On July 29 local time, Akio Toyoda, the chairman of Toyota Motor, said in an interview that if the rate of shareholders’ support for him continues to decline at this year’s rate, he may not be re-elected as a director.

June 18, at the annual general meeting of shareholders of Toyota Motor, amid the doubts and opposition from some investment institutions and shareholders, Akio Toyoda was again appointed as the chairman of Toyota Motor (equivalent to the chairman of the board).

In fact, Akio Toyoda’s re-election as the chairman of Toyota Motor was also expected, but the controversy over his re-election as the chairman has also been increasing. According to the data released by Toyota Motor, Akio Toyoda’s voting rate is only 72%, the lowest among the 10 board members, while it was 85% in 2023 and 96% in 2022. Akio Toyoda frankly admitted in an interview, “If it continues to decline at this rate, it may not be possible to be re-elected as a director next year.”

Akio Toyoda was elected as the president of Toyota with extremely low votes. The background is that there is large-scale fraud in Toyota’s subsidiaries, which affects the production and operation of Toyota. Secondly, Akio Toyoda is very conservative about the electrification transformation. Against the background of the global automotive industry accelerating its transformation, Toyota’s performance in the electric vehicle market is not satisfactory, and the advantages accumulated in the era of fuel vehicles have also begun to gradually be exhausted.

At present, Toyota Motor is still a giant in the automotive industry and has ranked first in global sales for five consecutive years.

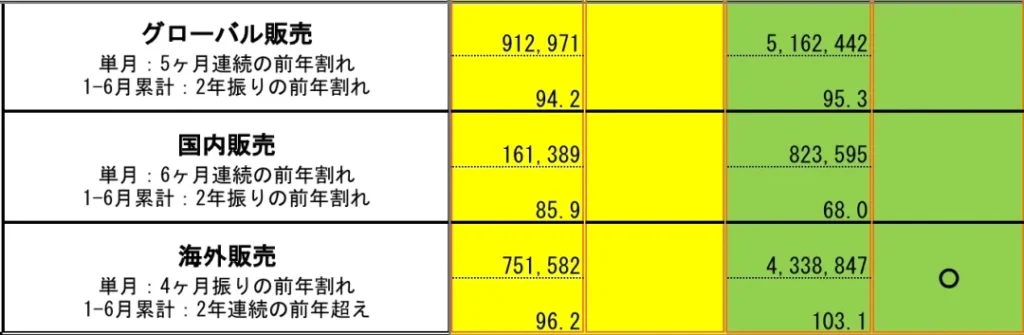

On July 30, Toyota Motor Corporation announced the global production and sales situation in June. The data shows that in June, the global sales volume of Toyota Motor was 912,971 vehicles, a year-on-year decline of 5.8%, of which the sales volume in the Japanese domestic market was 161,389 vehicles, a year-on-year decline of 14.1%, and the sales volume in the overseas market was 751,582 vehicles, a year-on-year decline of 3.8%. As of June, the global sales volume of Toyota in 2024 was 5,162,442 vehicles, a year-on-year decline of 4.7%, of which the Japanese domestic market declined by 32.0%, and the overseas market increased by 3.1% year-on-year.

It is understood that this is the fifth consecutive month that Toyota’s sales have declined. According to the previous data, in May, the global sales volume of Toyota Motor declined by 9.5% year-on-year, in April it declined by 0.5% year-on-year, in March it declined by 2.1% year-on-year, and in February it declined by 7.0% year-on-year, the first year-on-year decline since January 2023.

