On October 10, the China Automobile Dealers Association released the “China Automotive Retention Rate Research Report for September 2025.” The report covers rankings of vehicle value retention rates across countries, brands, model segments, and new energy vehicles (NEVs). Let’s take a look at the key changes in car value retention for September.

1. Value Retention by Vehicle Segment

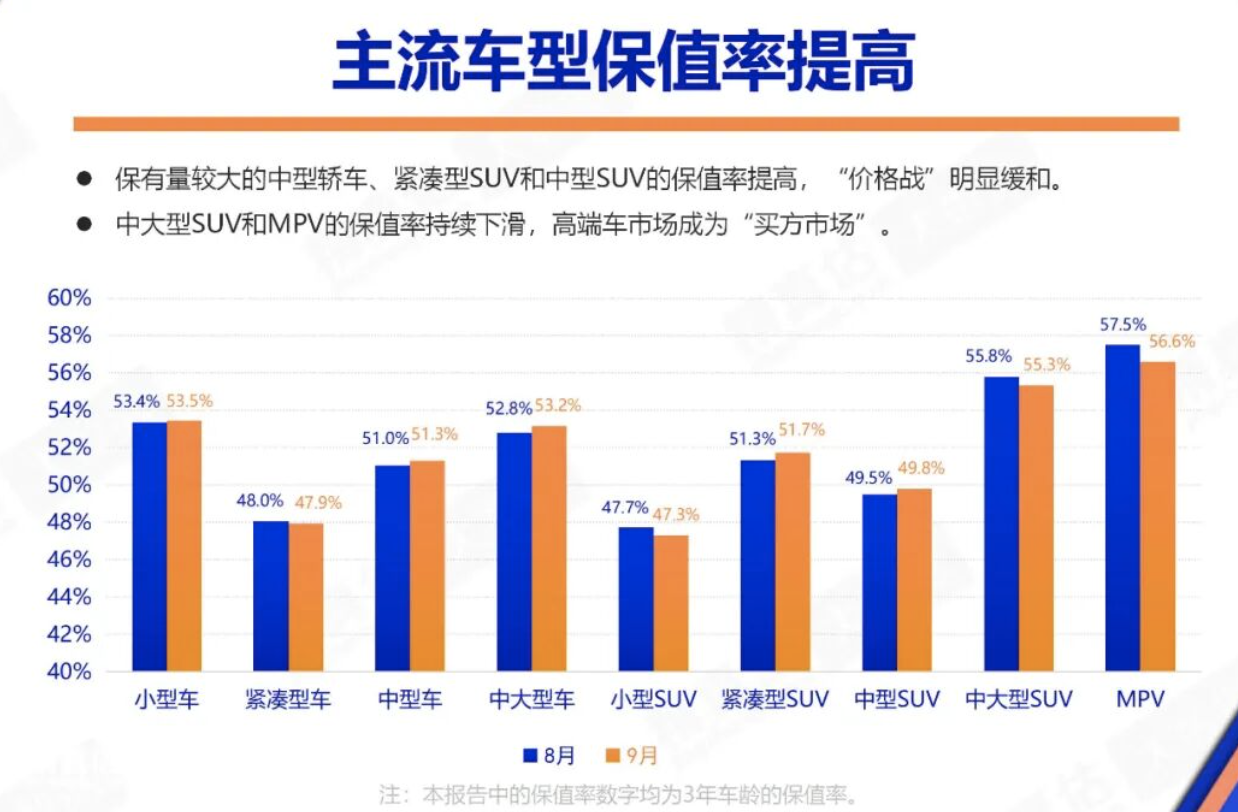

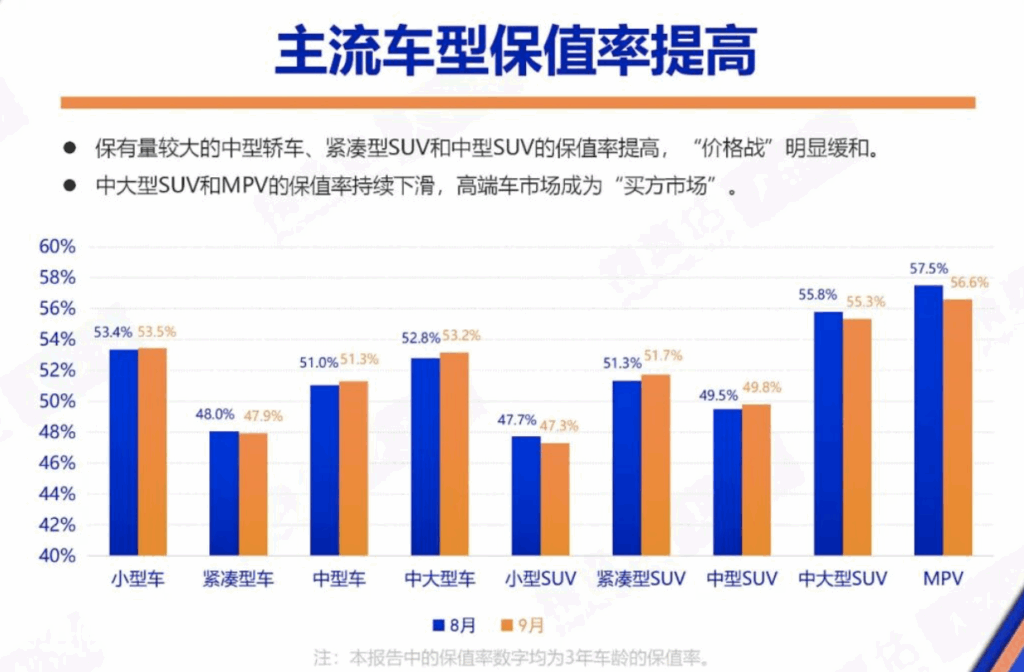

According to the report, MPVs continued to have the highest three-year value retention rate among all segments at 56.6%, though it fell by 0.9% from August. Mid-to-large SUVs ranked second at 55.3%, down 0.5% month-on-month. Compact cars and small SUVs also saw slight decreases of 0.1% and 0.4%, with retention rates of 47.9% and 47.3%, respectively.

In contrast, small cars, midsize cars, mid-to-large cars, compact SUVs, and midsize SUVs all experienced growth, increasing by 0.1%, 0.3%, 0.4%, 0.4%, and 0.4%, reaching 53.5%, 51.3%, 53.2%, 51.7%, and 49.8%, respectively.

The report noted: “Due to regional subsidy limits and rising new car prices, used car prices for mainstream segments have rebounded.”

2. Value Retention by Country and Brand

Luxury Brands

In September, the top three luxury brands were Porsche (67.2%), Lexus (60.0%), and Mercedes-Benz (58.4%), with monthly increases of 0.7%, 0.4%, and 0.1%, respectively.

BMW, Audi, Tesla, Cadillac, and Volvo also saw growth, while Land Rover, Lincoln, Jaguar, and Infiniti declined.

