On October 16, Chinese electric vehicle maker NIO drew market attention after being sued by Singapore’s sovereign wealth fund, GIC.

According to media reports, GIC accused NIO of inflating revenue and profits through its jointly established subsidiary, Wuhan Weineng Battery Asset Co., Ltd. (“Weineng”), misleading investors and causing GIC significant investment losses.

A court filing submitted by GIC to the U.S. District Court for the Southern District of New York in August 2025 named several NIO executives as defendants. The lawsuit claims that Weineng is not an independent company but rather a “shell” entity controlled by NIO. Although NIO holds only 19.84% of Weineng’s shares, it effectively benefits from up to 55% of its economic interests through accounts receivable and guarantees. Moreover, Weineng’s entire business depends on NIO, lacking operational independence—its battery types, volumes, and pricing are all determined by NIO. NIO allegedly earned over $600 million in battery rental revenue through Weineng but failed to disclose its equity interest in the company. By misrepresenting its relationship with Weineng and overstating revenue and earnings, NIO is accused of artificially inflating its stock price.

Weineng was established by NIO to implement its “Battery-as-a-Service” (BaaS) model, providing battery leasing and asset management services. As an independent legal entity, Weineng has completed several funding rounds and achieved profitability. The company was founded in August 2020 by NIO in partnership with CATL, Guotai Junan, and others. NIO holds a 19.8% stake, making it the largest shareholder, but it does not consolidate Weineng’s financial results into its statements. Following Weineng’s establishment, NIO’s revenue increased from RMB 2.85 billion in Q4 2020 to RMB 6.64 billion.

Public filings show that between August 2020 and July 2022, GIC purchased approximately 54.45 million NIO ADS shares. During that period, NIO’s stock price peaked at $66.99 but has since dropped sharply to around $6.80. GIC suffered heavy investment losses estimated between $500 million and $2 billion, which may be the key reason behind the renewed legal action — an attempt to recover some of its losses through litigation.

On the evening of October 16, NIO responded that the lawsuit is not a new event and is unrelated to its current operations. It stems from unsubstantiated allegations made in a June 2022 short-seller report by Grizzly Research LLC. The report, NIO stated, was baseless and contained numerous factual errors, misleading conclusions, and unsupported claims. To protect shareholder interests, NIO’s Board formed an independent committee in August 2022, assisted by international law firms and forensic accounting experts, to conduct a thorough internal investigation. The committee concluded that all allegations were unfounded.

NIO emphasized that as a company listed in the U.S., Hong Kong, and Singapore, it strictly adheres to compliance and corporate governance requirements across all three markets. The BaaS model, since its introduction, has enhanced the user experience for both vehicle purchases and ownership while contributing to advancements in battery life. Going forward, NIO said it will continue to drive battery technology innovation and sustainable business development for the benefit of users and the new energy vehicle industry as a whole.

