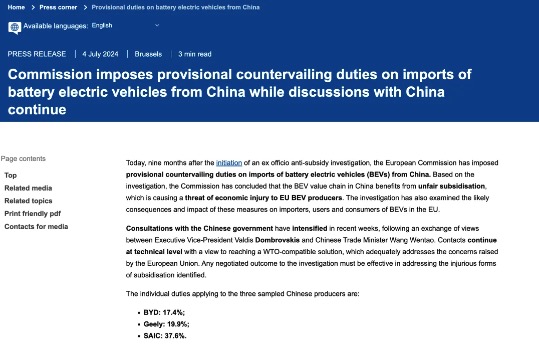

Local time on July 4, the European Commission (hereinafter referred to as the “European Commission”) issued an announcement, deciding to impose temporary anti-subsidy duties on electric vehicles imported from China since July 5. The longest period is 4 months. During this period, EU member states will decide on the final anti-subsidy measures through voting. If it is passed, the EU will officially impose an anti-subsidy tax on Chinese electric vehicles for a period of 5 years. However, the European Commission said in the announcement that it will continue to negotiate with the Chinese side in the hope of reaching a solution that complies with the rules of the World Trade Organization.

According to the announcement, BYD, Geely Automobile, and SAIC Group, the three Chinese automakers sampled for investigation, will respectively be imposed temporary anti-subsidy taxes of 17.4%, 19.9%, and 37.6%, among which the tax rate of SAIC Group has been lowered compared to the rate disclosed on June 12, and BYD and Geely remain unchanged. The European Commission explained this change by referring to the opinions submitted by the relevant parties regarding the accuracy of the calculation. According to the announcement of the EU, other Chinese automakers that cooperate but are not sampled will be imposed a weighted average tariff of 20.8%, and the tax rate for non-cooperating automakers will be 37.6%.

At present, the EU imposes a 10% tariff on all imported vehicles. If this additional tariff is added, this means that the tariff to be paid by BYD electric vehicles exported to Europe will reach 27.4%, Geely Automobile will reach 29.9%, and SAIC Group will even reach 47.6%.

After the release of this measure, German automobiles and German business people have all expressed concerns.

BMW Group’s chief executive, Oliver Zipse, said on the 4th that “the relevant approach of the European Commission simply won’t work. It will not only fail to enhance the competitiveness of European automakers, but may also damage those enterprises that actively conduct business globally.” German Transport Minister Volker Wissing pointed out that imposing additional tariffs is a “destructive approach”, and a solution should be sought through dialogue, and competition should be promoted rather than obstacles created. The president of the German Automotive Industry Association, Hildegard Müller, also stated that China and Europe must strive to find solutions through open and constructive dialogue. Matthias Bauer, director of the European Center for International Political Economy, believes that no one can benefit from imposing additional tariffs. The EU’s tax increase move not only affects Chinese automotive companies, but also hits foreign automotive manufacturers that produce in China.

For the European Commission’s act of imposing tariffs on Chinese electric vehicles, the Chinese side also gave a clear response.

The EU Chamber of Commerce in China said on the 4th that the European side should actively promote the synergy of China-Europe in the automotive field in the future in terms of technological innovation, infrastructure, and standard mutual recognition, and play the role of policy support and guidance. The EU Chamber of Commerce in China calls on the European side to return to the multilateralist approach of promoting free trade and global cooperation instead of resorting to protectionism and imposing high tariffs.

Chinese Ministry of Commerce spokesperson He Yadong said at the regular press conference on the 4th that as of now, multiple rounds of consultations have been held at the technical level between China and Europe. There is a four-month window period until the final ruling. It is hoped that the European side will move towards the same direction as the Chinese side, show sincerity, step up the process of consultation, and reach a mutually acceptable solution as soon as possible based on facts and rules.

Today at noon, SAIC released the tweet “Further Defense, SAIC Requests the EU to Hold a Hearing”, stating that to effectively safeguard its own legitimate rights and interests and the interests of global customers, SAIC will formally request the European Commission to hold a hearing on the temporary anti-subsidy tax measures for Chinese electric vehicles and further exercise the right of defense according to law. The defense content includes: The anti-subsidy investigation by the European Commission involves business sensitive information, such as requiring to cooperate to provide chemical formulations related to batteries, etc., which goes beyond the normal scope of the investigation. The European Commission has incorrect determinations regarding subsidies, such as including the new energy vehicle purchase subsidies given to domestic consumers in the subsidy rate calculation for sales in the EU. The European Commission ignored some of the information and defense opinions submitted by SAIC during the investigation, and made an unfavorable presumption based on the so-called “non-cooperation in the investigation” in Article 28 of the “Basic Regulation on Anti-Subsidy”, which artificially increased the subsidy rate of multiple items.

In addition, XPeng Motors has responded to the decision of the European Commission to impose temporary anti-subsidy taxes on Chinese electric vehicles. XPeng Motors stated that the company is evaluating the feasibility of establishing manufacturing capabilities in Europe to adapt to market changes. At the same time, XPeng Motors promises that existing and consumers who placed orders before the tariff takes effect will not be affected by price increases. It is understood that XPeng Motors officially entered the German market in March, listed two models of G9 and P7, and plans to further expand to other European markets such as Italy, the UK, and France.

NIO stated that the company closely follows and follows up on the relevant progress and measures of the EU anti-subsidy investigation. At the current stage, NIO will maintain the pricing of its products on the sale in the European market and will evaluate the market strategy based on the progress of the tariff policy. It is believed that appropriate market competition is beneficial to users and hopes to reach a solution with the EU before the implementation of the final measure in November 2024.

Although the EU is still promoting the so-called anti-subsidy investigation, Chinese automakers still have cards to play, among which building their own factories and jointly enhancing the popularity of new energy products of Chinese automakers in Europe are its two major killer moves. For the EU’s anti-subsidy investigation, the industry also believes that there is no need to worry too much. Although the anti-subsidy investigation of European pure electric vehicles in China may result in an additional tariff of about 20%, due to the still strong demand for new energy vehicles in the European market, there is still a time window opportunity for China’s new energy exports. In addition, the EU’s anti-subsidy investigation is bound to backfire on itself.