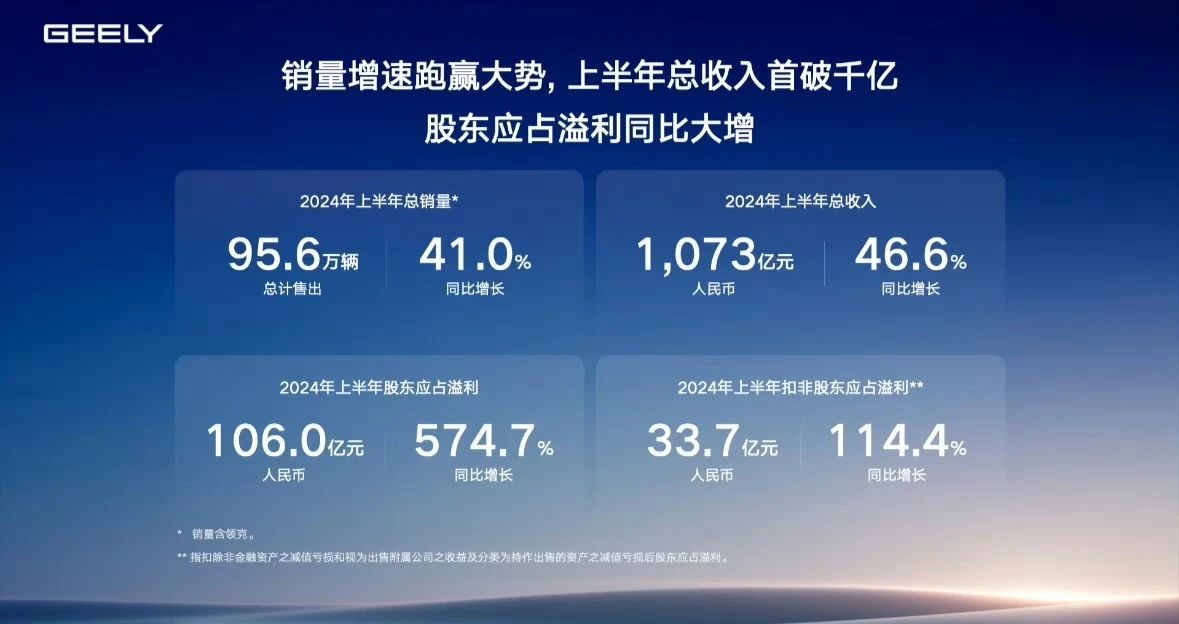

On August 21, Geely Automobile officially released its financial report for the first half of 2024. The financial report shows that in the first half of 2024, Geely Automobile achieved an operating income of 107.3 billion yuan, surpassing the 100 billion mark for the first time, with a year-on-year increase of 46.6%; the profit attributable to shareholders was 10.6 billion yuan, a year-on-year increase of 574.7%; the profit attributable to shareholders excluding non-recurring items was 3.37 billion yuan, a year-on-year increase of 114%; the net cash level increased by 25.4% year-on-year to 35.7 billion yuan, and the cash flow reserve was sufficient. In addition, the total gross profit of Geely Automobile in the first half of the year increased significantly to 16.2 billion yuan, and the gross profit margin was 15.1%.

From the financial report data, it can be seen that Geely Automobile has achieved high-quality growth without being overly affected by the “involution” of the automotive market environment. Instead, it has achieved counter-trend growth, which also lays a solid foundation for continuing to “roll up” in the second half of 2024. At the financial report conference, Gui Shengyue, the executive president and executive director of Geely Holding, said that in the first half of 2024, the sales proportion of new energy vehicles of Geely Automobile increased significantly, and fuel vehicles returned to the first place among domestic brands. The dawn of Geely Automobile’s return to brilliance has been seen. He believes that with the reasonable layout of Geely Automobile’s new energy vehicles in various price segments, and the joint improvement of the scale effect and intelligent technology, the situation of turning losses into profits in the new energy sector will come soon.