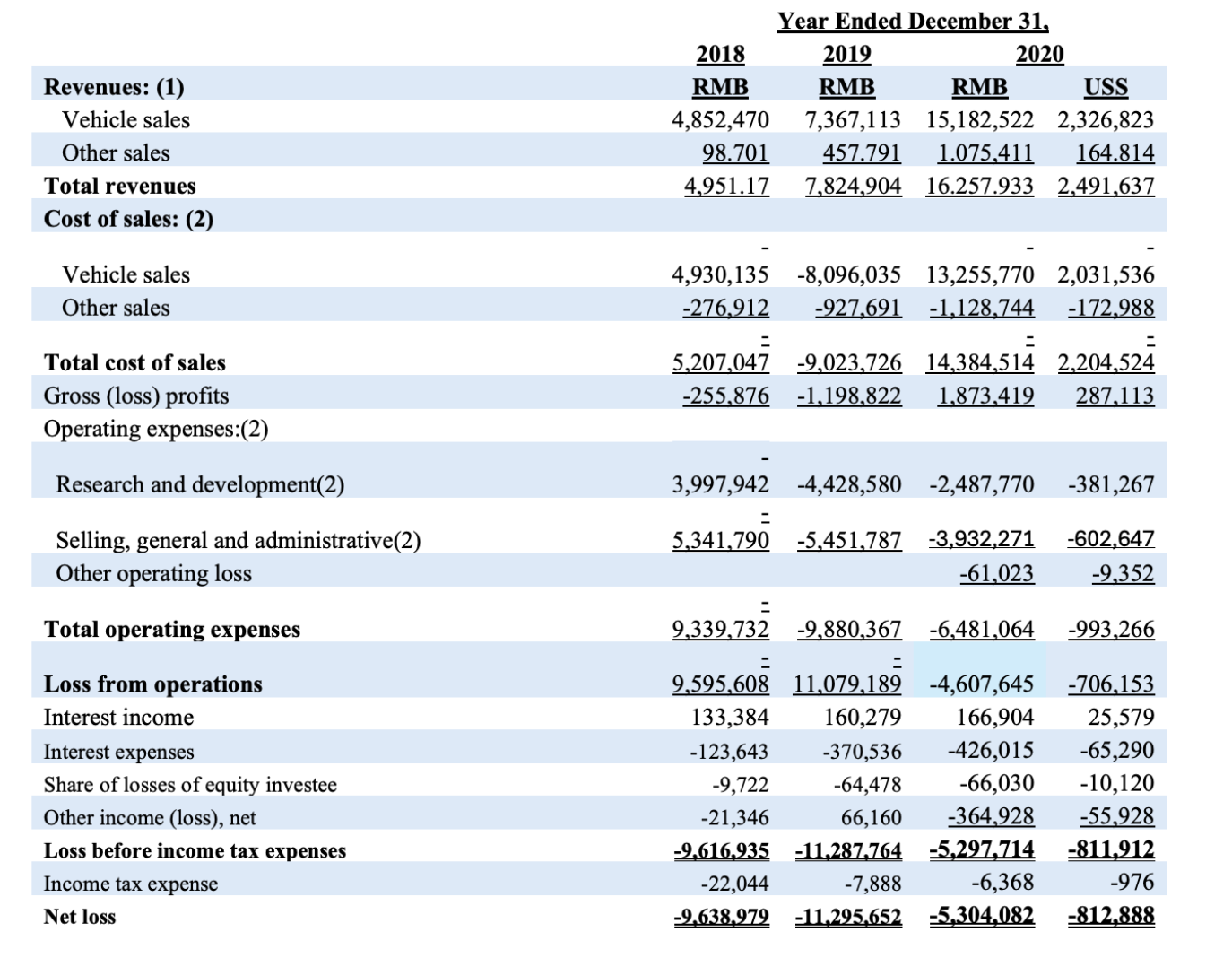

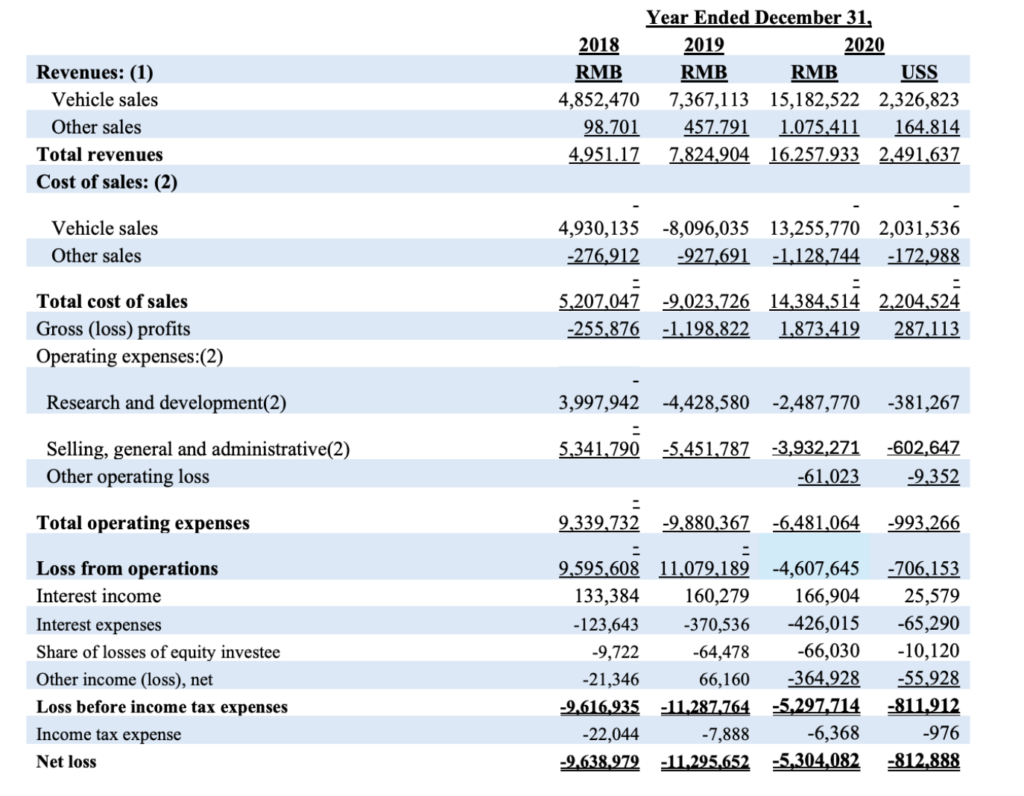

In June 2022, U.S. short-seller Grizzly Research published a report alleging that NIO exaggerated revenue and net margins through accounting manipulation. The report claimed NIO used its Weineng affiliate to inflate its financial results via related-party transactions, boosting its stock price by more than 450% since 2020. Grizzly stated that Weineng helped NIO achieve artificial growth and profitability expectations, adding billions in revenue and increasing NIO’s reported income and net profit by approximately 10% and 95%, respectively. The report also claimed NIO used BaaS accounting to record extra revenue while shifting battery-related costs off its balance sheet, misleading Wall Street and investors with distorted financial data.

NIO swiftly responded at the time, rejecting the report as lacking factual basis and filled with inaccuracies and misleading interpretations. In August 2022, NIO announced that an independent internal review led by its board’s audit committee, with two third-party firms assisting, had been completed and confirmed that all allegations were unsubstantiated. Later, in September 2022, the U.S. Securities and Exchange Commission (SEC) issued an inquiry to NIO focusing on the accounting treatment of transactions involving Weineng. NIO responded with detailed explanations, and the SEC took no further action thereafter — a move seen as validation of NIO’s response.

In the latest quarter, NIO delivered 87,071 vehicles, up 40.8% year-over-year, with a record 34,749 deliveries in September. Despite steady growth, NIO remains unprofitable, and investors are closely watching for when it will turn a profit. According to CEO William Li, NIO aims to achieve its first quarterly profit in Q4 2025. In the first half of this year, the company reported a loss of RMB 11.745 billion, while its Q3 2025 financial results have yet to be disclosed.