April 17th, the Volvo Group publicly released the financial report for the first quarter of 2024. The data shows that in the first quarter of 2024, Volvo’s net sales were 131.2 billion Swedish kronor (approximately 86.798 billion RMB), which was basically flat compared to the same period last year, but exceeded the market’s estimated 129.18 billion Swedish kronor; the adjusted operating profit was 18.16 billion Swedish kronor (approximately 12.015 billion RMB), exceeding the estimated 17.24 billion Swedish kronor; the adjusted operating profit margin was 13.8%.

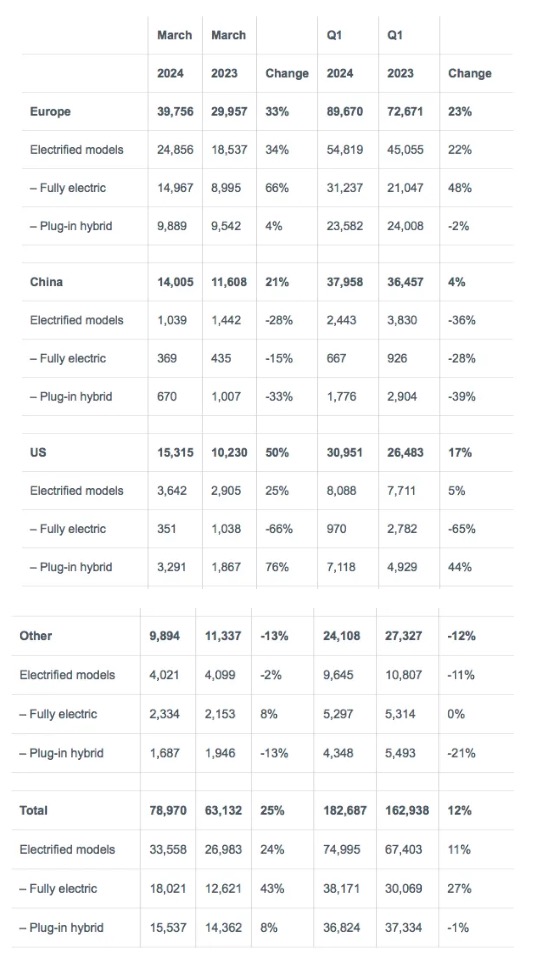

In terms of sales, in the first quarter of 2024, Volvo Cars’ global cumulative sales were 182,687 vehicles, a year-on-year increase of 12%. Broken down by major markets, Volvo Cars’ cumulative sales in the European market in the first quarter were 89,670 vehicles, a year-on-year increase of 23%; the cumulative sales in the US market were 30,950 vehicles, a year-on-year increase of 17%; the cumulative sales in the Chinese market were 37,958 vehicles, a year-on-year increase of 4%, of which the sales of new energy models were 2,443 vehicles, a year-on-year decrease of 36%.

Taken as a whole, Volvo Group’s overall performance is still acceptable, but Volvo still lacks highlights in the sales of new energy vehicles in the Chinese market. Volvo is recognized as one of the earliest traditional luxury brands to begin the electrification transformation, and it is currently making every effort to accelerate the promotion of the electrification transformation. On March 26th, the last Volvo XC90 SUV rolled off the assembly line at Volvo’s Torslanda factory in Sweden. This car is the last vehicle equipped with a diesel engine for Volvo. This move means that Volvo has officially said goodbye to its 45-year history of producing diesel vehicles and entered a new era of electrification. However, Volvo has stated officially that it will still produce gasoline-engine cars until 2030, when only electric vehicles will be produced. Before this, Volvo had proposed a comprehensive electrification strategy in 2017 and further deepened and clarified the market layout in 2021.

AutoTimes believes that Volvo’s rapid layout for the electrification transformation is a gesture of embracing the market, but as one of the earliest automakers to announce the cessation of internal combustion engine R&D and manufacturing and the complete transformation to electrification in the future, the majority of Volvo’s electric vehicles in the global second-largest market – the Chinese market are still “oil-to-electricity” products, which is also the key reason for its difficult to increase sales.

Up to now, Volvo’s sales in the Chinese market still rely on fuel vehicles, and only the existing electric vehicles are mainly plug-in hybrid models. The official website shows that the currently domestically produced models of Volvo in China include the S90, S60, XC60, and XC40, among which the S90, S60, and XC60 have introduced plug-in hybrid models based on fuel vehicles, and the XC40 has introduced pure electric models based on fuel vehicles.

Retail data shows that in the first quarter of this year, the top three models of Volvo in China in 2023 were the XC60, S90, and S60, with sales of 16,448 vehicles, 8,425 vehicles, and 4,090 vehicles respectively; the XC40 came next, with 1,868 vehicles, and the rest of the models were all below 1,000 vehicles. Obviously, in the Chinese new energy market, Volvo has obviously fallen behind a number of luxury automakers such as Audi, Mercedes-Benz, BMW, and Tesla.

It should be noted that now the Chinese market has become a major country in global new energy vehicle sales. With the intensification of the internal competition in the domestic new energy vehicle market, Volvo is facing the pressure of fully achieving the electrification transformation in China. “How to accelerate the realization of the electrification transformation and development in the Chinese market” remains a difficult problem for Volvo, and it urgently needs to launch a model that can prove its strength in the field of luxury electric vehicles.

In general, although Volvo’s determination in the new energy transformation is very strong, there is still a lot of work that it needs to make up for in order to run further on the new energy track. As for whether Volvo can hand in a satisfactory “report card” under the “radical” transformation strategy, it is worthy of expectation.

According to the plan, Volvo’s sales target within the year is a 15% increase.