel from the core management of Weltmeister such as Hou Haijing.

It is reported that Hou Haijing is one of the co-founders of Weltmeister, with rich experience in product production and technology. He has served as the production manager of the general assembly workshop of Shanghai General Motors, the vice president of Foton Motor, the general manager of Hawtai Motor, and the vice president of Geely Group. The main scope of work is the production of vehicle models. In 2018, Hou Haijing joined Weltmeister and served as a co-founder. In the early days of Weltmeister’s entrepreneurship, it was mainly composed of six co-founders, including Shen Hui, Lu Bin, Du Ligang, Zhang Ran, Hou Haijing, and Xu Huanxin. Hou Haijing’s main scope of work is the Weltmeister Chengdu Research Institute, responsible for the production line and technological research and development. Shen Hui is responsible for the overall strategic planning, Lu Bin is responsible for the strategic planning and implementation of the sales system and customer management, Du Ligang is the chief financial officer, mainly responsible for supervising and managing finances, and Xu Huanxin serves as the chief operator, mainly responsible for the daily operation of the company.

It is understood that at the beginning of its establishment, important events of Weltmeister were decided by the small board of directors composed of these six people. However, in 2020, there were already rumors that Lu Bin, the co-founder of Weltmeister, had left the company. Subsequently, the official response stated: Lu Bin left due to personal reasons, and Weltmeister greatly appreciated his contribution to the company. After Lu Bin’s departure, the co-founders of Weltmeister, Du Ligang, Zhang Ran, and Xu Huanxin, have also been successively reported to have left the company.

The frequent departure of key senior personnel is related to Weltmeister’s sales performance in recent years. Weltmeister was established in 2015 and was founded by Shen Hui, the former vice president of Geely Holding Group. Its headquarters is located in Shanghai. The following year, the WM New Energy Vehicle Smart Industrial Park was laid the foundation in Oujiangkou, Wenzhou, and the mass production trial assembly vehicle was offline. In 2018, Weltmeister acquired Zhongshun Automobile Holding Co., Ltd. to obtain vehicle manufacturing qualifications. In the same year in March, the WM Wenzhou factory was successfully completed. In September of the same year, the first mass-produced vehicle EX5 was officially launched, which is a compact pure electric SUV with a price range of 146,800-198,800 yuan.

In 2019, Weltmeister’s cumulative sales volume was 16,876 vehicles, ranking second in the sales list of new car-making forces. In terms of financing, Weltmeister has undergone multiple rounds of financing since its establishment, with a financing scale of up to 41 billion yuan, and was once regarded by both inside and outside the industry as the most promising new car-making force in the market.

However, in recent years, the sales of other new car-making forces have grown rapidly, while Weltmeister’s sales have grown slowly. Data shows that from 2020 to 2021, Weltmeister’s sales were 21,937 vehicles and 44,152 vehicles respectively. In 2022, Weltmeister’s sales fell even further to 34,637 vehicles. In comparison, the sales of ideal Motors, NIO, and XPeng Motors have all exceeded 100,000 vehicles during the same period. In addition to sluggish sales, Weltmeister has also fallen into a financial crisis, with a steady stream of negative news such as production suspension, layoffs, pay cuts, store closures, factory shutdowns, headquarters owed rent, and equity freezes.

Data shows that as of the end of March 2022, Weltmeister had 6.67 billion yuan of long-term loans and 2.28 billion yuan of short-term loans, with a combined external debt of 9 billion yuan. In addition, according to the prospectus submitted by Weltmeister last year, from 2019 to 2021, Weltmeister’s net losses were 4.145 billion yuan, 5.084 billion yuan, and 8.206 billion yuan respectively, with a total net loss of 13.632 billion yuan in three years. As of the end of June 2022, Weltmeister’s cash flow on the books was only 4.156 billion yuan.

However, even though Weltmeister is in a very bad situation, the official has been releasing good news to the outside world in the past two years. Weltmeister Chairman Shen Hui once said in an interview, “As long as Weltmeister has one breath left, it can still continue to fight. The biggest challenge now is how to get through the darkness before dawn.” Until last October, Weltmeister finally couldn’t hold on and applied for bankruptcy reorganization.

From the most promising new car-making force to now bankruptcy reorganization, Weltmeister’s outcome may not be surprising. In recent years, with the rapid development of new energy vehicles, competition has become increasingly fierce, and many new car-making forces have been gradually eliminated in the competition.

In this context, Weltmeister is tight on funds, deeply mired in negative news such as layoffs, pay cuts and pay freezes, work stoppages, and rent arrears. It is not easy to get out of the quagmire. Although Weltmeister firmly states that it will not lie flat or collapse, the high debt and the illegal issues of senior internal personnel will all cause great damage to Weltmeister, which is on the verge of death. Even if it successfully completes the reorganization in the future, it will face a series of challenges.