Land Rover had the sharpest drop of 2.0%, now at 53.4%. The report commented: “Land Rover’s lack of focus on sedan products led to a noticeable drop in its retention rate this month.”

Joint-Venture Brands

Among joint-venture brands, Honda (56.2%) and Toyota (55.6%) maintained the top two spots despite slight declines of 0.1% and 0.2%.

Mazda rose 1.0% to 51.2%, ranking fifth, while Nissan (47.1%) and Mitsubishi (44.0%) slipped by 0.2% and 0.4%, respectively.

Overall, among the five Japanese brands on the list, Mazda was the only one to show improvement.

Other Foreign Brands

Volkswagen, Kia, Ford, and Jeep all improved slightly, with rates around 51–53%. In contrast, Hyundai, Buick, Citroën, Skoda, Peugeot, and Chevrolet all experienced declines, falling between 41–48%.

Chinese Brands

Among domestic automakers, GAC Trumpchi led again at 56.0%, though it fell by 0.5% from August.

It was followed by Tank (55.7%), Changan (53.2%), Geely (51.9%), Lynk & Co (51.5%), and Haval (50.3%).

Changan, Geely, and Haval all achieved month-on-month growth, as did Li Auto, MG, Hongqi, Oshan, BYD, Zeekr, Leapmotor, ORA, and Bestune.

However, Chery, Roewe, Wuling, and Neta declined, with Chery dropping the most by 3.0% to 47.0%.

NIO remained unchanged at 40.4%.

3. New Energy Vehicle (NEV) Retention

By power type, plug-in hybrids (PHEVs) had a three-year retention rate of 43.2%, down 0.7%, while pure electric vehicles (BEVs) rose 0.2% to 42.8%.