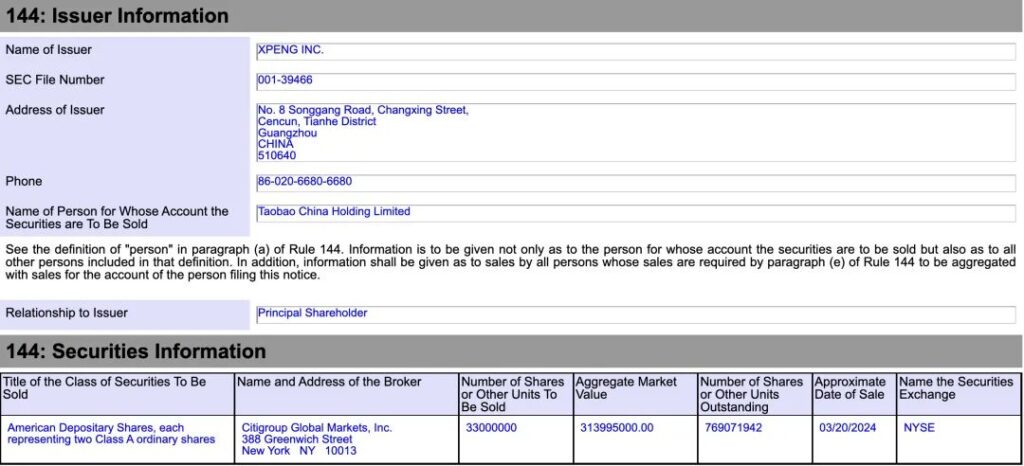

March 20, documents from the US Securities and Exchange Commission showed that Alibaba’s subsidiary, Taobao China Holding Limited, plans to sell Xiaopeng Motors’ American Depositary Shares (ADS), totaling 33 million shares, with a total value of about $314 million (approximately RMB 2.261 billion). The transaction price is between $9.6 and $9.75 per share, which is lower than the market price.

