On July 23, Li Auto released the latest weekly sales list for the 29th week of 2024 (July 15 to July 21) as scheduled.

First, let’s take a look at the sales list of new energy brands in the Chinese market. The top five automakers that entered the list are BYD, Li Auto, Tesla, AITO and Wuling. In the new week, BYD continued to top the list with a weekly sales volume of 66,700 units, and it is also the only brand with sales exceeding 60,000 units. Tesla ranked third with a weekly sales volume of 10,500 units, and was replaced by Li Auto in the new week. For reference, in the last week (July 8 to July 14), Tesla ranked second on the list with a sales volume of 11,400 units.

Li Auto ranked second only to BYD, but the sales volume was much lower than that of BYD, with a weekly sales volume of 10,900 units, and AITO ranked fourth on the list with a sales volume of 9,300 units. Wuling Automobile also squeezed into the top five of the list, with a weekly sales volume of 8,500 units.

In addition to the above brands, including GAC Aion, Leapmotor, NIO, Volkswagen, and Deepal also entered the sales list of new energy vehicle brands in the Chinese market in the new week, with weekly sales volumes of 6,900 units, 4,900 units, 4,600 units, 3,800 units and 3,600 units respectively.

Next, let’s take a look at the TOP10 sales list of new force brands in the Chinese market. Li Auto is still the sales champion of new force brands in the Chinese market, with a weekly sales volume of 10,900 units, which is higher than that of AITO’s 9,300 units. This is also the third time that Li Auto has topped the new force sales list in a weekly sales volume in this month.

According to statistics, from July 1 to 21, the cumulative sales volume of Li Auto was 30,200 units, and the cumulative sales volume of AITO was 26,600 units, with a difference of 0.36 million units. The current competition between the two is still fierce, but according to the current sales trend, if there is no accident, Li Auto may continue to top the new force sales list in July.

It is worth noting that the weekly sales list released by Li Auto has also caused quite a lot of controversy. On March 26 this year, Li Auto stopped the behavior of releasing the weekly sales data regularly every Tuesday, and did not resume the weekly list release until May 7, which then triggered a lot of discussions among netizens. On July 17, Zhang Xiao, the head of the product line of Li Auto, explained the weekly sales list data released by Li Auto every week and responded to the statement about “moisture in the data”.

Zhang Xiao said: “The statistical data in the automotive industry may be the relatively most standardized and complete. From capacity planning to capacity utilization rate, from wholesale reporting (wholesale) to dealer inventory statistics, from retail reporting (retail) to compulsory insurance insurance volume, as well as import and export and used car circulation, every link in this industry has the official statistics backed by the government. These data cannot be faked. The numbers that everyone discusses every day, who is true and who is false, we can see it in minutes.”

In addition, Zhang Xiao pointed out that the order volume cannot be verified or falsified because there is no unified standard for the order volume, which is an internal data of the enterprise and an internal process indicator in the automotive circulation. In principle, the enterprise has no obligation and no responsibility to announce. At the same time, Zhang Xiao also emphasized: “All disclosed data of listed companies must be reviewed by the corresponding regulatory agencies, not how much they want to say.”

Back to the weekly sales list, in the new week, Leapmotor’s weekly sales volume was 4,900 units, ranking third on the list, the same as last week. NIO and Deepal both entered the top five of the list, with weekly sales volumes of 4,600 units and 3,600 units respectively. Compared with Li Auto and NIO, the performance of XPeng Motors is a bit lonely, ranking eighth on the list with a weekly sales volume of 1,900 units. By the end of the first half of the year, the pattern of “Weilai, Xiaopeng and Li Auto” has been clearly differentiated. For reference, in the first half of the year, the sales volume of Li Auto was 189,000 units; the sales volume of NIO was 87,400 units; and the sales volume of XPeng Motors was 52,040 units.

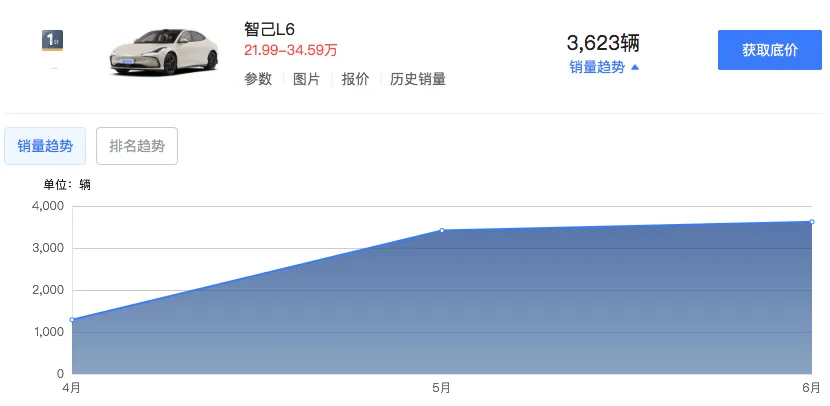

In addition to this, including Zeekr, Denza, Xiaomi Motors and IM Motors entered the top ten of the list, with weekly sales volumes of 3,000 units, 2,100 units, 1,500 units and 1,300 units respectively. Among them, IM Motors is a subsidiary of SAIC, jointly established by SAIC, Alibaba and Zhangjiang government, positioning as a high-end intelligent electric vehicle brand. “Auto Industry Focus” believes that the increase in the sales volume of IM Motors is related to the listing of IM L6. This car is the fourth model under the brand, positioning as a medium and large-sized pure electric sedan, and was listed on May 13, and the listing equity price is 199,900 – 325,900 yuan.

