On August 17th, Faraday Future (FF) announced and officially launched its “EAI and Crypto” dual-flywheel & dual-bridge ecosystem strategy at Pebble Beach, marking the second chapter of FF’s bridge strategy. In a social media video, Jia Yueting stated that the dual-flywheel concept is derived from the flywheel effect, which will generate a powerful dual-flywheel momentum. With “EAI and Crypto” as core drivers, FF aims to build a Web2+Web3 dual-engine cyclic growth system that operates independently yet mutually empowers each other. This system will form a steadily functioning and accumulative EAI EV ecosystem, combined with a rapidly growing Crypto ecosystem. The integration of both will bridge the Sino-US automotive industries, ultimately creating maximum value for shareholders and investors.

Jia Yueting emphasized: “The ultra-long bull market of crypto assets in the next decade will accelerate the rapid realization of FF and FX’s strategic goal of scaling up blockbuster products in the EAI EV blue ocean.” As planned, the first phase of the strategy includes an asset procurement plan of $500 million to $1 billion, with the first $30 million asset allocation expected to be implemented next week. The subsequent phases aim to reach a scale of tens of billions of dollars as soon as possible. FF stated: “This is not only a milestone in the major upgrade of the bridge strategy but will also 开启 the company’s second growth curve. It will build a fast-growing system that operates independently and mutually empowers, significantly enhancing the company’s profitability, capital return capacity, operating cash flow, and net asset value, optimizing the asset-liability structure, and ultimately accelerating the maximization of shareholder interests.”

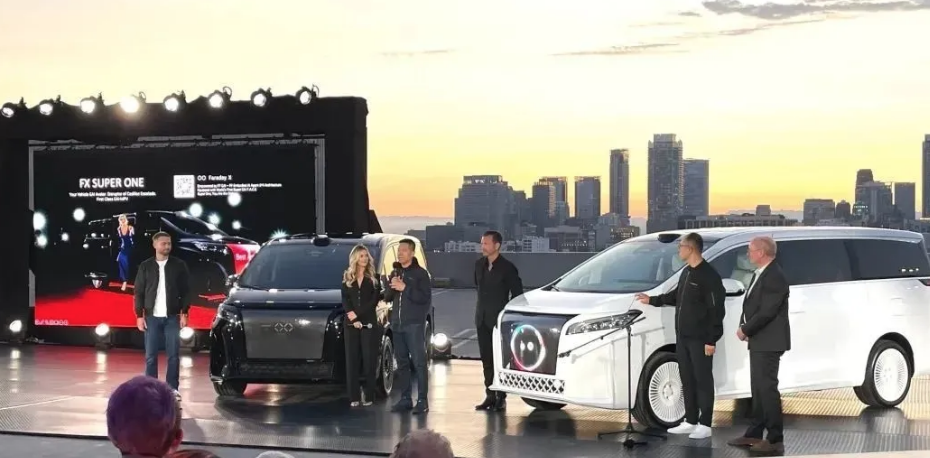

FF began its automotive venture as early as May 2014, when Jia Yueting officially founded the FF brand in California, USA. Its first mass-produced electric vehicle, the FF91, was unveiled in January 2017 but did not hit the market until May 2023. Surprisingly, total deliveries of the FF91 have remained below 30 units since its launch, and its sluggish market performance has directly led to huge gaps in FF’s financial reports. To address this, FF has pinned its hopes on its second brand, Faraday X (FX), which was launched in September 2024. Positioned as a “high-value-for-money” brand, FX aims to create “double the performance at half the price” AI EV products, primarily targeting the U.S. market. FX has planned three models: the First Class AI-MPV “Super One,” FX5, and FX6. The FX5 is expected to be priced between $20,000 and $30,000, while the FX6 will range from $30,000 to $50,000.

On July 18th, FX’s first new vehicle, the FX Super One, made its debut, with simultaneous C-end pre-orders opening at a deposit of $100. Positioned as a pure electric mid-to-large MPV, it offers four-seat GOAT, six-seat, and seven-seat versions, with mass production scheduled for the end of 2025. On July 24th, multiple media outlets reported that Great Wall Motor has become the first Chinese automaker to partner with Faraday Future. As one of the four Chinese automakers in Jia Yueting’s “Sino-US Automotive Industry Bridge Strategy,” Great Wall Motor is the first to implement the strategy, with the FX Super One obtaining cooperative authorization from Great Wall Motor’s Wei brand Gaoshan.

Notably, FF has been accelerating its 布局 since 2025, but it still faces a huge debt gap. According to the latest financial report, in the first quarter of this year, FF’s operating income was $300,000, mainly from FF 91 deliveries and leasing revenue. The net operating loss was $43.8 million, slightly higher than the $43.6 million in the same period. Total operating expenses were $22.8 million, a $200,000 decrease from the same period. For reference, FF’s full-year net loss in 2024 was $355.8 million, including $206.4 million from non-operating losses and non-cash expenses. Operating losses stood at $149.7 million, a 47.7% year-on-year decline, while operating cash outflows were $70.2 million, a 75% year-on-year drop.