Recently, Oliver Blume, the CEO of the Volkswagen Automotive Group, admitted in an interview with the media that Volkswagen cannot maintain a leading position in the Chinese electric vehicle market. He stated that Volkswagen hopes to avoid setting “utopian” goals for its market share in China. In the intense competitive environment, having a market share exceeding 10% is already “very considerable”.

Although Volkswagen has achieved brilliant achievements in the era of traditional fuel vehicles, the current Chinese automotive market has entered an era of comprehensive electrification, and fuel vehicles are gradually being abandoned by the market. The advantages accumulated by traditional auto giants like Volkswagen are slowly fading away. All traditional automakers are facing tremendous pressure in the process of electrification transformation. Overall, the progress of electrification transformation of traditional automakers is not as good as that of local Chinese automakers. Even though the Volkswagen ID series stands out among many joint venture electric vehicles, compared with the mainstream Chinese electric vehicle manufacturers in China, Volkswagen is far behind.

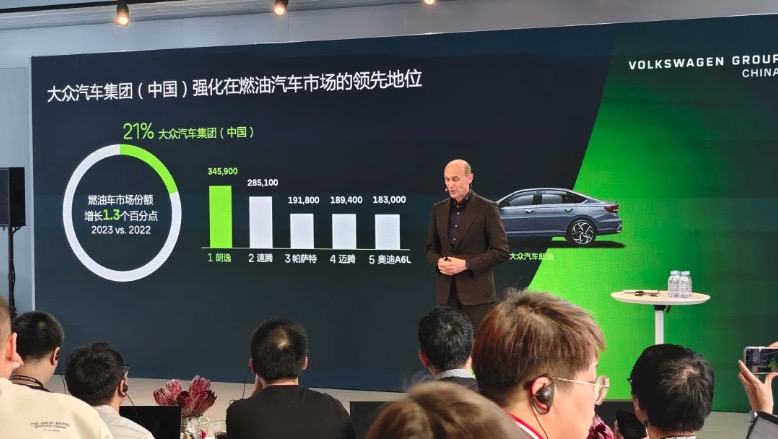

The data shows that in 2023, the Volkswagen Automotive Group delivered a total of 3.236 million vehicles in China throughout the year, with a year-on-year growth of 1.6%, and it still remains the largest single market globally. Among them, the annual delivery volume of pure electric vehicles is 192,000, with a year-on-year growth of 23.2%. For the Volkswagen Automotive Group, fuel vehicles are its base in China, and it has also made it clear that at this stage, it will not stop producing fuel vehicles. “Before 2027, the Volkswagen Automotive Group will still produce fuel vehicles. By 2027, the Volkswagen Automotive Group will also provide 30 local produced fuel and hybrid vehicles.” It is understood that in 2023, the Volkswagen brand will launch new Magotan / Passat, new Tiguan L, new Polo, new Golf and other fuel vehicles.

However, with the continuous increase in the penetration rate of new energy vehicles in the Chinese market, and the share of joint venture brands based on fuel vehicles being eroded, Volkswagen is facing more intense competition from Chinese brands. Despite achieving growth, Volkswagen’s market share is declining, from 18% in 2018 to 14% in 2023. The Volkswagen Automotive Group emphasized in its annual report that it will continue to focus on investing in the Chinese market, new products, battery business, and the platforms of pure electric vehicles and fuel vehicles.

The chairman and CEO of the Volkswagen Automotive Group (China), Bernd Pischetsrieder, stated that Volkswagen’s goal is to maintain the first position among international auto manufacturers in China and maintain a top three position in the Chinese market. To achieve these goals, Volkswagen plans to complete two new vehicle platforms in the next three years. This platform will be located in Hefei, and the four models launched will also be the main models of Volkswagen Anhui in the future, using battery, electric drive, and motor solutions targeted at the Chinese market, with a price range between 140,000 and 170,000 yuan. In addition, Volkswagen has also collaborated with XPeng Motors to jointly develop two Volkswagen-branded electric vehicle models for the Chinese pure electric mid-size vehicle market, and the first model is planned to be launched in 2026.

The electric offensive launched by Volkswagen in the Chinese market is becoming increasingly fierce. At present, the pure electric models sold by Volkswagen in the Chinese market include the ID.7 VIZZION, ID.3, ID.4 CROZZ, ID.4 X, ID.6 CROZZ, ID.6 X and other models, as well as the ID.U series models to be launched this year. However, in the face of the strong attack of Chinese new energy brands, the development path of Volkswagen in the Chinese new energy vehicle market is destined to not be very smooth.

In addition, Volkswagen is also laying out in the field of intelligence. Its software company CARIAD has successively become a joint venture with Horizon and Zhongke Chuangda, hoping to use the power of local technology companies to increase intelligent research and development, so as to better meet the needs of consumers in the Chinese market. In March this year, Volkswagen announced that it will deepen cooperation with Israel’s autonomous driving technology company Mobileye to jointly promote the mass production of autonomous driving technology, and Mobileye will provide advanced driving assistance systems based on Mobileye’s self-developed platform for Volkswagen’s brands including Audi, Bentley, Lamborghini, and Porsche.

The tide of the electric era is surging, and the design of “set of dolls”, the outdated style, and the inability to keep up with the mainstream of the market in terms of intelligence have made Volkswagen’s advantages in fuel vehicles disappear completely. In this context, the electrification transformation of Volkswagen is extremely urgent, and it also makes Volkswagen see the necessity and feasibility of starting the “second curve” in China. From the current market layout of Volkswagen, whether it is internal self-evolution or external seeking for cooperation, it is to stay in the Chinese market as much as possible, but it is not so simple for this huge giant ship to reach the other side quickly.

For German industry, China is still extremely important, especially for automotive manufacturers. At present, the Chinese market is the largest single market in the world for well-known automotive manufacturers such as Volkswagen, BMW, and Mercedes-Benz. It is reported that German Chancellor Scholz will visit China in April, and senior executives of many German companies such as BMW and Mercedes-Benz will go to China together. The report said that the list of senior executives on this visit highlights the status of China as Germany’s largest trading partner when the German prime minister makes a major foreign visit.