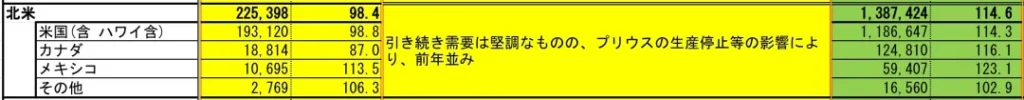

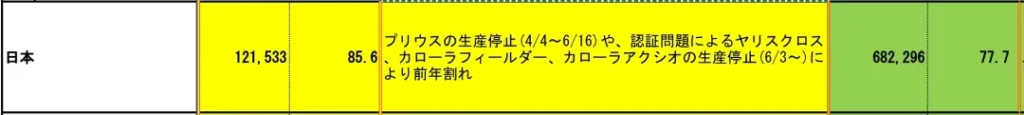

From the perspective of the global market, in June, the sales volume of Toyota Motor in Japan was 161,389 vehicles, a year-on-year decline of 14.1%. The reason for the decline in sales was the loss in the first half of the year due to the suspension of production of the Prius and the suspension of production of the Corolla Fielder, Axio, and Yaris Cross due to certification issues. From other markets, Toyota Motor showed an abnormal decline in the North American market, with sales of 225,398 vehicles, a year-on-year decline of 1.6%, of which the sales in the US market was 193,120 vehicles, a year-on-year decline of 1.2%. Toyota Motor achieved growth in the European market, with sales of 105,861 vehicles in the European market, a year-on-year increase of 2.7%, among which the sales in the UK, Italy, Germany, and Spain all increased, and the largest increase was in Italy, increasing by 15.7% to 12,331 vehicles.

