For years, Mexico repeatedly stressed that it would “never take sides between China and the United States.” Yet, after U.S. Secretary of State Marco Rubio visited Mexico and met with President Claudia Sheinbaum on September 3, Sheinbaum announced the following day that Mexico is considering tariffs on countries “without trade agreements with us,” explicitly naming China. She added that details on the affected industries would be released “at the appropriate time.”

On September 9, the Mexican government submitted a budget proposal that includes new import duties on more than 1,400 products, most of them from Asia. The move is expected to generate an additional 70 billion pesos (≈ USD 3.76 billion) in revenue for the treasury.

Although officials stressed that “China is not the only country affected,” analysts widely believe U.S. pressure is the key driver. As The New York Times put it: “Trump pushed, and Sheinbaum could not resist.”

Mexico’s Recent Moves Against Chinese Imports

Since the beginning of 2025, Mexico has rolled out a series of measures targeting Chinese goods:

January: Imposed temporary tariffs on imported textiles and direct-sale clothing, including from China, to protect domestic producers.

March: To appease Washington and avoid broad U.S. tariffs, Mexico levied 10–20% duties on Chinese cars, electronics, and chemicals, tightened re-export controls, and strengthened rules-of-origin checks.

April: Extended March’s tariffs until midyear and expanded them to plastics and steel.

May: Joined the expanded U.S.-led Indo-Pacific Economic Framework (IPEF), pledging further restrictions on Chinese high-tech imports.

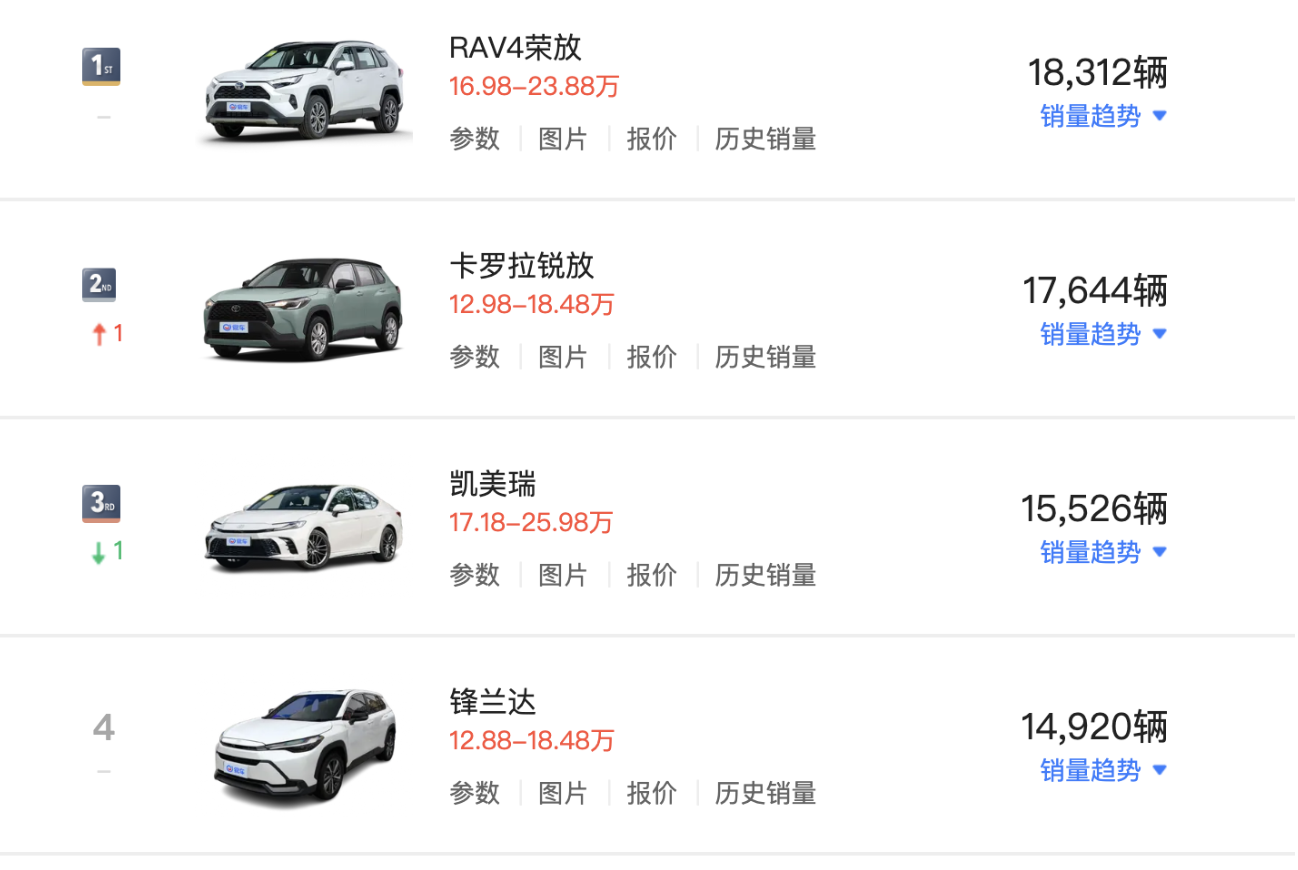

July: Imposed up to 35% countervailing duties on Chinese electric vehicles, echoing the U.S.’s 100% tariff policy. BYD and other Chinese brands saw their market share in Mexico fall from 15% to 10%.

August: Raised import duties on parcels valued under USD 2,500 from 19% to 33.5%, largely affecting Chinese e-commerce goods.

September: Announced final countervailing duties on low-priced Chinese footwear (USD 0.54–22.50 per pair), effective for five years, alongside the existing 35% tariff that remains valid for two more years.

China’s Response and Bilateral Trade

China’s Ministry of Foreign Affairs has warned against such measures, stating: “China respects nations resolving trade frictions with the U.S. through negotiations, but firmly opposes any arrangement that sacrifices Chinese interests. If such situations arise, China will not accept them and will take reciprocal countermeasures. China has both the determination and capability to safeguard its rights and interests.”

China is Mexico’s second-largest global trading partner after the U.S., while Mexico is China’s second-largest trading partner in Latin America. In 2024, bilateral trade reached USD 109.43 billion, with Chinese exports totaling USD 90.23 billion and imports from Mexico amounting to USD 19.19 billion. China’s main exports to Mexico include electronic components, auto parts, and household goods, while imports consist primarily of crude oil, electrical equipment, and medical instruments.