On April 1, Tesla China announced that the price of domestic Model Y has been raised by 5,000 yuan. The latest price of Model Y is 263,900 yuan, the long-range version of Model Y is 304,900 yuan, and the high-performance version of Model Y is 368,900 yuan. It is worth mentioning that the previous 8,000 yuan cash car insurance subsidy policy and the highest 10,000 yuan paint discount policy will also expire on March 31. Based on this calculation, including insurance subsidies, the actual price increase of this Model Y is as high as 23,000 yuan.

In the case of other car companies lowering prices, Tesla has gone against the trend, and many netizens said they “don’t understand”. In the view of “AuToTimes”, this move may be a变相 forced order move, intended to boost sales at the end of the quarter. Currently, the delivery time of Tesla Model 3 and Model Y is 2-6 weeks.

After entering 2024, the price war in the domestic auto market has become increasingly fierce. Chinese new energy vehicle manufacturers have lowered the prices of their electric vehicles on a large scale in order to further seize market share. Taking BYD as an example, it launched the Qin PLUS Honor Edition and Destroyer 05 models after the Long Nian Spring Festival, with the starting price reduced to 79,800 yuan, and shouted the slogan of “lower electricity than oil”. Since then, not only independent brands, but also SAIC-GM-Wuling, GAC Honda, and SAIC-GM have joined the price competition by launching entry-level models with lower prices to cope with market competition.

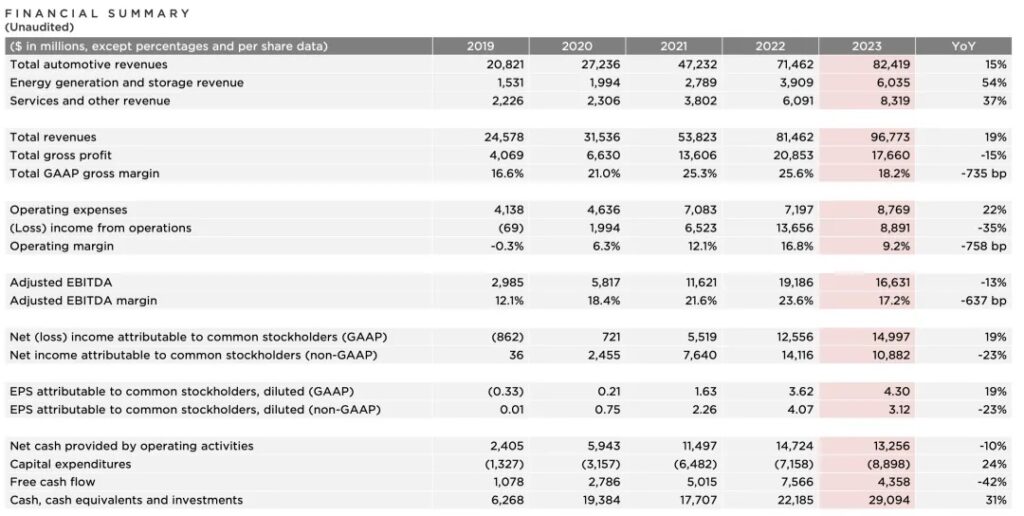

Despite the fierce competition in the domestic auto market, Tesla still decides to raise prices, which is closely related to its profit performance under pressure. In 2023, Tesla delivered 1.8086 million vehicles globally, just achieving the delivery target of 1.8 million vehicles. However, behind Tesla’s successful completion of the 2023 sales target, it is inseparable from the profit sacrifice and volume for price. During the reporting period, Tesla’s annual revenue was $96.773 billion, a year-on-year increase of 18.79%; the net profit attributable to common shareholders was $14.997 billion, a year-on-year increase of 19%; although it achieved double growth in revenue and profit, the gross profit margin fell from 19.3% in the first quarter to 17.6% in the fourth quarter. Goldman Sachs analysts have stated that the main headwinds Tesla faces include larger-than-expected cuts in vehicle prices, increased competition in electric vehicles, delays in products and functions such as FSD and the third-generation platform. Although Tesla has long-term growth potential, it faces significant short-term risks.

There is no doubt that Tesla’s current product competitiveness is clearly insufficient, and the speed of Tesla’s model replacement is too slow. Generally speaking, a fuel vehicle is redesigned in about three years and replaced in about six years. In the era of electrification, the frequency of electric vehicles is higher, and the redesign of domestic electric vehicles is shortened to two years, and the replacement is shortened to four years. Looking at Tesla, the Model 3 was released in 2016 and the redesign was only launched in 2023.

In the past, many Chinese electric vehicles would see Tesla as a competitor, or even a model, and surpassing Tesla became their top priority. However, from the current market performance, although the market performance of the vast majority of electric vehicles is still not as good as Tesla’s, they have indeed achieved a breakthrough in core technologies. The reason why some consumers are still willing to choose Tesla is based on brand recognition. First, Tesla is a foreign brand, and second, it has been in the electric vehicle market for a long time, and finally, it also masters core technologies, but Tesla is also slowly being abandoned. On March 28, Xiaomi SU7 was officially announced for listing, and its direct competitor is the Model 3. The starting price of 215,800 yuan is 30,000 yuan lower than the Model 3. It is larger in size, cooler in shape, and more technological. After being listed for 24 hours, it won 88,898 orders. More people choosing Xiaomi SU7 means that the users of the Model 3 will lose a lot, and even affect the Model Y.

Data from the China Passenger Car Association shows that in February, Tesla’s domestic retail sales were 30,100 vehicles, a year-on-year decrease of 11%. In the first two months of this year, the total delivery volume was 70,000 vehicles, a year-on-year increase of 15%. Consumers have a relatively heavy wait-and-see sentiment on prices, and the positive incremental factors brought about in the short term are not obvious. There will be a temporary sluggish wait-and-see phenomenon in sales when prices are reduced. The positive purchasing effect brought about by short-term price reductions is offset. However, under the trend of the fierce price war in the Chinese auto industry, can Tesla’s counter-trend price increase actually preserve itself?