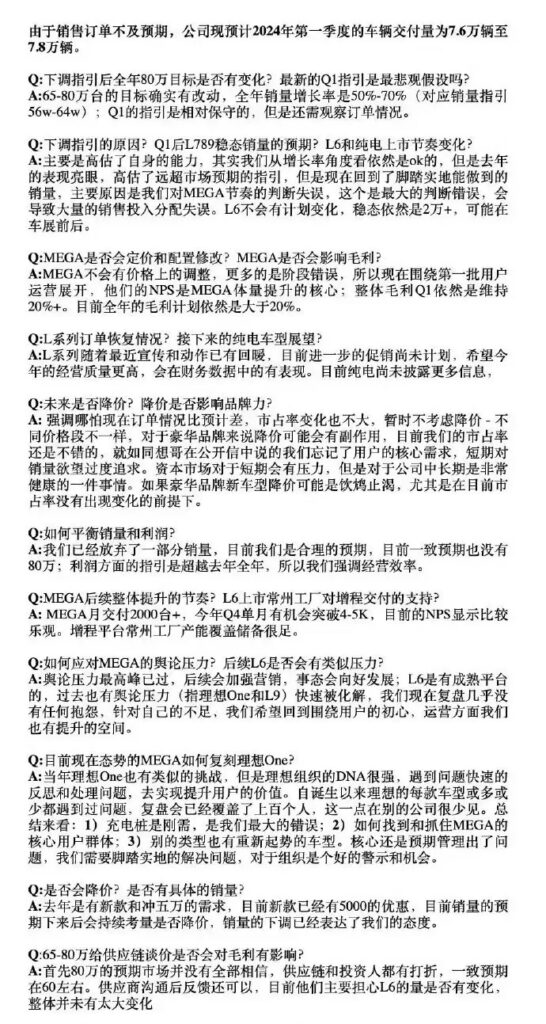

A document named “LI Auto Internal Communication Summary” was exposed, and LI Auto may downgrade its annual sales target. The internal communication summary shows that due to the lower-than-expected sales orders, the delivery volume in the first quarter of 2024 is expected to be 76,000-78,000 vehicles. After the downgrade guidance, the annual sales target will change. The sales growth rate in 2024 is 50%-70%, corresponding to a sales guide of 560,000-640,000 vehicles, which is downgraded by 160,000-240,000 vehicles compared to the previous 650,000-800,000 vehicles. This also means that LI Auto’s goal of challenging the sales of BBA in the Chinese region may fail.

In addition, in response to various problems that have arisen after the launch of MEGA, LI Auto made it clear that even if the performance of MEGA is less than expected, there will be no pricing adjustments. Three aspects will be used to boost the market performance of MEGA: 1. Strengthen the infrastructure construction of charging piles; 2. Further seize the core user group of MEGA; 3. Solve problems down-to-earth. For infrastructure construction, the latest guideline is that there will be more than 10,000 urban charging piles and more than 3,000 high-speed charging piles in 2024. It is understood that LI Auto’s sales expectation for MEGA has been reduced to 2,000 vehicles/month. After the above changes, it is expected that the monthly delivery volume in Q4 will increase to 4,000-5,000 vehicles. Previously, LI Auto’s monthly sales expectation for MEAG was 8,000 vehicles, challenging the first place in the sales of all categories of more than 500,000 vehicles.

At present, LI Auto still mainly relies on the L series for volume. Although the L-series product market is now suppressed by the AITO, the market share has not changed much. LI Auto will not consider price reductions for the time being. LI Auto stated that the price reduction of luxury brands will have a negative impact on the brand power, especially the price reduction of new models is no different from drinking poison to quench thirst. The Ideal L6 is likely to be launched after the 2024 Beijing Auto Show, with a monthly sales expectation of more than 20,000 vehicles.

However, as of the time of publication, LI Auto has not commented on the relevant information. An internal source of LI Auto told Jiemian News that the internal has not received the notice of the adjustment of the annual sales target, but if the adjustment will effectively reduce internal pressure and focus on responding to the product offensive of AITO. On March 21, Li Xiang, CEO of LI Auto, issued a full-company letter internally, reflecting on the rhythm and sales issues of Ideal MEGA, and making targeted adjustments to product management, dealers, charging network layout, and sales expectations.

Li Xiang mentioned in the internal letter that Ideal MEGA and high-voltage pure electric must go through a stage similar to Ideal ONE and extended-range electric from 0 to 1, and cannot have the operating potential from 1 to 10 as the Ideal L series when it is launched. However, the inside of LI Auto mistakenly operated the business validation period of Ideal MEGA’s 0 to 1 stage as the high-speed development period from 1 to 10, resulting in a miscalculation of the pure electric strategy rhythm. Li Xiang said that due to the chaotic rhythm of MEGA, the sales team significantly reduced the time and energy of serving L-series users, and even the main model Ideal L8 did not have a place in the store. Next, it will abandon the all-round sales strategy and focus on large retail centers in top cities for product experience and test drives, and accelerate the construction of supercharging stations in these cities.

In the full-company letter, Li Xiang also reflected on the issue of everyone paying too much attention to sales: “We are too focused on sales and competition from top to bottom, which makes desire surpass value, and significantly reduces our originally best user value and operating efficiency. The pursuit of desire has made us become the people we hate.” To this end, LI Auto will lower the expected and desire for sales, return to healthy growth, return to the improvement of the most proficient user value, and return to the improvement of the most proficient operating efficiency.

In addition, LI Auto will abandon the all-round sales strategy, focus on large retail centers in top cities for product experience and test drives, and accelerate the construction of supercharging stations in these cities. After effectively completing the stage from 0 to 1, it will be promoted to more cities and a larger user group. It is understood that LI Auto will build urban supercharging stations on a large scale within the year, and it is expected to reach 600 in the second quarter and 2,000 by the end of 2024. Highways + cities will reach 2,700 by the end of the year.

Not long ago, LI Auto delivered a perfect financial report. In 2023, its revenue was 123.85 billion yuan, becoming the first new car-making force in China to break through the 100 billion yuan mark in annual revenue, and its net profit was 11.81 billion yuan. It was the first year for LI Auto to achieve profit since its delivery. As of the end of 2023, the company’s cash reserve reached 103.67 billion yuan. Adequate cash flow can support its investment in sales and energy replenishment. Whether LI Auto can win this turnaround remains to be verified.