After U.S. market close on Wednesday Eastern Time, Tesla released its financial report for the third quarter of 2025. According to the report, Tesla’s third-quarter revenue reached $28.1 billion, representing a 12% year-over-year increase, exceeding analysts’ expectations of $26.37 billion. Net profit was $1.77 billion, down 29% from the same period last year, while adjusted earnings per share (EPS) came in at $0.50, below analysts’ expectations of $0.54. Additionally, Tesla’s gross margin for the quarter was 18%, higher than the estimated 17.2%, and free cash flow was $3.99 billion, well above the estimated $1.25 billion.

In short, while Tesla’s Q3 revenue hit a record high, profitability fell short of expectations.

Automotive Business Performance

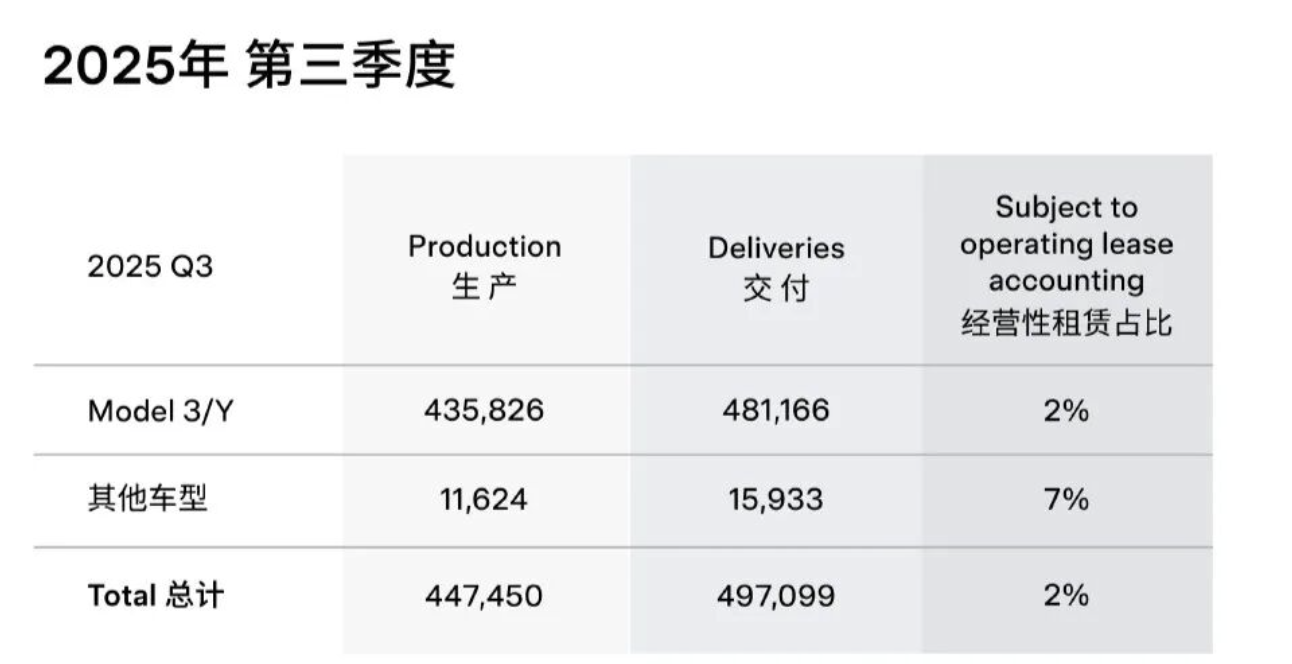

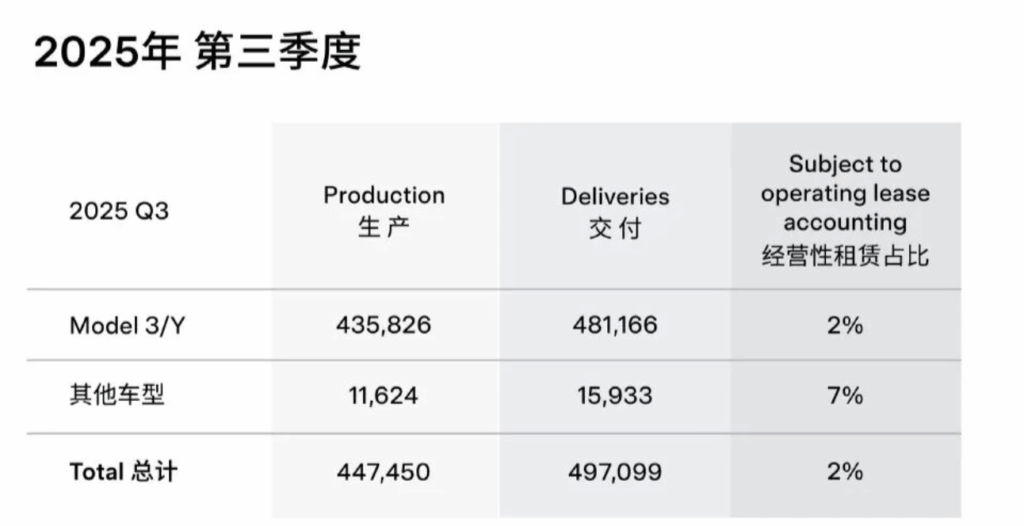

Specifically, Tesla’s automotive revenue reached $21.2 billion in Q3, up 6% year-over-year from $20 billion in the same period last year. This increase was largely driven by higher vehicle deliveries. Data shows that Tesla delivered 497,000 vehicles worldwide in the third quarter, a 7.4% year-over-year increase, significantly higher than the market forecast of 439,600 vehicles. Among them, 169,200 vehicles were delivered in China during the quarter.

Market Analysis

Analysts believe Tesla’s third-quarter performance was dragged down by a continued decline in European sales. However, the slowdown in Europe was partly offset by stronger sales in the U.S. market, as American consumers rushed to purchase electric vehicles before the expiration of federal tax credit policies. This boosted Tesla’s revenue growth, although profitability still fell short of expectations.

As a result of these developments, Tesla’s stock closed at $438.97 on October 22 (Eastern Time), down 0.82%, giving the company a market capitalization of $1.46 trillion.

