July 22, some investors questioned Guanghui Automobile that Guanghui Automobile purchased the assets of the major shareholder Guanghui Group at a high premium through private placement financing of 37.8 billion yuan, and there were 9.8 billion intangible assets among the purchased assets, and at the same time, 18.8 billion goodwill assets were generated. Is this situation true?

In response to the above rumors, Guanghui Automobile issued a clarification on its official website:

(1) According to public information, in 2015, Guanghui Automobile injected about 22.8 billion yuan of assets and went public through backdoor listing of “Meiluo Pharmaceutical”. Since then, Guanghui Automobile has raised a total of 17.37 billion yuan through non-public offering and public offering of convertible bonds, including two private placements and one convertible bond financing, all of which are used to support the development of the company’s main business: 6 billion supporting funds raised through issuing shares to purchase assets and raising funds in 2015; 8 billion funds raised through non-public offering of shares in 2017; 3.37 billion funds raised through public offering of convertible corporate bonds issued in 2020. The total amount of financing for the three times is 17.37 billion yuan, not the “37.8 billion yuan financing” mentioned in the rumors, and this calculation method may misunderstand the 22.8 billion yuan of asset injection, and there is a deviation in understanding.

(2) Regarding the description in the rumors that “purchasing the assets of the major shareholder Guanghui Group at a high premium, and there are 9.8 billion intangible assets among the purchased assets” is also not in line with the facts. According to the 2023 annual report, the company’s intangible assets are 7.911 billion yuan, including 2.695 billion yuan of land use rights, 5.087 billion yuan of franchise rights, 95.2429 million yuan of software and others. Among them, the land use rights are recorded at the actual payment price. Due to the earlier purchase, it belongs to an underestimated asset; the franchised rights authorized by the manufacturer are intangible assets recognized during the process of enterprise merger, which is that this group has taken over the brand car retail business of the acquired unit and obtained the franchised rights authorized by the brand manufacturer, and none of them belong to the category of “purchasing the assets of the major shareholder Guanghui Group at a high premium”.

(3) The rumors also mentioned “and at the same time, 18.8 billion goodwill assets are generated”. Goodwill is the difference between the merger cost and the fair value of the net assets of the acquired party on the purchase date in the non-consolidated enterprise merger in the reporting period, that is, it is formed when Guanghui Automobile acquires and merges 4S stores during its development and growth, and it is also not formed by “purchasing the assets of the major shareholder Guanghui Group”. In fact, when the company recognized goodwill in the merger and acquisition at that time, it did not re-evaluate the goodwill after resetting the net assets of some acquisition cases, and because the net assets of the 4S store surface are mainly land assets, and the value of land assets has been doubling at a relatively fast speed. Therefore, when identifying the original net assets, the land assets were not re-evaluated, resulting in a relatively large portion of the goodwill balance item being the premium of land value, resulting in a relatively large overall goodwill balance of the company, which is actually mostly the premium of risk-free land value.

Not long ago, Guanghui Automobile received a regulatory letter from the Shanghai Stock Exchange. Because the closing price of Guanghui Automobile’s stock has been lower than 1 yuan for 20 consecutive trading days, Guanghui Automobile’s stock and convertible corporate bonds have touched the delisting conditions, and the trading has been suspended since the opening of the market on July 18. Because there is no delisting consolidation period for trading-type delisting, if there is no accident, Guanghui Automobile’s stock will soon be delisted from the Shanghai Stock Exchange.