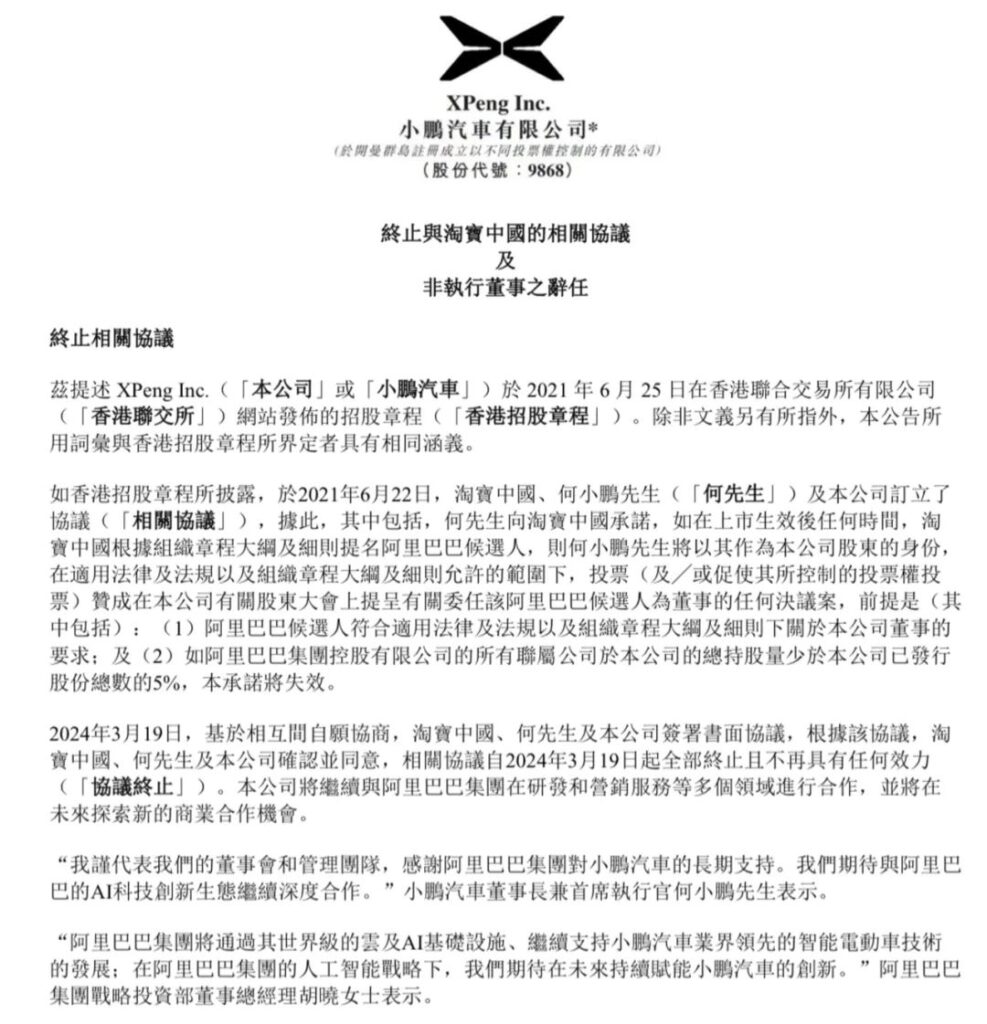

On the evening of March 19, Xiaopeng Motors announced on the Hong Kong Stock Exchange that based on mutual voluntary negotiations, Taobao China, He Xiaopeng, and the company signed a written agreement. According to the agreement, Taobao China, He Xiaopeng, and the company confirmed and agreed that the relevant agreements would all be terminated and would no longer have any effect from March 19, 2024. The company will continue to cooperate with the Alibaba Group in multiple areas such as research and development and marketing services and will explore new business cooperation opportunities in the future. The board of directors of the company announced that Ms. Hu Xiao has submitted her resignation as a non-executive director of the company to the board of directors, which will take effect from March 19, 2024, to devote more time to her other business affairs and based on the termination of the above agreement. It is understood that Hu Xiao is currently the Managing Director of the Strategic Investment Department of Alibaba Group.

It should be noted that this is not the first time that the Alibaba Group has reduced its holdings in Xiaopeng Motors. In December 2023, Alibaba sold 25 million ADS of Xiaopeng Motors, totaling about $391 million, and the shareholding ratio decreased from 12.49% to 9.24%.

With this large-scale reduction, it means that Xiaopeng Motors and Taobao China under Alibaba have terminated the director appointment agreement. Regarding this reduction in holdings by Alibaba in Xiaopeng Motors, He Xiaopeng, the chairman and CEO of Xiaopeng Motors, said: “On behalf of our board of directors and management team, I would like to express our gratitude to the Alibaba Group for its long-term support of Xiaopeng Motors. We look forward to continued in-depth cooperation with Alibaba’s AI technology innovation ecosystem.”

As of the time of publication, Alibaba has not responded to the reason for reducing its holdings in Xiaopeng Motors.

Xpeng Motors is one of the leading domestic car-making companies, founded in 2014 and headquartered in Guangzhou. It was initially co-founded by He Xiaopeng, Xia Heng, and He Tao. He Xiaopeng, the original founder of UC and president of Alibaba Mobile Business Group, is one of the earliest investors of Xpeng Motors.

In August 2017, He Xiaopeng left Alibaba and joined Xpeng Motors as the chairman. In August 2020, Xpeng Motors was officially listed on the New York Stock Exchange with the stock code “XPEV”. Alibaba has a deep connection with Xpeng Motors. Before Xpeng Motors landed on the US stock market, it underwent three rounds of financing, including Round A0, A1, and A2. The A0 round came from Alibaba Group and He Xiaopeng himself. According to the prospectus, before the IPO, the management of Xpeng Motors held 40.9% of the shares, with He Xiaopeng holding 31.6% and being the largest shareholder, and Alibaba holding 14.4% as the largest external shareholder. Since Xpeng Motors was listed on the US stock market, Alibaba has also been the second-largest shareholder of the company, holding more than 10% of Xpeng Motors’ shares through Taobao China. In August 2023, Xpeng Motors established a strategic partnership with Volkswagen, and currently, Volkswagen is the third-largest shareholder of Xpeng Motors.

The reduction of Alibaba’s stake in Xpeng Motors has also raised concerns in the market about the future of Xpeng Motors. Analysts believe that this move may indicate a pessimistic outlook for the future development of Xpeng Motors.

Currently, Xpeng Motors’ financial performance is not good. Financial data shows that in 2023, Xpeng Motors’ revenue was 30.68 billion yuan, a year-on-year increase of 14.2%; the net loss was 10.38 billion yuan, a year-on-year increase of 13.57%; and the gross profit margin was -1.6%. Xpeng Motors stated that the increase in promotion efforts, the decline in new energy vehicle subsidies, and the provision for inventories and purchase commitment losses related to the upgrade of G3i and existing models were the key reasons for the decline in gross profit margin. From the perspective of delivery volume, Xpeng Motors’ performance in 2023 was also ordinary. In 2023, a total of 142,000 vehicles were delivered, only achieving 70% of the annual target of 200,000 vehicles.

In a recent public letter, He Xiaopeng pointed out that 2024 will be the first year for Chinese auto brands to enter the “blood sea” competition and the first year of the elimination round. For Xpeng Motors, this year is a challenging one. According to the plan, Xpeng Motors will introduce a new A-class brand product priced between 100,000 and 150,000 yuan to the world within a month and will incorporate AI large models into vehicles in the second quarter. Regarding this year’s goals, He Xiaopeng said outright, “The performance needs to double, the organization needs to fill in all the shortcomings, and the operation needs to take the first step towards high-quality.” The expected annual sales target will exceed 280,000 vehicles. If calculated based on the annual sales target of 280,000 vehicles, it means that about 23,000 new vehicles need to be delivered per month.

As of the closing on March 21, Xpeng Motors’ shares in Hong Kong fell 6.54% to HKD37.90 per share.