Retail data shows that the cumulative sales volume of IM Motors in the first half of this year was 23,267 units, among which the sales volumes from January to June were 5,001 units, 2,000 units, 3,000 units, 3,000 units, 4,251 units and 6,015 units respectively. Analyzing from the data, the sales volume of IM Motors showed obvious growth in May and June, mainly due to the listing of IM L6, which contributed 3,417 units and 3,623 units respectively in May and June.

Finally, let’s take a look at the TOP10 sales list of luxury brands in the Chinese market. From the brand ranking on the list, the top five in the list are still “regulars”. In the new week, perhaps due to the influence of the “exit price war” news, in the new week, BMW’s first position in sales was replaced by Mercedes-Benz, the latter ranked first on the list with a weekly sales volume of 13,600 units, while the weekly sales volumes of BMW and Audi were 13,400 units and 12,500 units respectively. In response to the previous news of “BMW China will exit the price war”, BMW China said that in the second half of the year, BMW will focus on business quality in the Chinese market and support dealers to make steady progress.

Li Auto and Tesla ranked fourth and fifth on the list respectively, with weekly sales volumes of 10,900 units and 10,500 units. Outside the top five of the list, including AITO, NIO, Lexus, Zeekr and Denza all entered the top ten, with weekly sales volumes of 9,300 units, 4,600 units, 4,400 units, 3,000 units and 2,100 units respectively.

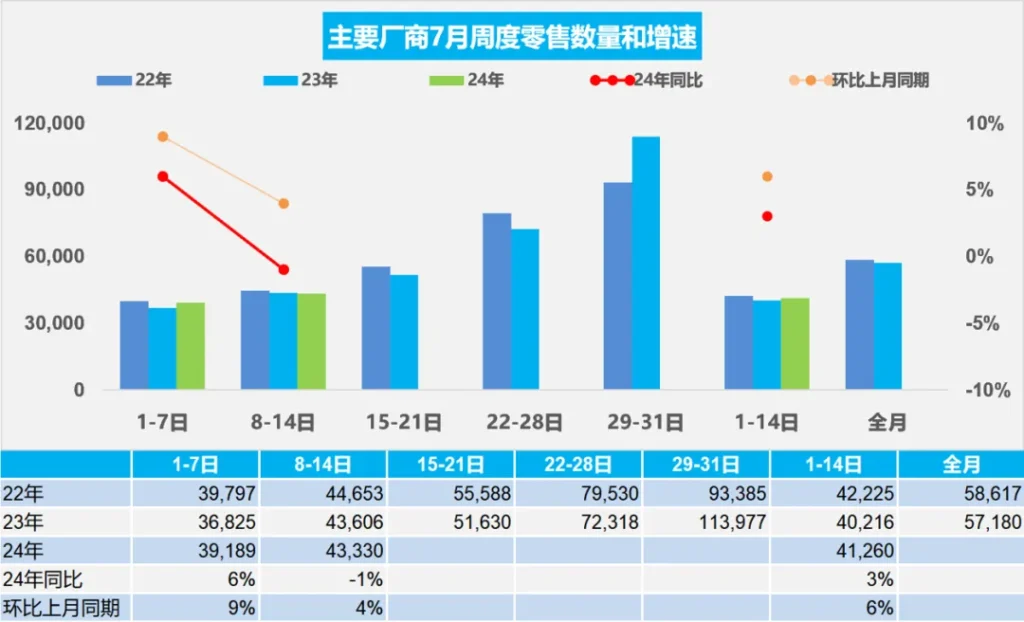

According to the latest data of the China Passenger Car Association, from July 1 to 14, the retail sales volume of passenger cars was 578,000 units, an increase of 3% year-on-year and an increase of 6% month-on-month. The China Passenger Car Association said that compared with the influence of the Dragon Boat Festival holiday and college entrance examination factors at the beginning of June, the sales status at the beginning of July is relatively normal, and the sales growth pressure in the second half of the month will be reflected. In addition, the strong promotional efforts in the first half of this year have disrupted the normal price trend of the car market. Coupled with the super strong promotional efforts in the second quarter have had an overdraft effect on the consumption of car purchase customers in the second half of the year, and the effect of price reduction in exchange for sales volume in July may be weakened.

It should be noted that 2024 is defined as a critical period for the survival of the fittest of auto companies, and at the same time, it is also a critical year for new energy auto companies to gain a firm foothold. As time enters the second half of the year, the competition among auto companies will inevitably become more intense.