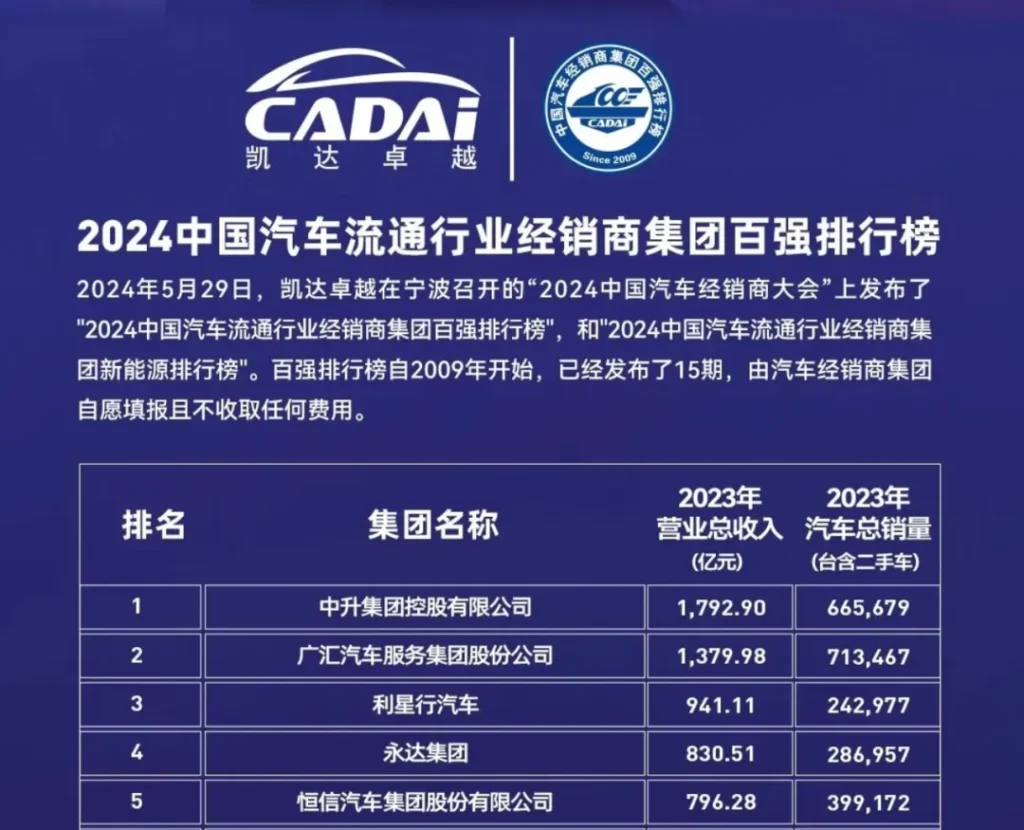

From the fundamental point of view, Guanghui Automobile is actually not bad. In 2023, Guanghui Automobile turned losses into profits, with an annual revenue of 137.998 billion yuan and a net profit of 392 million yuan. According to the annual revenue calculation, Guanghui Automobile ranks second in China, second only to Zhongsheng Group, and is one of the only two dealer groups with revenue exceeding 100 billion. It is understood that as of December 31, 2023, Guanghui Automobile covers a national auto distribution network in 28 provinces, autonomous regions and municipalities directly under the Central Government, and operates a total of 735 business outlets, including 695 4S stores, and is one of the largest dealer groups in China.

After entering 2024, the operating situation of Guanghui Automobile continues to deteriorate. The total operating revenue in the first quarter was 27.79 billion yuan, a year-on-year decline of 11.49%; the net profit was 70.9405 million yuan, a year-on-year decline of 86.61%; recently, Guanghui Automobile released the interim performance forecast, and it is expected that the net profit in the first half of 2024 will be -6.99 billion yuan to -5.83 billion yuan.

The predicament of Guanghui Automobile is a microcosm of the survival status of dealers. The price war continues to intensify, and selling cars at a loss has already become the norm for dealers, and the profit space has been eroded step by step. In addition to Guanghui Automobile, large auto dealers such as Zhongsheng Group, Yongda Automobile, Baideli Holdings, Meidong Automobile, and Zhengtong Automobile have also fallen into the dilemma of profit decline.

In the past two years, auto dealers have long bid farewell to the “lying down and counting money” good days. The survey report released by the China Automobile Circulation Association shows that in 2023, more than 70% of the dealers failed to complete the annual task indicators, the loss ratio was as high as 43.5%, and the profit ratio was only 37.6%. Due to multiple factors, more and more auto dealers have to move towards the outcome of exiting the network, shutting down or changing the operation of auto brands. The delisting of Guanghui Automobile as the industry leader is just one of the footnotes of the traditional dealer model entering the verge of elimination.