Gui Shengyue’s confidence comes from the rapid growth of Geely Automobile’s sales. Data shows that in the first half of 2024, Geely Automobile’s cumulative total sales reached 956,000 units, a year-on-year increase of 41%. Among them, the sales of pure electric vehicles were 187,000 units, a year-on-year increase of 49%, and the sales of plug-in hybrid vehicles were 133,000 units, a year-on-year increase of 502%. Based on this calculation, the penetration rate of new energy vehicles of Geely Automobile has increased from 21.8% in the same period to 33.5%. This data not only indicates the success of Geely Automobile’s new energy transformation but also indicates that Geely Automobile can keep up with the rapid development trend of new energy vehicles. Compared with the difficult transformation of some auto companies in new energy vehicles, Geely New Energy has achieved a steady increase in sales proportion, which fully reflects the richness of Geely New Energy’s product line and its sufficient market competitiveness.

Since this year, Geely’s new energy transformation has comprehensively accelerated towards newness. In the first half of the year, Geely Galaxy series achieved cumulative sales of 81,000 units, a year-on-year increase of 742%, with an average monthly sales of more than 10,000 units. Geely Galaxy New Energy was launched in February 2023 and plans to launch 7 new models in two years, including four intelligent electric hybrid L series (L5, L6, L7, L9) and three Galaxy intelligent pure electric E series (E6, E7, E8), covering A0 to B-level electric hybrid products. On August 3, Geely Galaxy E5 was officially launched. The limited-time preferential guiding price was 1.098 – 1.458 million yuan. The new car is equipped with new high-value technical applications such as Shendun Short Knife Battery, GEA Global Intelligent New Energy Architecture, and Galaxy 11-in-1 Intelligent Electric Drive, forming the product layout of “pure electric + electric hybrid, sedan + SUV” of Geely Galaxy. Gan Jiayue, the CEO of Geely Automobile Group and the executive director of Geely Automobile Holdings Limited, said that the overall sales of Geely Galaxy could achieve break-even when reaching 250,000 – 300,000 units. Judging from the current growth rate of the Galaxy series and the continuously expanding product matrix, the break-even of the Galaxy series can be said to be just around the corner.

In addition, the sales of Lynk & Co and Zeekr have also achieved rapid growth. In terms of the Lynk & Co brand, the total sales in the first half of the year were 126,000 units, a year-on-year increase of 53.6%. The Lynk & Co brand continues to lead the upward development of Chinese automotive brands. The first pure electric sedan – Lynk & Co Z10 officially opened for reservations on August 15, with a pre-sale price starting at 215,800 yuan. The new car is positioned as a medium and large-sized pure electric sedan, and some models are built with an 800V architecture and equipped with lithium iron phosphate battery packs.

In terms of the Zeekr brand, a total of 88,000 units were delivered in the first half of the year, a year-on-year increase of 106%, winning the championship of Chinese pure electric brands above 200,000 yuan in 2024 and achieving the highest rate of annual sales target completion among new forces. It is understood that Zeekr will launch medium and large-sized flagship products in the sedan and MPV markets. The new car with the code name EX1E, a full-size SUV, will be released in the third quarter of 2025, while Zeekr 7X, a medium-sized SUV, will be listed at the 2024 Chengdu Auto Show.

It is worth mentioning that Zeekr is close to break-even. The financial report shows that in the second quarter, Zeekr achieved revenue of 20.04 billion yuan, a year-on-year increase of 58%, setting a new quarterly record; the comprehensive gross profit margin was 17.2%, of which the vehicle gross profit margin was 14.2%; the net loss in a single quarter was 1.81 billion yuan, a year-on-year increase of 28.7%. Zeekr’s net loss stems from its continuous increase in R&D investment. In the second quarter, Zeekr’s R&D investment was as high as 2.62 billion yuan, a year-on-year increase of 89.6%. Zeekr stated that under the Hong Kong accounting standards, after excluding the impact of share-based payments, Zeekr’s net loss in the first half of the year narrowed significantly to 0.7 billion yuan, and it achieved a profit in the second quarter.

