On August 1, National Business Daily reported that Polestar’s China operations are undergoing a strategic adjustment, with insiders suggesting the company may completely withdraw from the Chinese market by the end of this year. Polestar has not yet issued an official response.

This is not the first time such reports have surfaced. Back in February, Polestar was rumored to be leaving China. At the time, the company responded that operations remained stable and that organizational restructuring was being carried out to adapt to the rapidly changing market environment and improve efficiency. Polestar emphasized that customer rights were unaffected and after-sales service continued as normal.

Background

Polestar began as a performance partner for Volvo, before being integrated into Volvo’s racing and performance R&D unit in 2009. In 2015, Volvo acquired Polestar outright, making it its electrification-focused performance division. In October 2017, Volvo and Geely jointly announced the formation of Polestar as a standalone brand. In June 2022, Polestar was listed on the NASDAQ in New York.

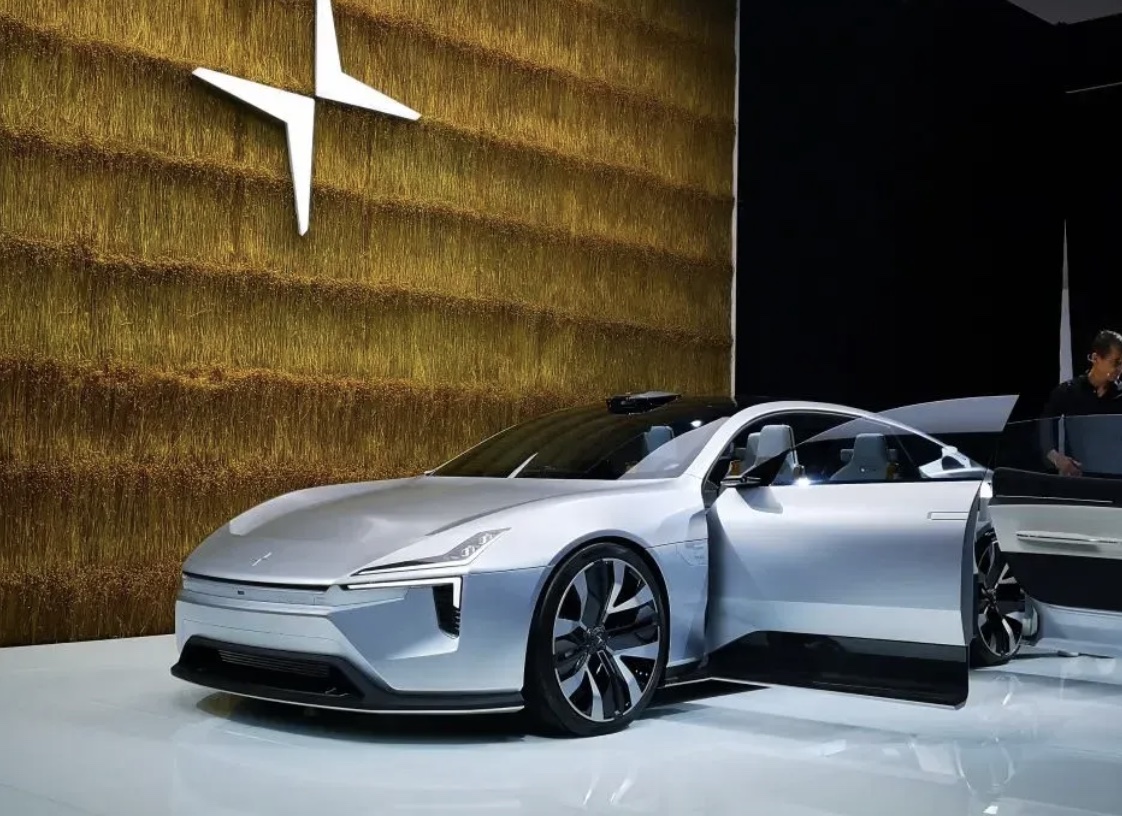

To date, Polestar has launched the Polestar 1, Polestar 2, Polestar 3, and Polestar 4. The Polestar 1, a luxury hybrid coupe, debuted in 2017 with a price tag of 1.45 million RMB. In 2019, Polestar introduced its second model, the Polestar 2 sedan, built on Volvo’s CMA platform to compete with the Tesla Model 3, priced between 258,000 and 338,000 RMB. The Polestar 3 SUV launched in 2023, priced between 880,000 and 1.03 million RMB in China.

Market Challenges

Despite its pedigree, Polestar has struggled in China due to low brand awareness and high prices. Global sales in 2024 totaled 44,900 units, down 15% year-on-year. Domestic sales were even weaker:

2021: 2,048 units

2022: 1,717 units

2023: 1,100 units

H1 2024: 1,612 units

H1 2025: only 69 units

Financial Struggles and Restructuring

From 2020 to 2024, Polestar accumulated $5.19 billion in losses. In response, it launched extensive organizational restructuring starting in 2023. This year, Jonas Engström was appointed as the new COO, while earlier, Jean-Francois Mady became CFO in September 2023. Leadership changes have been frequent as Polestar seeks a turnaround.

At the same time, cost-cutting measures have been implemented, including global layoffs. In January 2024, Polestar announced it would cut 450 jobs worldwide to accelerate profitability and balance cash flow by 2025. CFO Johan Malmqvist said the cuts were driven by macroeconomic conditions and the need to control costs.

Exit from Partnerships in China

In April 2025, Polestar terminated its cooperation framework with Xingji Meizu, effectively ending its joint business operations in China and regaining distribution rights. This move sparked speculation that Polestar’s prospects in China had become even more difficult. Polestar, however, described the termination as a strategic decision and reiterated its commitment to deepening its presence in the Chinese market with a high-end positioning.

Outlook

Despite poor sales, Polestar has continued to highlight the importance of China. Polestar China’s president Feng once admitted that the brand had taken “wrong turns” in the market, focusing too little on localized branding. Going forward, the company aimed to introduce one new model per year to strengthen its portfolio. But with intensifying competition in China’s EV market, combined with weak brand recognition and limited technological reserves, Polestar faces steep challenges in sustaining its operations.