On July 8, the official website of the Guangzhou Municipal Planning and Natural Resources Bureau issued a public announcement titled “Idle Land Confirmation Notice” (Document No. 9 [2025]).

According to the announcement, the Nansha Branch of the bureau issued an Idle Land Investigation Notice to Hengchi New Energy Automobile Technology (Guangdong) Co., Ltd., a subsidiary of Evergrande Auto. The investigated plot had already been registered under Real Estate Ownership Certificate No. 11021857 (Guangzhou, 2022), with an area of 437,441 square meters, designated for industrial use. The registered owner was Hengchi New Energy Automobile Technology (Guangdong) Co., Ltd.

Based on the Idle Land Disposal Measures and the State-owned Land Use Right Transfer Contract, the bureau determined that the land has remained idle since June 9, 2021, due to company-related reasons. The bureau stated that it would proceed to dispose of the land in accordance with the law.

Background of the Company

Public records show that Hengchi New Energy Automobile Technology (Guangdong) Co., Ltd. was established in July 2020 with a registered capital of RMB 3 billion, fully owned by Evergrande New Energy Vehicle Investment Holding Group Co., Ltd. The company has faced mounting legal and financial troubles:

37 consumption restriction orders totaling RMB 18.67 billion;

34 enforcement cases with the same amount, all unfulfilled;

3 dishonesty enforcement cases totaling RMB 530.7 million;

10 enforcement notices totaling RMB 5.51 billion.

The company has also been publicly named for tax arrears.

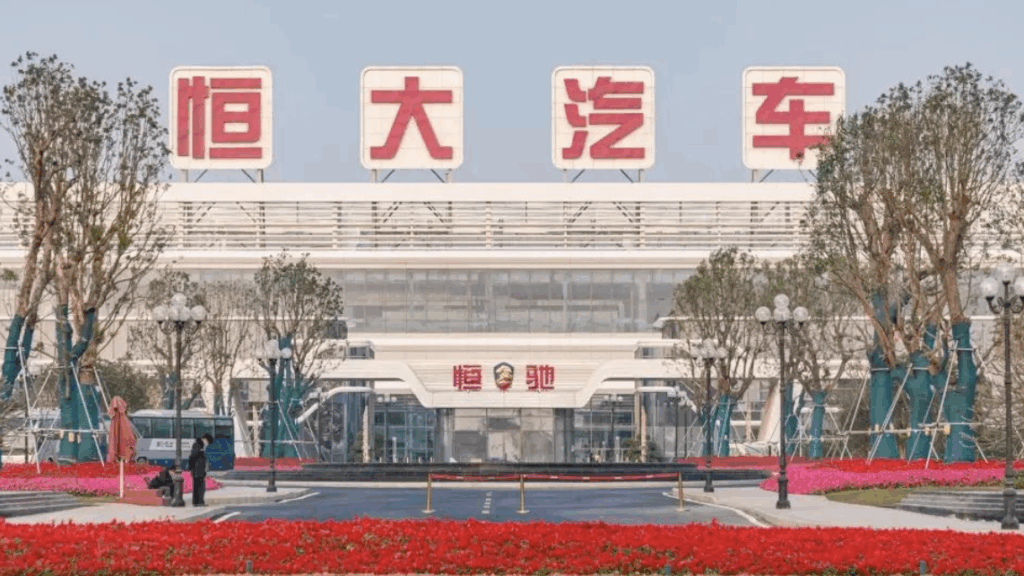

In September 2020, Evergrande spent RMB 590 million (≈ USD 81 million) to acquire this land, with plans to develop EV manufacturing and core component R&D facilities. However, due to Evergrande Auto’s financial crisis, the land has remained unused for nearly four years, leading to its official designation as idle land.

Previous Speculation and Denial

In March this year, Evergrande Auto’s Hong Kong-listed stock experienced abnormal fluctuations, with intraday gains exceeding 230%. Market rumors suggested that GAC Group’s Huawang (GH Project) intended to acquire Evergrande’s Nansha factory. Both parties quickly denied the reports: GAC Group stated it had never engaged in any negotiations with Evergrande, and Evergrande Auto also issued a notice declaring it was unaware of any reasons for the unusual stock movement.

Evergrande Auto’s Bold Yet Troubled Car-Making Efforts

Since entering the EV sector, Evergrande Auto’s founder Xu Jiayin pursued an aggressive expansion strategy, spending nearly RMB 50 billion (≈ USD 6.9 billion) in investments. In August 2020, Evergrande unveiled six electric vehicle models simultaneously in Shanghai and Guangzhou, covering segments from sedans and coupes to SUVs, MPVs, and crossovers.

The company’s first mass-production car, the Hengchi 5, was unveiled in July 2022. At the time, company president Liu Yongzhuo praised it as “the best pure EV SUV under RMB 300,000,” claiming mass sales were inevitable. However, the Hengchi 5 remains Evergrande Auto’s only model, with negligible market presence. The company has since faced plant shutdowns, subsidiary restructurings, and existential financial crises.

Financial Struggles

According to its financial report for the first half of 2024 (as of June 30):

Revenue was RMB 38.37 million (≈ USD 5.3 million), down 75.17% year-on-year.

Net loss widened to RMB 20.26 billion (≈ USD 2.8 billion), nearly tripling from the previous year and exceeding the full-year loss in 2023.

Total assets stood at RMB 16.37 billion, with cash and equivalents at only RMB 39 million.

Liabilities reached RMB 74.35 billion (≈ USD 10.2 billion).

On June 30, Evergrande Auto announced that due to ongoing liquidity problems, it could not confirm the release date of its 2024 financial report, and its stock—already suspended since April 1—would remain halted indefinitely.