Under the pattern where the main logic of Geely’s new energy is becoming increasingly clear, each brand actively participates in the market competition by focusing on user needs and clear brand positioning. Through establishing collaborative cooperation in basic technology research, basic architecture development and application, as well as in the supply chain and manufacturing, the scale effect and systematic advantages of Geely Holding can be exerted.

At present, Geely Automobile is accelerating the implementation of “Intelligent Geely 2025”, making significant progress in key technical fields such as intelligent driving, cockpit systems, artificial intelligence and on-board chips, and achieving all-round breakthroughs in intelligent architectures, high-performance three-electric systems and safety technologies. The financial report data shows that the total R&D investment in the first half of this year increased by 17.9% year-on-year to 7 billion yuan. Based on Geely’s current level of making money through technology, this part of the R&D investment may also turn into Geely’s income in the future.

In addition, the overseas market will also become a key development target for Geely. Geely brand completed the launch of 12 products in 30 overseas countries in the first half of the year and has deployed over 650 sales and service outlets in 76 countries. In the first half of 2024, Lynk & Co steadily advanced the layout of the European and Asia-Pacific markets. During the reporting period, Lynk & Co officially entered the markets of Azerbaijan and the Philippines. As of now, Lynk & Co has opened 12 experience stores in 7 European countries and has landed 10 Lynk & Co centers and 2 Lynk & Co spaces in the Asia-Pacific market. At the same time, as of June 30, Zeekr has entered nearly 30 international mainstream markets including Sweden, the Netherlands, the United Arab Emirates, Mexico, etc., including right-hand drive markets such as Thailand, Malaysia and Indonesia.

Although the EU tariffs are not friendly to Chinese auto exports, Geely also has countermeasures. Li Donghui, the CEO of Geely Holding Group and the vice-chairman and executive director of Geely Automobile Holdings Limited, said that Geely Holding has long carried out global layout. For the European region in the next step, Geely Holding will definitely have diverse market and production capacity layout arrangements, such as using the factories of Volvo, LEVC and Lotus or cooperating flexibly with other global partners to complete the production capacity planning and deployment.

In the first half of this year, Geely Automobile made breakthrough progress in both new energy transformation and intelligence, with operating income surpassing 100 billion for the first time, steady sales growth and further improvement in profitability. In 2024, Geely Automobile has raised its annual sales target to 2 million units, of which new energy sales will increase by 70% year-on-year and export sales will increase by 45% year-on-year. In the second half of the year, Geely Automobile will successively launch 6 intelligent new energy products. Among them, for the Geely brand, in addition to the Galaxy E5 launched on August 3, there will also be 1 high-quality pure electric compact SUV and 1 plug-in hybrid SUV. Lynk & Co brand will have 2 new pure electric products, including the first pure electric product Lynk & Co Z10 to be officially listed in September and 1 new compact pure electric SUV to be launched within the year. Zeekr brand will have 2 new models listed. Zeekr 7X and Zeekr MIX are expected to be listed in the third and fourth quarters respectively. Looking forward to the future, Geely will continue to focus on the transformation of new energy and intelligence, build a stable technical fortress, and strengthen the empowerment of the technological ecosystem for intelligent driving and intelligent travel.

In the future, Geely Automobile will continue to focus on the transformation of new energy and intelligence. Through continuous technological innovation and global layout, it will consolidate its leading position in the global market. This is not only Geely’s self-transcendence as an industry giant but also its continuous leading innovation performance in the global automotive industry. At the same time, Geely Automobile also insists on being an enterprise with leading product quality and technology, putting quality on top of the product and ensuring that the long-term interests of customers are not compromised. Based on these two points, it is necessary to not only maintain product competitiveness but also effectively control product costs. Gui Shengyue said that the long-term competition under the price war will test the profit ability of auto companies. Currently, through years of market summary and exploration of coping strategies, Geely’s profit ability has been on the right track. Therefore, Geely is also confident of seizing opportunities in the “market chaos”.