On July 20 local time, German Porsche Automobile released the latest personnel change announcement. Alexander Pollich will officially succeed Michael Kirsch as the CEO of Porsche in mainland China, Hong Kong and Macau regions on September 1. Michael Kirsch will return to Germany for another important task and will be announced later.

The official said that Alexander Pollich has been working at Porsche for more than 23 years and has held several management positions. Since July 2018, Alexander Pollich has been serving as the chairman of the Porsche board, and the sales expert with international experience, Alexander Pollich, will be responsible for the important Chinese sales market. It is understood that after Alexander Pollich takes over as the president and CEO of Porsche China, in addition to ensuring the current operating business of Porsche, it will also implement a value-oriented and brand-appropriate growth strategy in the Chinese market. In addition, the focus will be on deeper cooperation with local dealers and further optimizing internal processes and structures.

In the press release, Porsche thanked Michael Kirsch for his outstanding contribution to Porsche’s China business in the past two years. The data shows that Michael Kirsch has many years of management experience in the Chinese market. He served as the chief operating officer of Porsche China from 2012 to 2016, responsible for sales, dealer development and direct sales business. Since 2019, Michael Kirsch has served as the president and chief executive officer of Porsche Japan. In the previous three years, he was mainly responsible for the Porsche Korean market. In June 2022, Porsche announced that Michael Kirsch would succeed Jens Puttfarcken as the president and chief executive officer of Porsche China to fully take charge of the business in the Chinese region.

It is worth mentioning that according to the European media “Bild”, in the opinion of this media, Porsche’s replacement of the manager of most of China and the Hong Kong and Macau regions from Michael Kirsch to Alexander Pollich is the result of Porsche’s dissatisfaction with the sales performance in the Chinese market.

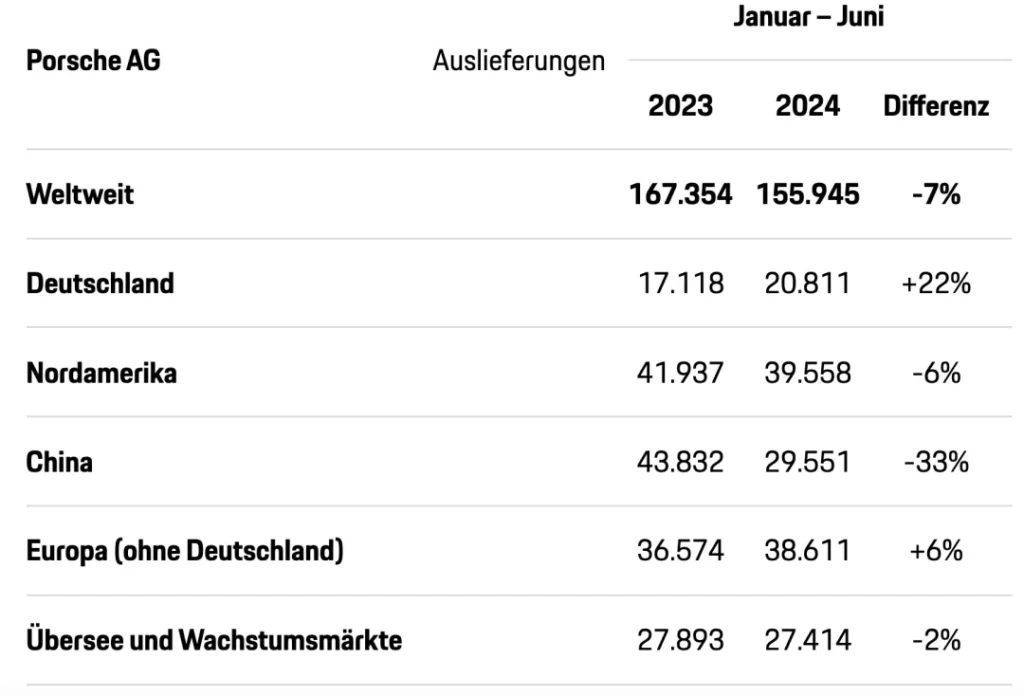

On July 9, Porsche released the latest sales data showing that in the first half of 2024, Porsche’s global sales were 155,945 vehicles, a year-on-year decline of 7%, among which the total delivery volume in the Chinese market was 29,551 vehicles, a year-on-year decline of 33%, and it was the only market with a double-digit decline and also lost the position of the largest single market in the world.

