Great Wall Motor Reports H1 2025 Results: Net Profit Down Despite Revenue Growth

On July 18, Great Wall Motor released its financial results for the first half of 2025. The company reported revenue of RMB 92.367 billion, up 1.03% year-on-year. However, net profit attributable to shareholders dropped to RMB 6.337 billion, a decline of 10.22% YoY. Excluding non-recurring items, net profit stood at RMB 3.582 billion, down sharply by 36.38% YoY.

The automaker explained that while sales and revenue grew during the reporting period, investment in new product cycles, direct-to-customer sales channels, technology upgrades, and brand promotion increased significantly, leading to profit volatility. By the end of June, Great Wall Motor’s total assets reached RMB 222.448 billion (+2.17% YoY), while liabilities declined slightly to RMB 138.001 billion (-0.52% YoY).

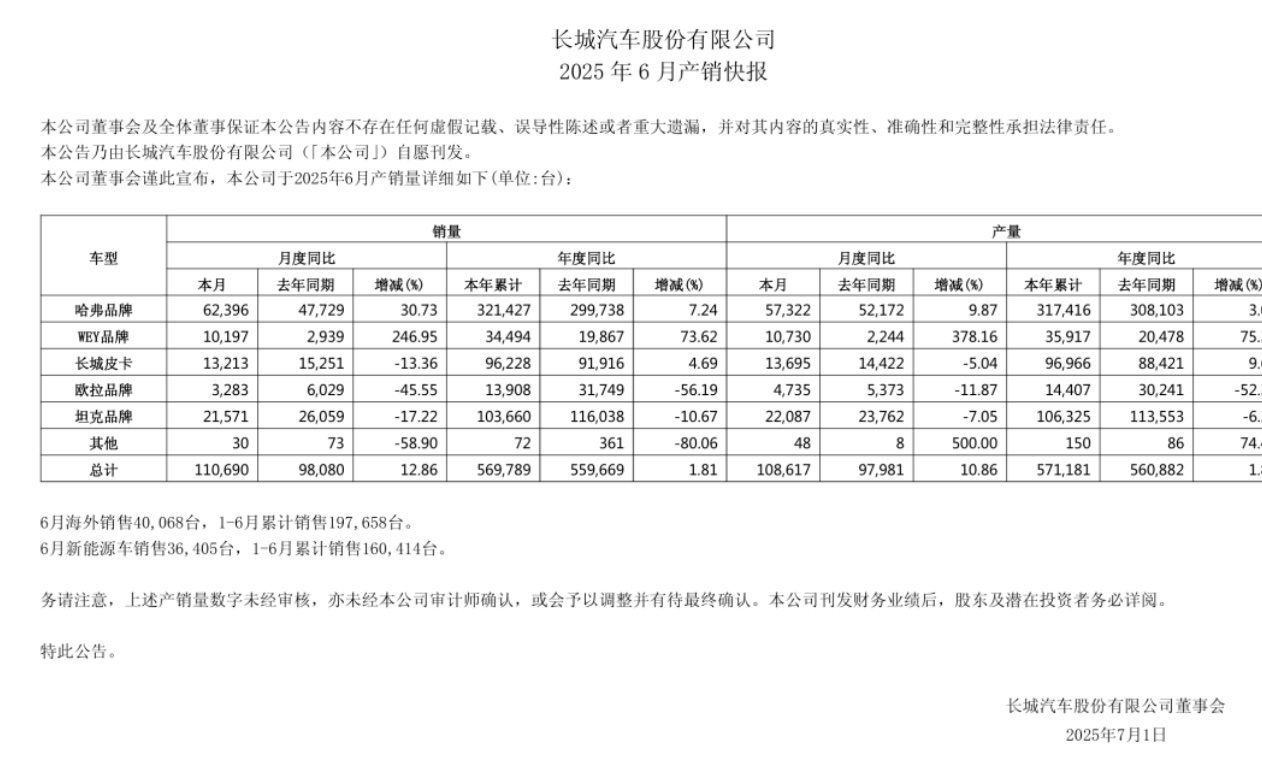

Sales Performance

In H1 2025, Great Wall Motor sold 569,789 vehicles (+1.81% YoY), including 160,414 NEVs and 197,658 units in overseas markets. By brand:

Haval remained the backbone with 321,427 units, up 7.24% YoY.

WEY surged 73.62% YoY to 34,494 units, driven by the success of the new Blue Mountain SUV.

ORA fell 56.19% YoY to 13,908 units, amid a lack of new model launches since 2023.

Tank declined 10.67% YoY to 103,660 units, facing intensified competition in the off-road SUV segment.

Great Wall Pickup posted 96,228 units, up 4.69% YoY.

Market Context & Challenges

Once a success story in the fuel-vehicle era, Great Wall Motor now faces increasing pressure as China’s auto industry shifts rapidly toward electrification. While the company has accelerated its NEV strategy, it still lags behind rivals such as BYD and Geely in terms of competitiveness and innovation.

In 2025, Great Wall has launched several new models, including the 2nd-generation Haval Xiaolong MAX, the all-new Gaoshan MPV, Tank 300 Hook Edition, Tank 700 Hi4-T, and the new ORA Haomao. On July 17, the 2026 Haval Big Dog was officially launched, offering three variants priced from RMB 123,900 to RMB 149,900 (limited-time offer: RMB 98,900–124,900). The new model, featuring a 14.6-inch infotainment screen with Coffee OS 3 and 1.5T/2.0T engine options, recorded 20,668 orders within 24 hours of launch.

With intensified competition in the NEV sector, Great Wall Motor must accelerate product differentiation and innovation to regain momentum in the second half of 2025.