April 3, Honda China announced the terminal vehicle sales in the first quarter of 2024. Data shows that in the first quarter of 2024, Honda’s terminal vehicle sales in China were 206,907 vehicles, with a same-period ratio of 2024, Honda’s terminal vehicle sales in China were 206,907 vehicles, with a same-period ratio of 93.9% (that is, a year-on-year decrease of 6.11%). Among them, GAC Honda’s cumulative sales were 108,361 vehicles, a year-on-year decrease of 8.11%; Dongfeng Honda’s cumulative sales were 98,546 vehicles, a year-on-year decrease of 3.80%.

This time, Honda China did not directly disclose the terminal vehicle sales in March, but it is not difficult to infer from the data of the first two months. In March, Honda’s terminal vehicle sales in China were 60,449 vehicles, a year-on-year decrease of 26.32%. Among them, GAC Honda was 30,118 vehicles, a year-on-year decrease of 27.98%; Dongfeng Honda was 30,331 vehicles, a year-on-year decrease of 24.60%. For the reason for the decline in sales, Honda China did not give an explanation.

Taken together, whether it is the sales in March or the cumulative sales in the first three months, Honda China’s performance is not optimistic. Honda’s terminal vehicle sales in China in March have slumped surprisingly. If the reason for the sharp decline in sales in February is attributed to the impact of the Spring Festival holiday, then it should bottom out and rebound in March. As a reference, looking at other car companies that have announced sales, the overall sales of other car companies in March have rebounded significantly under the background of the overall downturn in sales during the Spring Festival holiday.

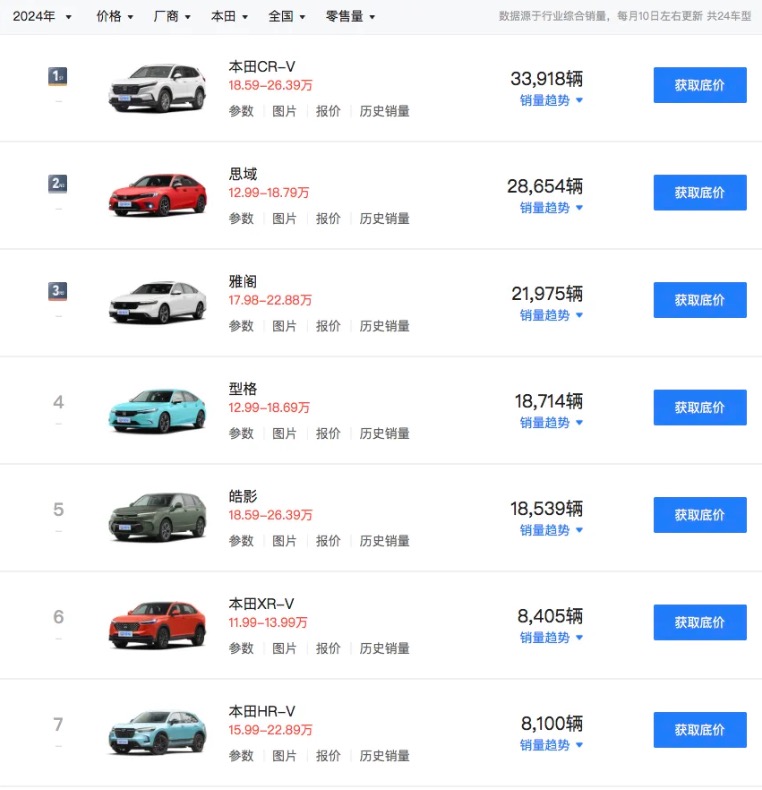

At present, the majority of sales of Honda China still comes from fuel vehicles, but fuel vehicles are becoming more and more difficult to sell. Taking the retail sales from January to February as an example, the top three models of Honda China are Honda CR-V, Civic, and Accord, with sales of 33,918 vehicles, 28,654 vehicles, and 21,975 vehicles respectively. The INTEGRA and BREEZE follow, with 18,714 vehicles and 18,539 vehicles respectively, and the sales of the rest of the models are all below 1,000 vehicles.

In the pure electric vehicle market, although Honda China launched two pure electric models, e:NP1/e:NS1, in April 2022, the sales of the two models have been sluggish since their launch. Retail data shows that in January and February, the cumulative sales of Dongfeng Honda e:NS1 was 1,261 vehicles, and that of GAC Honda e:NP1 was 56 vehicles.

AutoTimes believes that the decline in Honda China’s sales is related to the rapid rise of the domestic new energy market. Under the change of the auto market, fuel vehicles are difficult to sell and Honda cars lacking pure electric blockbuster products have thus continuously squeezed their market share in China.

Now, many Chinese car companies, including BYD, have begun to erode the joint venture market. Especially after the Spring Festival in the year of the dragon, BYD took the lead in launching an attack on joint venture fuel vehicles, shouting the slogan of “lower electricity than oil”. Since then, more and more new energy brands have followed BYD to cut prices, triggering a new round of price cuts and putting pressure on joint venture car companies.

It is worth mentioning that the decline in Honda’s sales in China is just a microcosm of the cold reception of Japanese brands in China. According to the data of the Passenger Vehicle Association, the sales of Japanese cars in February this year were about 159,000, a year-on-year decrease of 35.7%. Among them, the retail share of Japanese brands was 14.4%, a year-on-year decrease of 3.4%.

If Japanese joint-venture brands want to stay in the Chinese market, they must make some achievements in the electric vehicle market, especially in the current situation where new energy vehicles are extremely内卷ized. If Japanese joint-venture brands are not aggressive, it may mean regression. This also means that Japanese auto companies that rely on fuel vehicles to drive sales may be abandoned by consumers if they cannot make substantial innovations.

In the face of industry changes, Honda China has begun to accelerate the pace of transformation. Previously, it has made significant adjustments to the original “electric transformation plan”, including advancing the time to stop selling fuel vehicles from 2030 to 2027, and launching more electric products. According to the plan, Honda will launch two models, e: NS2 and e: NP2, this year. The two models are sister cars. In addition, Dongfeng Honda will launch three new pure electric models this year, including the launch of the e: NS2 model in June, the listing of the Lingxi L model in September, and the launch of a new SUV in December. Under the layout of many new cars, Dongfeng Honda reiterated that by 2025, the proportion of electric vehicles of Dongfeng Honda will reach 50%, and no fuel vehicles will be put into use in 2027. By 2030, more than 10 pure electric models will be launched.

On March 15, Japanese automakers Nissan and Honda announced the signing of a memorandum of understanding to carry out comprehensive cooperation in the electric vehicle business, including joint procurement, joint development of power platforms, and commonization of spare parts. The two sides hope to achieve cost reduction through resource integration and enhance the competitiveness of electric vehicle products. However, the current cooperation between the two sides is still in its early stages, and the final mode of cooperation remains to be confirmed.

Under the general trend of the strong rise of independent brands, Japanese joint-venture auto companies are facing competitive pressure in the Chinese market. The main reasons are not only the slow pace of product upgrading and the overly conservative introduction of new technologies, but more importantly, the lack of pure electric blockbuster products. At present, the challenge facing Japanese joint-venture brands is “how to find the right to speak in the electric age” and launch electric products that can support sales growth. It should be noted that since Japanese joint-venture brands are lack of classes in the transformation of electrification, even if new electric products are launched, they may face fierce competition challenges. There are still many classes that Japanese joint-venture brands need to make up for if they want to turn the tables against the wind.