It is understood that Porsche has entered the Chinese market since 2001. For Chinese car owners, its high-end brand positioning is not only a means of transportation, but also a symbol of identity and status. As a luxury brand, the core advantage of Porsche lies in its excellent performance and excellent driving experience. Whether it is the 911, Cayenne or Panamera, one can feel the ultimate speed and passion. In 2015, China surpassed the United States for the first time to become the largest single market of Porsche globally, continuously refreshing the historical record for 20 consecutive years. In 202, Porsche created a new historical sales high in the Chinese market, delivering 95,671 new cars throughout the year. In 2022, Porsche’s global sales were 309,884 vehicles, an increase of 2.6% year-on-year. Among them, the total delivery volume in the Chinese market was 93,286 vehicles, becoming the only market in Porsche’s global that declined, with a year-on-year decline of 2.5%. This is the first time that Porsche has experienced a decline since entering the Chinese market, and in 2023, Porsche’s sales in the Chinese market declined again, with a year-on-year decline of 15% compared to 2022.

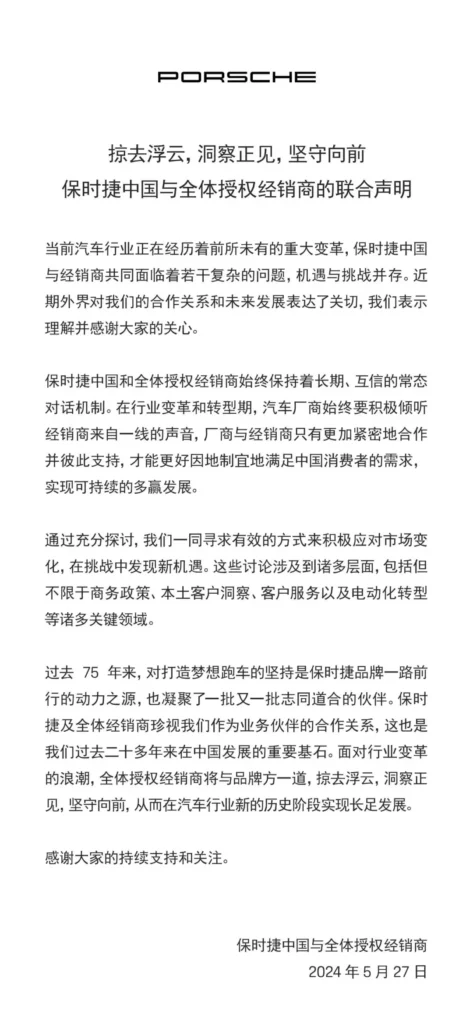

In May this year, there were news that some Chinese dealers of Porsche launched protests and boycotts, preparing to “force the German headquarters”. The fuse was that in order to complete the sales task, Porsche China chose to pressure the dealers with inventory. However, the pressure on inventory for dealers has huge financial pressure, resulting in the intensification of conflicts between Porsche and the dealers. Some Porsche dealers have stopped picking up cars and demanded subsidies from the Porsche headquarters while replacing relevant senior executives.

Subsequently, Porsche China released a joint statement titled “Sweeping away the clouds, perceiving the right view, and persisting forward” with all authorized dealers. Porsche China said that the current automotive industry is undergoing unprecedented major changes, and Porsche China and dealers are jointly facing several complex problems, with opportunities and challenges coexisting. Porsche China and all authorized dealers have always maintained a long-term and mutually trusting regular dialogue mechanism. In the period of industry transformation and transition, automotive manufacturers must always actively listen to the voices from the front line of dealers. Only by cooperating more closely and supporting each other between manufacturers and dealers can they better meet the needs of Chinese consumers according to local conditions and achieve sustainable win-win development. Porsche China said that through full discussions, Porsche China and all authorized dealers will jointly seek effective ways to actively respond to market changes and discover new opportunities in challenges. These discussions involve many aspects, including but not limited to business policies, local customer insights, customer service, and electrification transformation and many other key fields.

The core driving force of the growth of the imported market is still the consumption upgrade of passenger cars, but the electrification transformation has changed the demand for fuel cars, and the demand for imported fuel cars has also decreased significantly. As a super-luxury brand, Porsche is facing more and more new car-building forces, quickly laying out the high-end electric vehicle field and seizing the market share of traditional luxury brands, and it also has to make Porsche begin to examine its position in the Chinese market. Next, the next trump card in the luxury car competition will be new energy vehicles, especially those manufacturers that attach great importance to the electric vehicle market will take the initiative.

Porsche is like an “elephant turning around” in the electrification transformation, but this is also the development dilemma faced by global brands. In the wave of the process of electrification and intelligent transformation, this reality and dilemma have also caused the current situation that the transformation of traditional luxury car companies always seems to be a bit slower. Although Porsche firmly promotes the electrification strategy, it also has to slow down due to financial and technical issues.

According to Porsche’s planning goal, the sales of new energy models will account for half of the total sales in 2025, and the proportion of pure electric models will reach more than 80% by 2030. However, as Chinese new energy vehicle brands begin to attack the luxury market, Porsche’s market share in the Chinese market begins to decline year by year, and the time left for it is already very urgent. To maintain market stability in the Chinese market, Porsche must put down its stance and focus more on understanding the real needs of high-end users and show stronger product power.