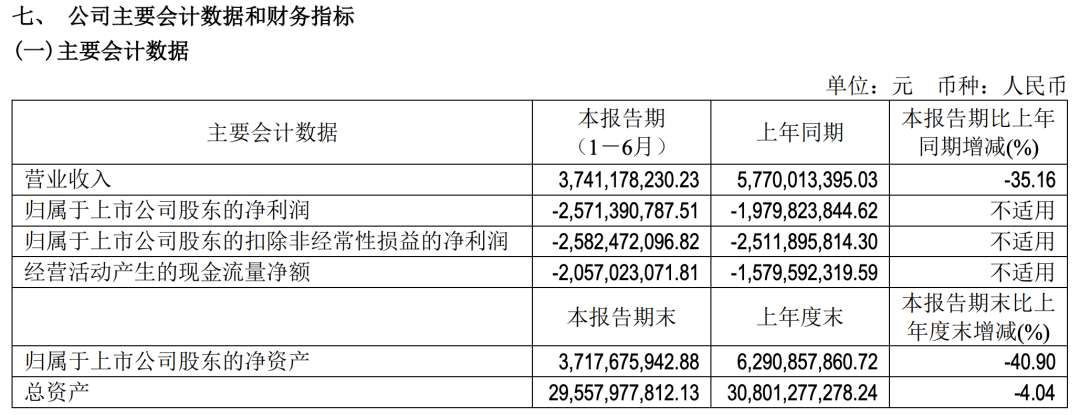

On August 26, BAIC Blue Valley disclosed its mid-term financial report for 2024. The financial report shows that in the first half of 2024, BAIC Blue Valley achieved revenue of 3.741 billion yuan, a year-on-year decline of 35.16%. While revenue declined, losses further expanded. The loss in the first half was 2.571 billion yuan, the largest loss during the same period in the history of BAIC Blue Valley, compared with a loss of 1.979 billion yuan in the same period. The announcement shows that in 2023, Beijing New Energy Automobile Co., Ltd. had a net loss of 1.20 billion yuan, and Beijing Blue Valley Arcfox Technology Co., Ltd. had a net loss of 1.45 billion yuan. BAIC Blue Valley stated that the decline in revenue in the first half was mainly due to the reduction in vehicle sales during the period, resulting in a year-on-year decrease in income. Data shows that in the first half of the year, BAIC Blue Valley’s sales volume was 28,011 units, a year-on-year decline of 20.40%. Regarding the expanded losses, BAIC Blue Valley stated that on the one hand, the competition in the new energy vehicle market has become increasingly fierce, and the price war has become increasingly intense, squeezing profit margins; on the other hand, the company has continuously invested in technological research and development, brand channel construction, brand image sharpening, and operational efficiency improvement to continuously promote product upgrading to the high-end, which has had a certain impact on the company’s short-term performance. If there are no surprises, 2025 will be the fifth consecutive year of losses for BAIC Blue Valley. Previously, from 2020 to 2023, BAIC Blue Valley had net losses of 6.482 billion yuan, 5.244 billion yuan, 5.465 billion yuan, and 5.400 billion yuan respectively. Coupled with the loss of 2.571 billion yuan in the first half of the year, BAIC Blue Valley has accumulated losses of more than 25 billion yuan in four and a half years. In terms of cash flow, BAIC Blue Valley is also under pressure. The net cash flow from operating activities in 2023 was -2.057 billion yuan, compared with -1.580 billion yuan in the same period. The company explained that this was mainly due to the reduction in sales volume and the year-on-year decrease in sales receipts. BAIC Blue Valley owns three electric vehicle brands: Arcfox Automobile, Beijing New Energy, and Xiangjie Automobile. In the first half of the year, BAIC Blue Valley’s vehicle sales were 28,011 units, a year-on-year decline of 20.40%. Retail data shows that Arcfox Automobile’s sales volume in the first half of the year was 17,843 units, among which the highest-selling model was Alpha T5 with 16,346 units. Arcfox Automobile is a high-end intelligent new energy vehicle brand created by BAIC Blue Valley. Its models on sale include Alpha T5, Arcfox Kola, Alpha S5, Alpha S, and Alpha T. As a high-end new energy brand, Arcfox Automobile does not have a large market volume, and there is still a gap compared with high-end new energy brands under other traditional automotive companies. Xiangjie Automobile is a brand jointly developed by BAIC Blue Valley and Huawei, and it is the third brand of Hongmeng Zhixing. The first model, Xiangjie S9, was officially launched on August 6. The new car is positioned as a medium and large flagship sedan, and two models, Max and Ultra, have been launched, with prices of 399,800 yuan and 449,800 yuan respectively. The latest data shows that the pre-orders for Xiangjie S9 exceeded 8,000 units within 20 days of its launch. As the first model under the brand jointly created by Huawei and BAIC Blue Valley, Xiangjie S9 will compete with several models such as Mercedes-Benz EQE, BMW i5, and NIO ET7. Compared with these competing models, with the support of Huawei technology, Xiangjie S9 has more advantages in intelligent configuration of the vehicle. At the same time, with the support of the new HarmonyOS 4 system, it is expected to have a more excellent vehicle machine experience. Previously, Avita and Seres successively invested 11 billion yuan to take stakes in Huawei. Regarding whether BAIC Blue Valley will take a stake in Huawei, Zhao Ji, the secretary of the board of BAIC Blue Valley, recently stated that there is no information to disclose at present. The company firmly bets on cooperation with Huawei from a strategic level. Currently, the interests of both sides are deeply intertwined, and future cooperation will further deepen. BAIC Blue Valley stated in the financial report that competition in the Chinese electric vehicle industry has intensified. Major auto companies have accelerated the update and iteration of their products, and the competition among auto companies has entered a white-hot stage. In order to continuously compete for market share, they have all adopted price reduction strategies. At the same time, new energy vehicles are rapidly developing towards intelligence and connectivity. The rapid iteration of technology has shortened the production cycle and life cycle of products, presenting new challenges in design, production, and manufacturing capabilities. Not long ago, BAIC Blue Valley adjusted the company’s management. Both BAIC Blue Valley New Energy Technology Co., Ltd. and Beijing New Energy Automobile Co., Ltd. underwent industrial and commercial changes. Liu Yu stepped down as the legal representative and chairman, and both positions were taken over by Dai Kangwei. At the same time, many other key personnel also changed. Mr. Zhang Guofu was appointed as the company’s manager, and Mr. Liu Guanqiao was appointed as the company’s deputy manager.

A loss of 2.5 billion yuan in half a year! The latest financial report of BAIC Blue Valley