Recently, Toyota Motor Corporation released its global production and sales data for August. The data shows that Toyota’s global sales in August reached 844,963 vehicles, a 2.2% year-on-year increase, marking the eighth consecutive month of growth. Sales in Japan were 96,269 units, a 12.1% decline compared to the same period last year, while sales in overseas markets reached 748,694 units, up 4.4%. By August 2025, Toyota’s global sales totaled 6,903,693 vehicles, up 5.0% year-on-year, with 999,963 units sold in Japan, a 7.3% increase, and 5,903,730 units sold in overseas markets, up 4.6%.

Global Market Overview:

In Japan, Toyota’s sales in August totaled 96,269 vehicles, down 12.1% year-on-year. In other markets, Toyota saw significant growth in North America, with sales reaching 259,816 vehicles, up 12.2%. In the U.S., sales grew by 13.6% to 225,367 units, and in Canada, sales increased by 14.4%. Toyota also achieved growth in the European market, with 76,501 units sold, up 4.8%. Among European countries, Italy, Germany, and Spain all saw increases, with Germany leading the growth at 14.4%, reaching 7,665 vehicles.

As Toyota’s second-largest global market, Asia saw a slight increase in August, with sales of 269,404 units, up 0.2%. In China (including Hong Kong), Toyota sold 153,415 units, a 0.9% increase. Despite ongoing challenges such as the transition to new energy vehicles and price competition, Toyota continued to exceed last year’s sales due to effective promotional measures linked to government subsidies and strong performance of the new BEV model, the bZ3X. In 2025, Toyota’s sales in China totaled 1,142,828 units, up 5.8%, outperforming other Japanese brands such as Nissan, Honda, and Mazda.

Sales in China:

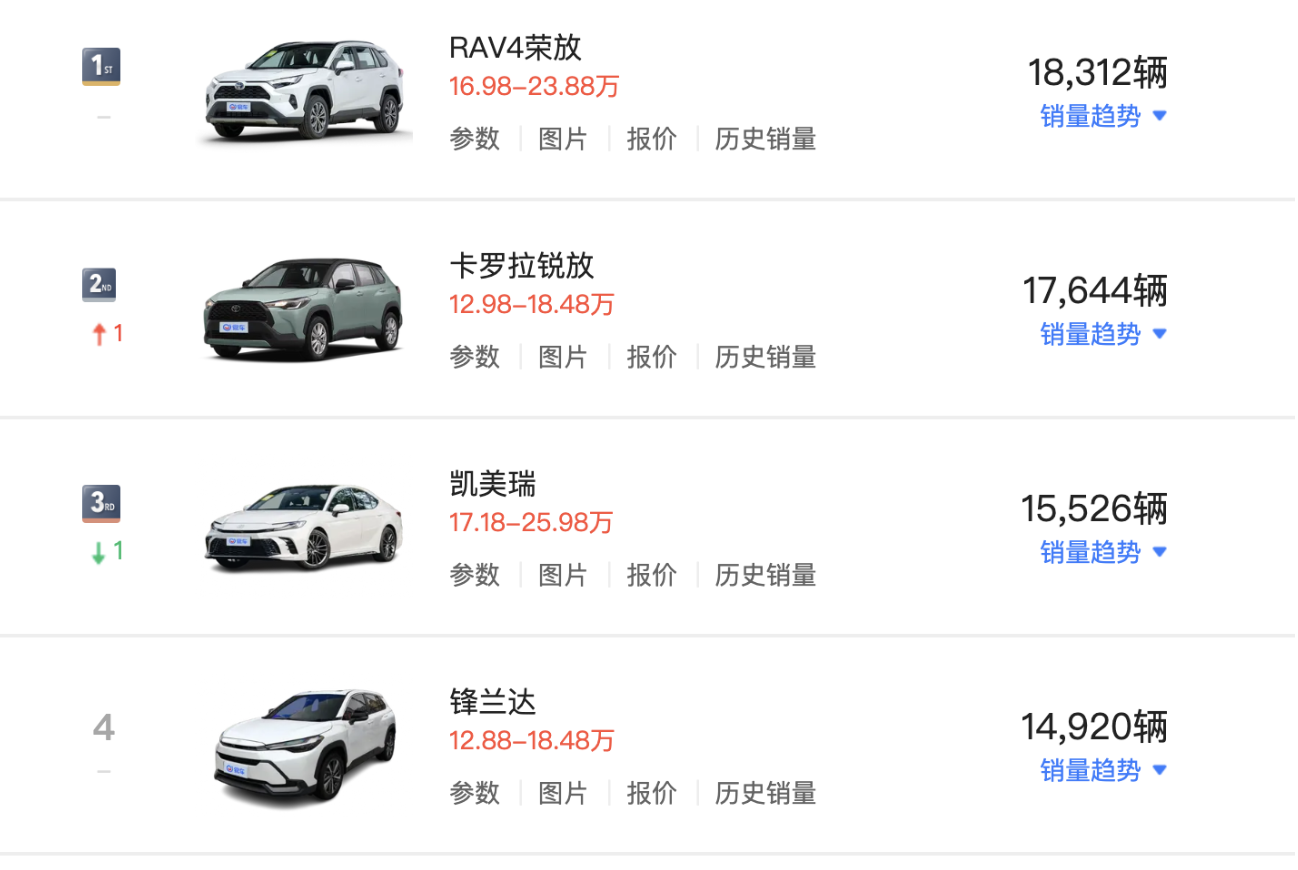

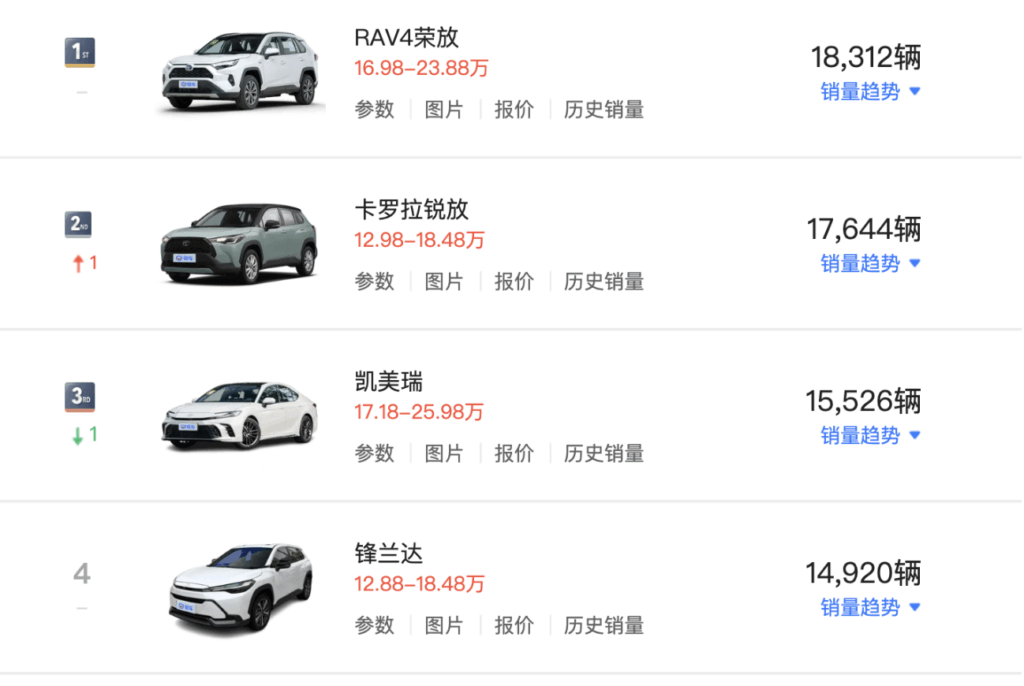

Retail data shows that in August, six Toyota models in China sold over 10,000 units: the RAV4, Corolla, Camry, Highlander, Vellfire, and Avalon, with sales of 18,131 units, 17,644 units, 15,526 units, 14,920 units, 11,509 units, and others, respectively. It is expected that the new generation of the Vellfire and RAV4 will soon be launched, having already completed registration with the Ministry of Industry and Information Technology. Additionally, new models of the Corolla and Levin will also be introduced shortly.

Challenges in Southeast Asia:

Due to the rise of Chinese new energy vehicle manufacturers entering the Southeast Asian market, Toyota’s sales in this region have significantly declined. In Indonesia, sales dropped by 19.2%, in Thailand by 3.2%, and in the Philippines by 5.0%.

For Toyota, to maintain its position in the automotive market, it needs to deeply reflect on its strategy. The automotive industry is evolving rapidly, and technological innovations and shifts in market demand are happening at an unprecedented pace. Despite Toyota’s strong technical capabilities and brand influence, these advantages are not guaranteed to ensure its dominance in the future. Continuous progress and innovation are essential for survival and growth in the intense competition.

However, we cannot overlook Toyota’s performance in other markets, including North America and Europe, where growth has been achieved. Yet, these increases cannot mask the challenges Toyota faces in the global market, especially in regions like Southeast Asia, the Middle East, and South America, where domestic brands are quickly expanding their market share, potentially affecting Toyota’s sales in these areas.