According to media reports, Tesla China will adjust the weekly working hours of Shanghai factory employees from the original six and a half days to five days earlier this month, thereby reducing the production of Model Y and Model 3, and this may continue until April. Employees have not received clear updated information on when normal production will resume. Tesla China has no response to this.

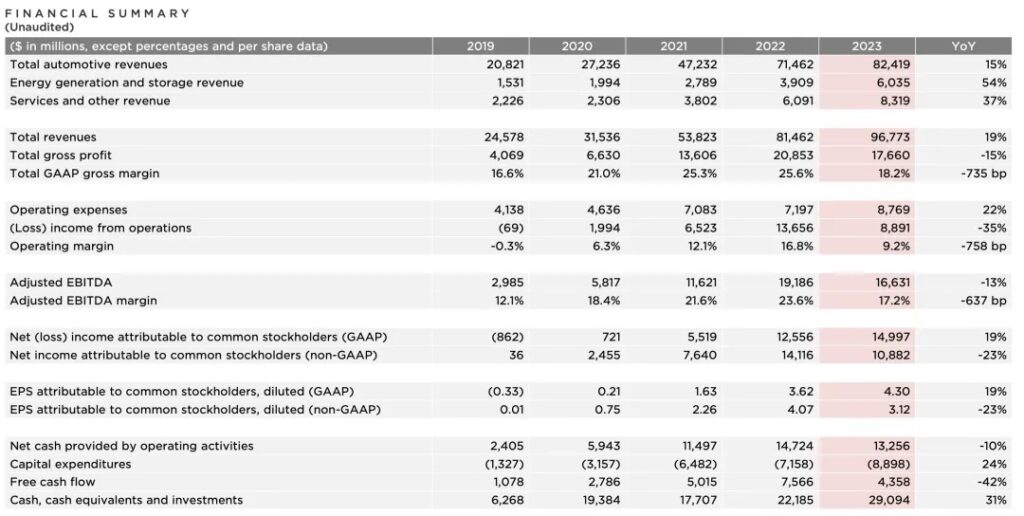

In 2023, Tesla delivered 1.8086 million vehicles globally, “reaching” the delivery target of 1.8 million vehicles. However, behind Tesla’s successful completion of the 2023 sales target, it is inseparable from sacrificing profits to increase sales. Throughout 2023, Tesla has cut prices in the US, Europe, and China markets, which undoubtedly enhances the competitiveness of Tesla models. Consumers are still willing to compromise on prices, but this also allows Tesla’s gross profit margin to decline once, falling from 19.3% in the first quarter to 17.6% in the fourth quarter.

There is no doubt that Tesla’s current product competitiveness is clearly insufficient, and Tesla’s model update speed is too slow. Generally speaking, a fuel vehicle is redesigned in about three years and updated in about six years. In the era of electrification, the frequency of electric vehicles is higher, and the redesign of domestic electric vehicles is shortened to two years, and the update is shortened to four years. In contrast, Tesla released the Model 3 in 2016 and only launched a redesign in 2023.

In the past, many Chinese electric vehicles would see Tesla as a competitor, or even a model, and surpassing Tesla became their top priority. However, from the current market performance, although the performance of the vast majority of electric vehicles is not as good as Tesla, from the perspective of core technology, it has indeed been surpassed. The reason why there are still consumers willing to choose Tesla is still based on brand awareness. First of all, Tesla is a foreign brand, and secondly, it has been in the electric vehicle market for a long enough time.

Moreover, Tesla has been regarded as the “catfish in the electric vehicle market” in the past, and its every move will be watched by domestic and foreign automakers. In 2023, Tesla took the lead in setting off a price reduction storm in the electric vehicle industry, which won it more market share, but also made other automakers feel unprecedented pressure. Faced with Tesla’s price reduction trend, many automakers have begun to adjust their pricing strategies, and following the price reduction has become a common phenomenon in the industry. However, in 2024, BYD took the lead in starting the price, and Tesla also continued to offer a large number of preferential policies, but obviously, Tesla did not gain much attention at this time. The driving effect of price reduction on Tesla’s sales is decreasing, and the negative impact on performance begins to emerge. After all, if even price reduction cannot be sold, then Tesla may also find it difficult to come up with effective means to increase the market.

Not long ago, Tesla announced that it will raise prices on April 1, and the price of the Model Y will be increased by 5,000 yuan. The current 8,000 yuan official cash car insurance subsidy policy and the maximum 10,000 yuan paint reduction policy will also expire on March 31. According to the above algorithm, the salesperson said that the actual price increase this time is up to 23,000 yuan. While other automakers are lowering prices, Tesla is going against the trend, which is also a way to verify the market. This move may be a further measure to promote sales, aiming to boost sales at the end of the quarter. Currently, the delivery time for Tesla Model 3 and Model Y is 2 to 6 weeks.

In China, automakers that “roll up” the price reduction trend often hope to “increase sales with price”, but Tesla’s discounts have not led to an increase in sales. According to the data of the Passenger Vehicle Association, Tesla’s domestic retail sales in February were 30,100 vehicles, down 11% year-on-year, and the total delivery volume in the first two months of this year was 70,000 vehicles, up 15% year-on-year. Consumers have a relatively heavy wait-and-see sentiment on prices, and the positive incremental factors brought about in the short term are not obvious. There will be a temporary sluggish wait-and-see phenomenon in sales when the price is reduced, and the positive purchasing effect brought about by the price reduction in the short term is offset. However, under the trend of the fierce price war in the Chinese auto industry, can Tesla increase prices against the trend to protect itself? We’ll have to wait and see.