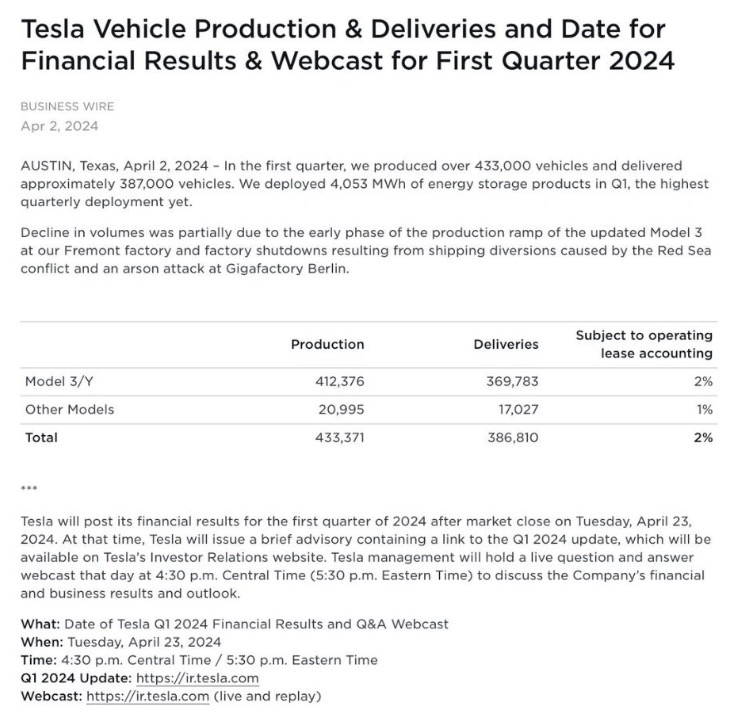

April 2, Tesla announced the delivery volume in the first quarter of this year. Data show that Tesla delivered 386,810 vehicles in the first quarter, a year-on-year decrease of 8.53% compared with 422,875 vehicles delivered in the first quarter of last year, and a 20.2% decrease compared with the fourth quarter of last year.

In response to the poor sales, the official said that this is mainly due to the fact that the Tesla factory in Fremont, California is currently in the stage of capacity climbing, the red sea situation has led to a shortage of parts transportation, which affects the production of some vehicles in the Berlin factory, and the Tesla German factory has recently been subjected to arson attacks, forcing Tesla to shut down and stop production again.

Regarding the poor sales in the first quarter, Tesla CEO Elon Musk also responded on his personal social platform, saying that BYD’s sales decreased by 42% compared to the previous quarter, which is a difficult season for everyone.

However, these factors mentioned by the official will indeed have a certain impact on sales. However, from the production and sales data released by the official in the first quarter, the auto output is more than the sales, which may mean that the poor delivery volume in the first quarter of Tesla is largely due to weak demand and fierce competition.

Taking the Chinese market as an example, with the rapid development of new energy vehicles in China, Tesla is no longer the only choice for consumers. BYD has a certain market share in the market below 200,000 yuan, which is Tesla’s largest competitor. Data shows that BYD’s delivery volume in the fourth quarter of 2023 was 484,507 vehicles, surpassing Tesla’s fourth-quarter delivery volume. In addition, it also faces the pressure of constantly encroaching on the market share of domestic new car-making forces.

To this end, on January 1, Tesla also announced a “price reduction” promotion! However, the effect of the strategy of exchanging prices for volume may not be so effective anymore. In order to stimulate sales, in March, there was news on the market that, according to inside information from Tesla China, starting from April 1, the price of the Tesla Model Y will be increased by 5,000 yuan; at the same time, the current 8,000-yuan official cash car insurance subsidy policy and the highest 10,000-yuan paint reduction policy will also expire on March 31. According to this calculation, the price adjustment range of Tesla in the Chinese market can reach up to 23,000 yuan.

Sure enough, on April 1, according to the information on Tesla’s Chinese website, the prices of a number of Tesla models have increased by 5,000 yuan. Among them, the price of the Tesla Model Y rear-wheel drive version has been raised to 263,900 yuan, the price of the Tesla Model Y long-range version has been raised to 304,900 yuan, and the price of the Tesla Model Y high-performance version has been raised to 368,900 yuan. For Tesla’s price increase this time, many industry insiders pointed out that it is likely to boost sales.

AutoTimes believes that Tesla’s weak sales in China is also related to the slow update of its models. At present, Tesla has a total of five models for sale worldwide, including the Model 3, Model Y, Model S, Model X, and the electric pickup Cybertruck. Among them, the Model S and Model X are the first models of Tesla to enter the Chinese market. Both models are introduced into the domestic market in the form of imports. Compared with the domestically produced Model 3 and Model Y, the sales advantage is not so obvious. Tesla’s sales in China mainly come from domestically produced Model 3 and Model Y.

On March 28, the first model of Xiaomi Auto, the SU7, was launched. This model is directly competing with the Tesla Model 3. The appearance of Xiaomi SU7 also puts great pressure on Tesla China. In the end, whether this price increase by Tesla can increase sales remains to be verified over time.

Returning to Tesla’s delivery results in the first quarter, it is not difficult to see that this result is very poor, lower than market expectations, and 90,000 less than Wall Street’s earlier expected delivery volume of 454,200. Or affected by the lower-than-expected sales in the first quarter, as of the deadline for submission, Tesla’s US stock is quoted at $166.63 per share, down 4.9%, and the latest market value is $530.7 billion.