A few days ago, the German car seat manufacturer Recaro Automotive announced that Recaro Automotive GmbH, headquartered in Kirchheim and Teck, has filed for bankruptcy with the Esslingen District Court.

Data shows that Recaro Automotive is a world-leading car seat manufacturer, producing ergonomic and sporty seats for well-known car manufacturers such as Aston Martin, BMW, Ford, Lamborghini, and Mercedes-Benz. In addition, the company also produces seats for the substitutes’ bench in football stadiums, and the seats of Stuttgart Football Club are produced by it.

The Recaro group, the parent company of Recaro Automotive, was first born in 1906 and was engaged in the manufacture of carriage compartments. Later, it had a close cooperation with the Porsche company. It once made a prototype car for the Beetle and later made body panels for Porsche’s first sports car – Porsche 356. In 1963, the founder Wilhelm Reutter sold the body design factory to the Porsche company and turned to the design and manufacture of car seats, and has been focusing on this industry ever since. Recaro Automotive stated that the bankruptcy procedure is limited to Recaro Automotive GmbH and does not include any other group companies. It is understood that the Recaro group has a wide range of businesses, covering many fields such as aircraft seats, gaming seats, child safety seats, and train seats, and these companies have not been affected by this bankruptcy incident.

Regarding the reason for the bankruptcy, Recaro Automotive did not give an explanation in the official statement. Professionals believe that the lack of business diversification and dependence on a small number of customers may be a key risk factor. Another reason may be that the entire automotive supplier industry is under pressure, with weak market demand and the transition to electric vehicles, which puts particularly great pressure on “small and beautiful” enterprises like Recaro Automotive.

The electrification transformation of the automotive industry has a huge impact on traditional car companies and the supply chain. The research and development of electric vehicle parts requires a large amount of funds. At the same time, some European enterprises also need to maintain the leading position in the traditional fuel vehicle field, which means that double investment needs to be made on two technical platforms. However, in Europe, due to the slow popularization of electric vehicles, the overall vehicle sales are still at a historical low. In addition, the profit margins of traditional automotive parts suppliers are also continuously declining, and enterprises find it difficult to achieve revenue and profit growth. Due to fierce market competition and the difficult electrification transformation, multinational parts giants will carefully consider every expenditure.

In the eyes of the outside world, due to the impact of multiple factors such as the weak European economy, high inflation, and the cost surge brought about by the intelligent electrification transformation, the operating pressure faced by these traditional automotive parts supply giants has increased sharply, and there is an urgent need to reduce costs. Especially after entering 2024, the measures of layoffs by German automotive parts giants have become more frequent, and more and more leading suppliers have joined the layoff wave.

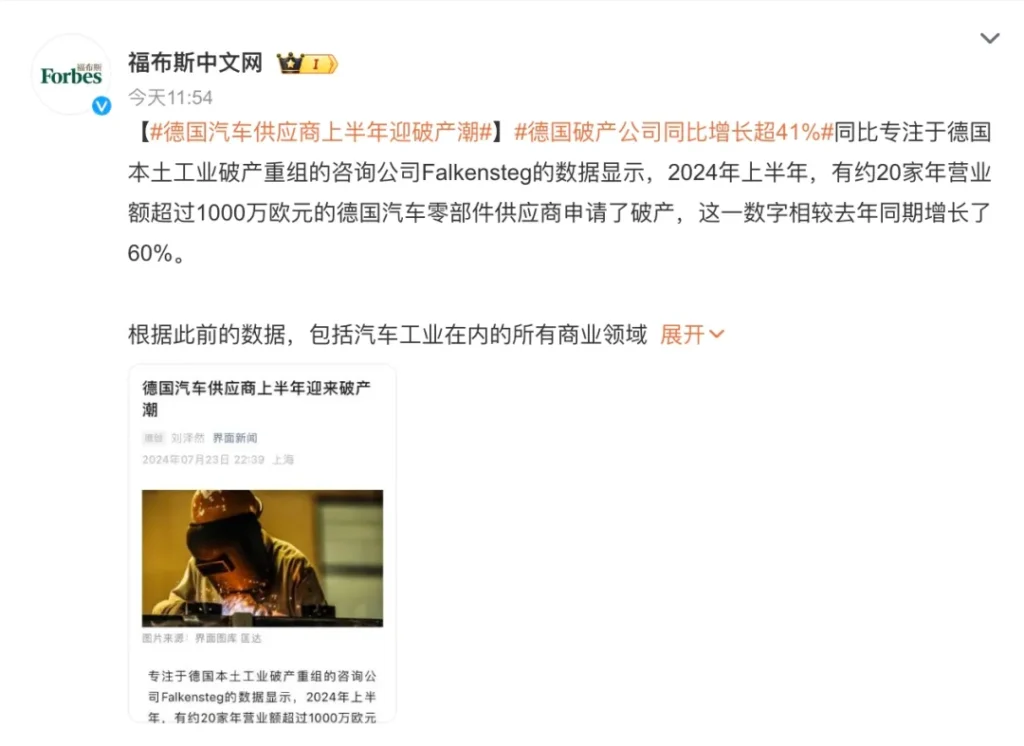

Previously, the German consulting company Falkensteg released the latest data showing that in the first half of 2024, a total of 20 German automotive parts suppliers with an annual income of more than 10 million euros filed for bankruptcy, an increase of 60% year-on-year. It is understood that in the commercial field including the automotive industry, a total of 162 companies in Germany with an annual revenue of more than 10 million euros filed for bankruptcy in the first half of the year, an increase of 41% year-on-year, among which real estate, the automotive supply chain and machinery manufacturing have become the hardest hit areas.

Although the giants in the automotive parts industry have stronger ability to resist risks, they all choose to lay off employees to achieve cost reduction and efficiency improvement to deal with the industry winter, including ZF, Continental and Bosch. A few days ago, the German automotive parts supplier ZF Group announced that it is expected to lay off about 11,000 to 14,000 people in Germany by the end of 2028, accounting for about a quarter of its total number of German employees. According to the official news of ZF, this layoff plan aims to reduce costs, enhance competitiveness, and free up resources for the company’s future development in the field of electrification.

Undoubtedly, all large parts suppliers need to face the transformation of electrification and intelligence, and the cost brought about by this transformation is very high. At the same time, the profit of the initial electric vehicle business is still far from being comparable to that of the traditional fuel business. In the case of the slowdown of the electrification trend in Europe, the order volume will also decrease accordingly. Based on this, some industry insiders predict that the number of bankruptcies of German automotive suppliers may further increase in the second half of the year. Due to the decline or delay of the demand for internal combustion engine technology and the pressure brought about by factors such as energy price surcharges and inflation compensation, traditional drive technologies are facing greater challenges.