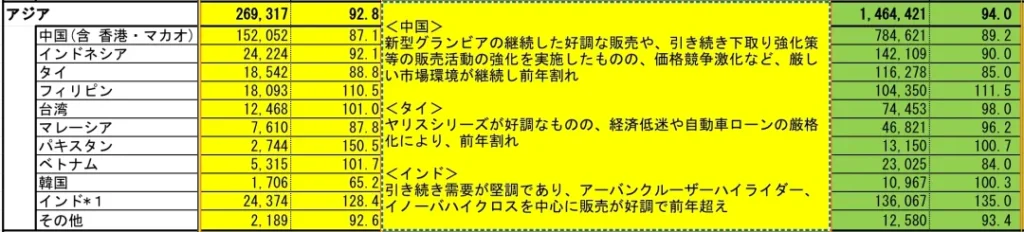

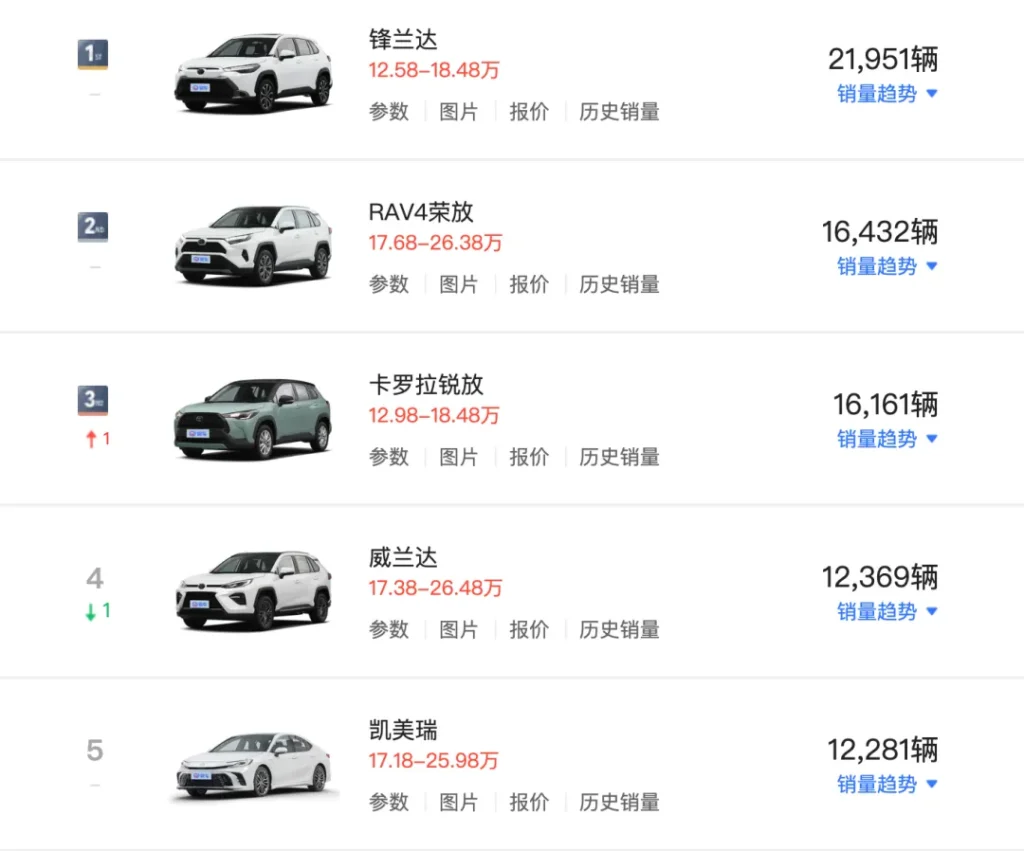

Compared with the above two markets, Toyota Motor is in a “tough battle” in Asia, which is also the main source of the decline in global sales of Toyota. The data shows that in June, the sales volume of Toyota Motor in the Asian market was only 269,317 vehicles, a year-on-year decline of 7.2%, of which the sales volume in the Chinese market (including Hong Kong) was 152,052 vehicles, a year-on-year decline of 12.9%, but achieved growth compared to May. Toyota Motor said that despite the launch of a new sales campaign, the severe market environment such as intensified price competition continued, and there was a decrease compared to the same period. According to the retail data, in June, there were five models of Toyota Motor in China with sales of over 10,000, namely the Frontlander, RAV4 Rongfang, Wildlander, Corolla, and Camry, with sales of 21,951 vehicles, 16,432 vehicles, 16,161 vehicles, 12,369 vehicles, and 12,281 vehicles, respectively. These models all showed growth compared to the sales in May, followed by the Corolla, Sienna, and Highlander, with sales of 8,870 vehicles, 8,099 vehicles, and 7,054 vehicles, respectively.

It has to be admitted that Toyota’s future in the Chinese market is worrying. Since this year, BYD’s strategy of “electricity is cheaper than oil” has made new energy vehicles quickly occupy the mainstream of the market. Under the impact of this powerful wave, the fuel vehicles led by Toyota have gradually lost their former luster and are facing the risk of being replaced by the market.

From the perspective of product layout, although the fuel vehicle technology of Toyota Motor is mature, under the general trend of energy transformation, it seems to be somewhat powerless, and the field of new energy vehicles is almost a blank. As the penetration rate of new energy vehicles in the Chinese market exceeds 50%, consumers’ acceptance of new energy vehicles is getting higher and higher, but Toyota has failed to launch competitive new energy products for a long time, which makes Toyota’s space in the Chinese market smaller and smaller, and the competitiveness gradually weakens. In the face of the fierce competition of new energy vehicles, Toyota has to adopt a price reduction strategy to try to find a glimmer of life in the market.

For the current Toyota, if it wants to keep its position in the automotive market, it needs to reflect deeply. The development of the automotive industry is changing rapidly, and the speed of technological innovation and changes in market demand is dizzying. Toyota, as an automotive enterprise with a profound historical heritage, the advantages of its strong technological strength and brand influence cannot guarantee that it will always be invincible. Only by continuous progress and innovation can it survive and develop in the fierce competition.

Of course, we cannot ignore Toyota’s performance in other markets, including the North American market and the European market have achieved growth. However, these growths cannot cover the challenges faced by Toyota in the global market. In Southeast Asia, the Middle East, South America and other regions, self-owned brands are rapidly expanding their market share, and Toyota’s sales volume in these markets may be impacted.

2024 is a key year for new energy vehicle enterprises to gain a firm foothold, and the competition is bound to be extremely fierce. With the rapid increase of the penetration rate of new energy vehicles, the market scale of traditional fuel vehicles is gradually shrinking, and the contradiction between the huge traditional production capacity and the gradually shrinking fuel vehicle market brings more intense.