Model Lineup and New Launches

Currently, Tesla’s global lineup includes the Model 3, Model Y, Model S, Model X, and the Cybertruck electric pickup. Among them, the Model 3 and Model Y remain the company’s main sales drivers, with 481,000 units delivered in Q3, while other models accounted for 16,000 units.

On August 19, Tesla launched the Model Y L in China, priced at ¥339,000, featuring a three-row, six-seat configuration and a longer body compared to the standard five-seat version. It is equipped with an 82 kWh LG lithium battery pack and has a CLTC range of 751 km.

In early October, Tesla officially introduced the Model 3 Standard and Model Y Standard in the U.S. market, both priced below $40,000. These new entry-level versions are only available in the United States. The Model 3 Standard starts at $36,990 (approximately ¥263,300), about $5,500 cheaper than the Premium RWD model, while the Model Y Standard starts at $39,990 (approximately ¥284,700), about $5,000 cheaper than the higher-end RWD version. Industry analysts believe these more affordable models are Tesla’s response to the phasing out of U.S. EV subsidies and increased market competition.

Outlook and Challenges

Tesla did not provide guidance for its Q4 vehicle production and delivery volumes in this report. However, tariffs and market competition remain key challenges. According to reports, Tesla’s CFO Vaibhav Taneja stated that tariffs had an overall impact of over $400 million in the third quarter.

Looking ahead to 2025, Tesla CEO Elon Musk previously stated during an earnings call that the company expects sales to grow by 20%–30% this year. This growth forecast is partly based on the introduction of a more affordable model and continued progress in autonomous driving technology.